Xcel Energy 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

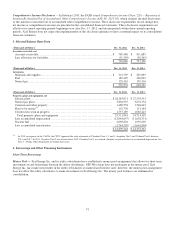

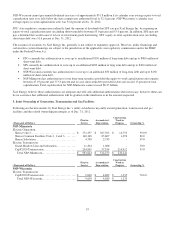

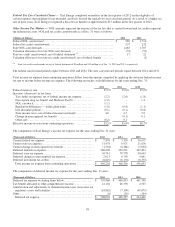

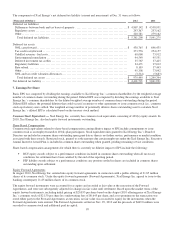

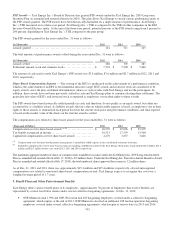

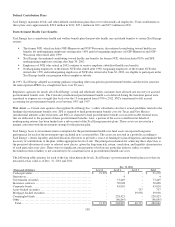

The components of Xcel Energy’s net deferred tax liability (current and noncurrent) at Dec. 31 were as follows:

(Thousands of Dollars)

2012

2011

Deferred tax liabilities:

Differences between book and tax bases of property ................................

..........

$

4,867,142

$

4,558,951

Regulatory assets ................................................................

..........

293,367

253,162

Other ................................................................

.....................

220,781

279,162

Total deferred tax liabilities ................................

...............................

$

5,381,290

$

5,091,275

Deferred tax assets:

NOL carryforward ................................................................

.........

$

430,765

$

696,435

Tax credit carryforward ................................................................

....

273,776

254,157

Unbilled revenue - fuel costs ................................

................................

60,068

73,912

Environmental remediation ................................................................

.

44,549

45,551

Deferred investment tax credits ................................

.............................

35,767

37,425

Regulatory liabilities ................................................................

.......

34,471

37,012

Rate refund................................................................

................

8,109

37,443

Other ................................................................

.....................

95,308

73,092

NOL and tax credit valuation allowances................................

.....................

(3,314)

(5,683)

Total deferred tax assets ................................................................

..

$

979,499

$

1,249,344

Net deferred tax liability ................................................................

.....

$

4,401,791

$

3,841,931

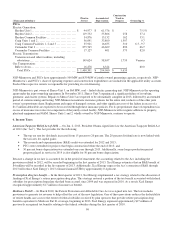

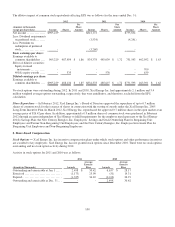

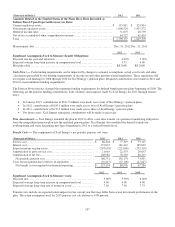

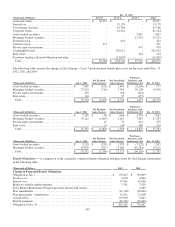

7. Earnings Per Share

Basic EPS was computed by dividing the earnings available to Xcel Energy Inc.’s common shareholders by the weighted average

number of common shares outstanding during the period. Diluted EPS was computed by dividing the earnings available to Xcel

Energy Inc.’s common shareholders by the diluted weighted average number of common shares outstanding during the period.

Diluted EPS reflects the potential dilution that could occur if securities or other agreements to issue common stock (i.e., common

stock equivalents) were settled. The weighted average number of potentially dilutive shares outstanding used to calculate Xcel

Energy Inc.’s diluted EPS is calculated based on the treasury stock method.

Common Stock Equivalents — Xcel Energy Inc. currently has common stock equivalents consisting of 401(k) equity awards. In

2010, Xcel Energy Inc. also had equity forward instruments outstanding.

Share-Based Compensation

Common stock equivalents related to share-based compensation causing dilutive impact to EPS include commitments to issue

common stock as an employer match to 401(k) plan participants. Stock equivalent units granted to Xcel Energy Inc.’s Board of

Directors are included in common shares outstanding upon grant date as there is no further service, performance or market condition

associated with these awards. Restricted stock, granted to settle amounts due certain employees under the Xcel Energy Inc. Executive

Annual Incentive Award Plan, is included in common shares outstanding when granted, pending remaining service conditions.

Share-based compensation arrangements for which there is currently no dilutive impact to EPS include the following:

• RSU equity awards subject to a performance condition; included in common shares outstanding when all necessary

conditions for settlement have been satisfied by the end of the reporting period.

• PSP liability awards subject to a performance condition; any portions settled in shares are included in common shares

outstanding upon settlement.

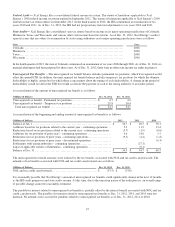

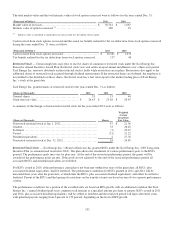

Equity Forward Agreements

In August 2010, Xcel Energy Inc. entered into equity forward agreements in connection with a public offering of 21.85 million

shares of its common stock. Under the equity forward agreements (Forward Agreements), Xcel Energy Inc. agreed to issue to the

banking counterparty 21.85 million shares of its common stock.

The equity forward instruments were accounted for as equity and recorded at fair value at the execution of the Forward

Agreements, and were not subsequently adjusted for changes in fair value until settlement. Based upon the market terms of the

equity forward instruments, including initial pricing of $20.855 per share based on the August 2010 offering price of Xcel Energy

Inc.’s common stock of $21.50 per share less underwriting fees of $0.645 per share, and as no premium on the transaction was

owed either party to the Forward Agreements at execution, no fair value was recorded to equity for the instruments when the

Forward Agreements were entered. The Forward Agreements settled on Nov. 29, 2010 and the proceeds of $449.8 million were

recorded to common stock and additional paid in capital.