Xcel Energy 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

Federal Tax Loss Carryback Claims — Xcel Energy completed an analysis in the first quarter of 2012 on the eligibility of

certain expenses that qualified for an extended carryback beyond the typical two-year carryback period. As a result of a higher tax

rate in prior years, Xcel Energy recognized a discrete tax benefit of approximately $15 million in the first quarter of 2012.

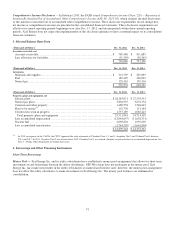

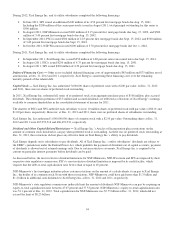

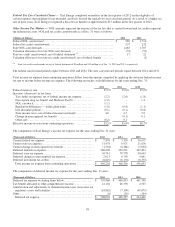

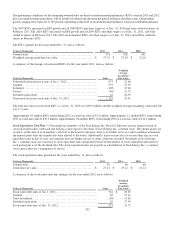

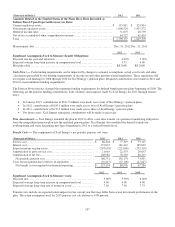

Other Income Tax Matters — NOL amounts represent the amount of the tax loss that is carried forward and tax credits represent

the deferred tax asset. NOL and tax credit carryforwards as of Dec. 31 were as follows:

(Millions of Dollars)

2012

2011

Federal NOL carryforward ........................................................ $ 969

$

1,710

Federal tax credit carryforwards ...................................................

257

232

State NOL carryforwards..........................................................

1,465

1,707

Valuation allowances for state NOL carryforwards ..................................

(52)

(51

)

State tax credit carryforwards, net of federal detriment (a).............................

17

22

Valuation allowances for state tax credit carryforwards, net of federal benefit ..........

-

(2

)

(a) State tax credit carryforwards are net of federal detriment of $9 million and $12 million as of Dec. 31, 2012 and 2011, respectively.

The federal carryforward periods expire between 2021 and 2032. The state carryforward periods expire between 2014 and 2031.

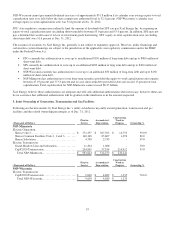

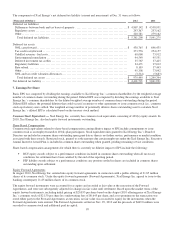

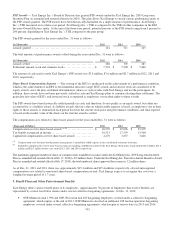

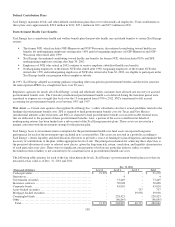

Total income tax expense from continuing operations differs from the amount computed by applying the statutory federal income

tax rate to income before income tax expense. The following reconciles such differences for the years ending Dec. 31:

2012

2011

2010

Federal statutory rate................................

..............

35.0

%

35.0

%

35.0

%

Increases (decreases) in tax from:

Tax credits recognized, net of federal income tax expense

..........

(2.2

)

(2.6

)

(1.8

)

Prescription drug tax benefit and Medicare Part D

.................

(1.2

)

-

1.4

NOL carryback................................

.................

(1.1

)

-

-

Regulatory differences — utility plant items

......................

(1.0

)

(0.8

)

(1.1

)

Life insurance policies ................................

..........

(0.1

)

(0.1

)

(0.8

)

State income taxes, net of federal income tax benefit

..............

4.0

4.3

3.9

Change in unrecognized tax benefits

.............................

-

(0.1

)

0.1

Other, net ................................

......................

(0.2

)

0.1

-

Effective income tax rate from continuing operations

................

33.2

%

35.8

%

36.7

%

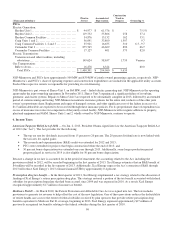

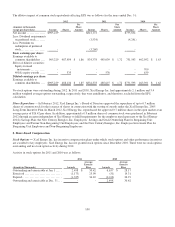

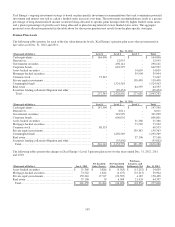

The components of Xcel Energy’s income tax expense for the years ending Dec. 31 were:

(Thousands of Dollars)

2012

2011

2010

Current federal tax expense................................

........

$

7,876

$

3,399

$

16,657

Current state tax expense ................................

..........

31,478

9,971

11,636

Current change in unrecognized tax benefits

........................

(1,704

)

(8,266

)

(2,982

)

Deferred federal tax expense................................

.......

366,409

383,931

362,393

Deferred state tax expense................................

.........

50,741

78,770

50,643

Deferred change in unrecognized tax expense

.......................

2,013

6,705

4,641

Deferred investment tax credits ................................

....

(6,610

)

(6,194

)

(6,353

)

Total income tax expense from continuing operations

..............

$

450,203

$

468,316

$

436,635

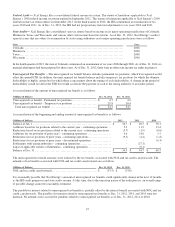

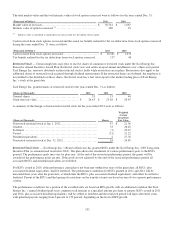

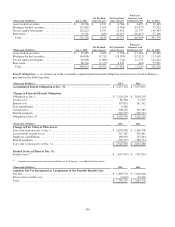

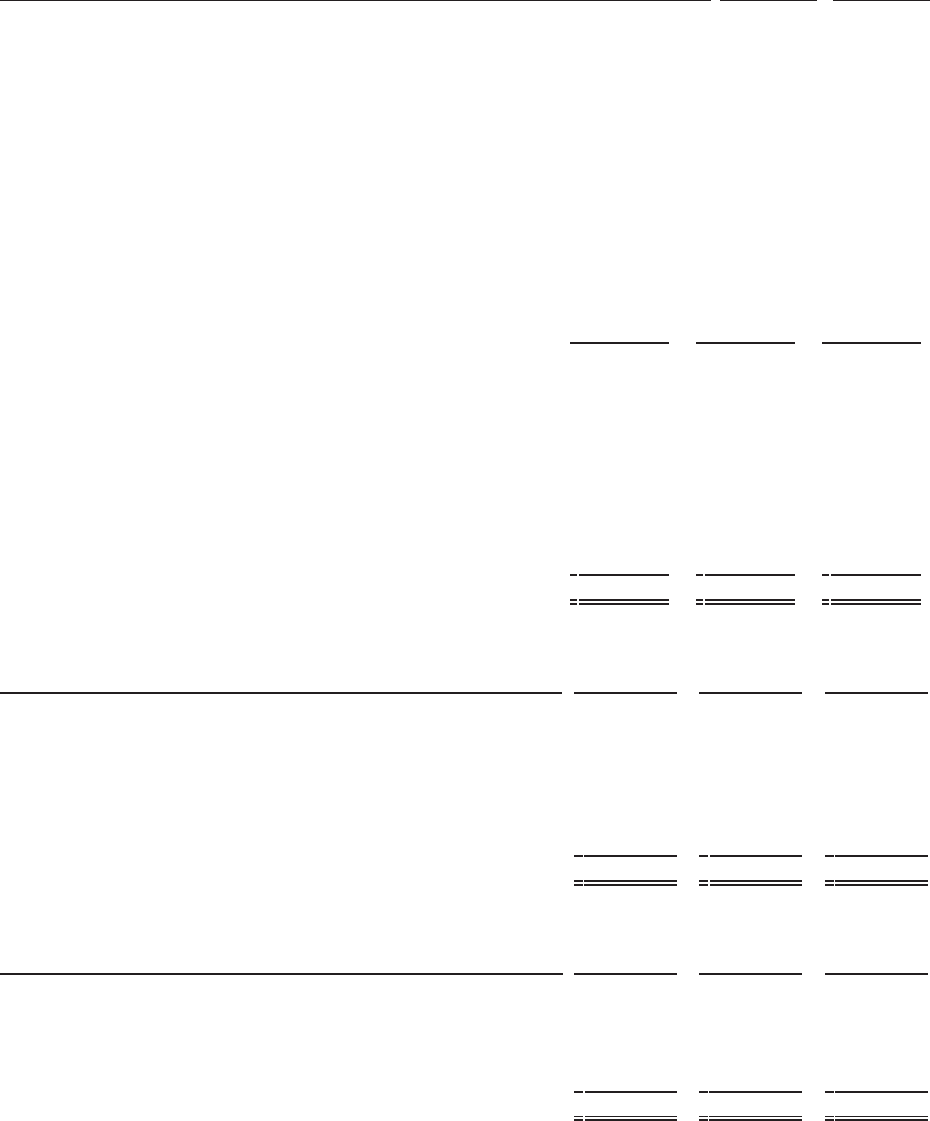

The components of deferred income tax expense for the years ending Dec. 31 were:

(Thousands of Dollars)

2012

2011

2010

Deferred tax expense excluding items below

........................

$

559,860

$

446,893

$

461,748

Tax benefit allocated to other comprehensive income

................

12,102

26,798

2,535

Amortization and adjustments to deferred income taxes on income tax

regulatory assets and liabilities ................................

...

(63,862)

(7,108)

(49,679

)

Other ................................

............................

(6)

(16)

(144

)

Deferred tax expense ................................

............

$

508,094

$

466,567

$

414,460