Xcel Energy 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

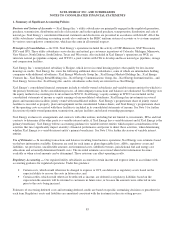

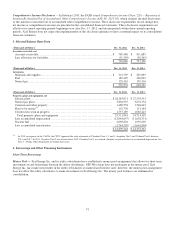

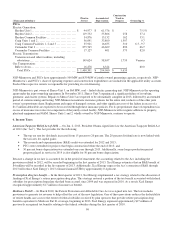

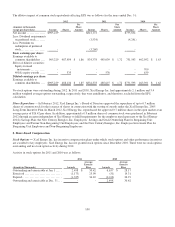

Commercial Paper — Xcel Energy Inc. and its utility subsidiaries meet their short-term liquidity requirements primarily through

the issuance of commercial paper and borrowings under their credit facilities. Commercial paper outstanding for Xcel Energy was

as follows:

Three

Months

Ended

(Amounts in Millions, Except Interest Rates)

Dec. 31, 2012

Borrowing limit ................................

................................

$ 2,450

Amount outstanding at period end................................

................

602

Average amount outstanding ................................

....................

398

Maximum amount outstanding................................

...................

602

Weighted average interest rate, computed on a daily basis

..........................

0.36%

Weighted average interest rate at end of period ................................

....

0.36

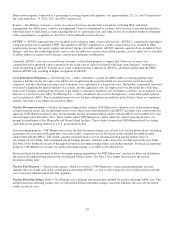

Twelve

Months

Ended

Twelve

Months

Ended

Twelve

Months

Ended

(Amounts in Millions, Except Interest Rates)

Dec. 31, 2012

Dec. 31, 2011

Dec. 31, 2010

Borrowing limit ................................................................ $ 2,450 $

2,450

$ 2,177

Amount outstanding at period end................................................

602

219

466

Average amount outstanding ....................................................

403

430

263

Maximum amount outstanding...................................................

634

824

653

Weighted average interest rate, computed on a daily basis ..........................

0.35%

0.36

%

0.36%

Weighted average interest rate at end of period ....................................

0.36

0.40

0.40

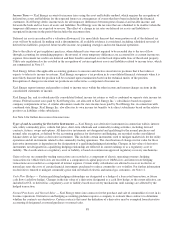

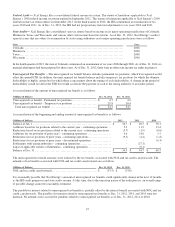

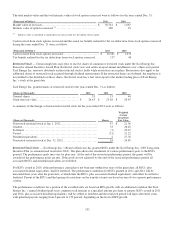

Letters of Credit — Xcel Energy Inc. and its subsidiaries use letters of credit, generally with terms of one year, to provide

financial guarantees for certain operating obligations. At Dec. 31, 2012 and 2011, there were $14.2 million and $12.7 million of

letters of credit outstanding, respectively, under the credit facilities. There were no letters of credit outstanding that were not

issued under the credit facilities at Dec. 31, 2012. There were $1.1 million of letters of credit outstanding at Dec. 31, 2011 that

were not issued under the credit facilities. The contract amounts of these letters of credit approximate their fair value and are

subject to fees determined in the marketplace.

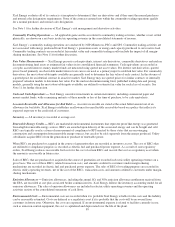

Credit Facilities — In order to use their commercial paper programs to fulfill short-term funding needs, Xcel Energy Inc. and its

utility subsidiaries must have revolving credit facilities in place at least equal to the amount of their respective commercial paper

borrowing limits and cannot issue commercial paper in an aggregate amount exceeding available capacity under these credit

facilities. The lines of credit provide short-term financing in the form of notes payable to banks, letters of credit and back-up

support for commercial paper borrowings.

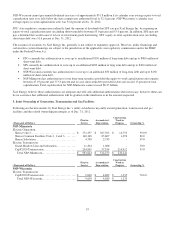

At Dec. 31, 2012, Xcel Energy Inc. and its utility subsidiaries had the following committed credit facilities available:

(Millions of Dollars)

Credit Facility

Drawn (a)

Available

Xcel Energy Inc. ................................

.....

$

800.0

$

179.0

$

621.0

PSCo ................................

................

700.0

158.0

542.0

NSP-Minnesota ................................

......

500.0

231.2

268.8

SPS ................................

.................

300.0

9.0

291.0

NSP-Wisconsin ................................

......

150.0

39.0

111.0

Total................................

...............

$

2,450.0

$

616.2

$

1,833.8

(a) Includes outstanding commercial paper and letters of credit.

All credit facility bank borrowings, outstanding letters of credit and outstanding commercial paper reduce the available capacity

under the respective credit facilities. Xcel Energy Inc. and its subsidiaries had no direct advances on the credit facilities

outstanding at Dec. 31, 2012 and 2011.