Xcel Energy 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.122

12. Rate Matters

NSP-Minnesota

Pending and Recently Concluded Regulatory Proceedings — MPUC

Base Rate

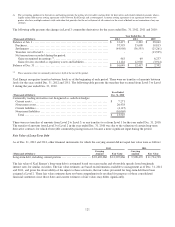

NSP-Minnesota – Minnesota 2012 Electric Rate Case — In November 2012, NSP-Minnesota filed a request with the MPUC for

an increase in annual revenues of approximately $285 million, or 10.7 percent. The rate filing is based on a 2013 forecast test

year, a requested ROE of 10.6 percent, an average electric rate base of approximately $6.3 billion and an equity ratio of 52.56

percent.

In December 2012, the MPUC accepted the filing as complete and approved the interim rates of approximately $251 million, as

requested, effective Jan. 1, 2013, subject to refund. In addition, the MPUC ordered NSP-Minnesota to file supplemental testimony

regarding its ability to refinance additional debt and to discuss the effects of certain changes to its equity ratio.

The procedural schedule is as follows:

• Intervenor Direct Testimony – Feb. 28, 2013

• Rebuttal Testimony – March 25, 2013

• Surrebuttal Testimony – April 12, 2013

• Evidentiary Hearing – April 18 – 24, 2013

• Initial Brief – May 15, 2013

• Reply Brief and Findings of Fact – May 30, 2013

• ALJ Report – July 3, 2013

• MPUC Order – Anticipated by September 2013

NSP-Minnesota - Minnesota 2010 Electric Rate Case — In November 2010, NSP-Minnesota filed a request with the MPUC to

increase electric rates in Minnesota for 2011 by approximately $150 million, or an increase of 5.62 percent, and an additional

increase of $48.3 million, or 1.81 percent, in 2012. The rate filing was based on a 2011 forecast test year, a requested ROE of

11.25 percent, an electric rate base of $5.6 billion and an equity ratio of 52.56 percent. The MPUC approved an interim rate

increase of $123 million, subject to refund, effective Jan. 2, 2011. In August 2011, NSP-Minnesota submitted supplemental

testimony, revising its requested rate increase to approximately $122 million for 2011 and an additional increase of approximately

$29 million in 2012.

In November 2011, NSP-Minnesota reached a settlement agreement with certain customer intervenors. In February 2012, NSP-

Minnesota filed to reduce the interim rate request to $72.8 million to align with the settlement agreement. In March 2012, the

MPUC approved the settlement. In May 2012, the MPUC issued an order approving the following:

• A rate increase of approximately $58 million in 2011 and an incremental rate increase of $14.8 million in 2012 based on

an ROE of 10.37 percent and an equity ratio of 52.56 percent.

• A reduction to depreciation expense and NSP-Minnesota’s rate request by $30 million.

NSP-Minnesota filed its final rate implementation and interim rate refund compliance filing in June 2012, which the MPUC

approved in August 2012. Final rates were implemented Sept. 1, 2012, and interim refunds were completed during October 2012.

NSP-Minnesota - 2012 Transmission Cost Recovery Rate Filing - In January 2012, the 2012 NSP-Minnesota TCR filing was

submitted to the MPUC, requesting recovery of $29.6 million of transmission investment costs not included in base electric rates

in the 2010 rate case settlement. In 2012, the Minnesota Department of Commerce (DOC) recommended that the MPUC exclude

$1.5 million of capitalized labor costs from the TCR, based on a prior MPUC decision in a TCR filing by another Minnesota

utility, and added that the costs NSP-Minnesota has incurred for its share of the CapX2020 Bemidji project should be capped for

TCR consideration at the level estimated in the CON application, plus reasonable escalation. The DOC did not assert the costs are

not recoverable in rates, but asserted the costs should not be eligible for recovery through the TCR adjustment mechanism. The

DOC’s position remained that the capitalized labor costs should not be recovered through the TCR and NSP-Minnesota estimates

that the DOC positions, if approved by the MPUC, would result in granting NSP-Minnesota approximately $26.3 million in

revenue requirements for 2012 under the TCR. Final MPUC action is anticipated in the first half of 2013.