Xcel Energy 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Preparation of the consolidated financial statements and related disclosures in compliance with GAAP requires the application of

accounting rules and guidance, as well as the use of estimates. The application of these policies involves judgments regarding

future events, including the likelihood of success of particular projects, legal and regulatory challenges and anticipated recovery

of costs. These judgments could materially impact the consolidated financial statements and disclosures, based on varying

assumptions. In addition, the financial and operating environment also may have a significant effect on the operation of the

business and on the results reported even if the nature of the accounting policies applied have not changed. The following is a list

of accounting policies and estimates that are most significant to the portrayal of Xcel Energy’s financial condition and results, and

that require management’s most difficult, subjective or complex judgments. Each of these has a higher likelihood of resulting in

materially different reported amounts under different conditions or using different assumptions. Each critical accounting policy

has been discussed with the Audit Committee of Xcel Energy Inc.’s Board of Directors.

Regulatory Accounting

Xcel Energy Inc. is a holding company with rate-regulated subsidiaries that are subject to the accounting for Regulated

Operations, which provides that rate-regulated entities account for and report assets and liabilities consistent with the recovery of

those incurred costs in rates, if the rates established are designed to recover the costs of providing the regulated service and if the

competitive environment makes it probable that such rates will be charged and collected. Xcel Energy’s rates are derived through

the ratemaking process, which results in the recording of regulatory assets and liabilities based on the probability of future cash

flows. Regulatory assets represent incurred or accrued costs that have been deferred because they are probable of future recovery

from customers. Regulatory liabilities represent amounts that are expected to be refunded to customers in future rates or amounts

collected in current rates for future costs. In other businesses or industries, regulatory assets and regulatory liabilities would

generally be charged to net income or OCI.

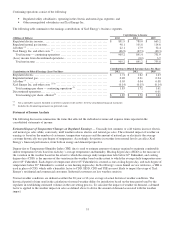

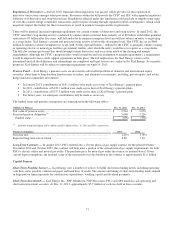

As of Dec. 31, 2012 and 2011, Xcel Energy has recorded regulatory assets of $3.1 billion and $2.8 billion and regulatory liabilities of

$1.2 billion and $1.4 billion, respectively. Each subsidiary is subject to regulation that varies from jurisdiction to jurisdiction. If

future recovery of costs, in any such jurisdiction, ceases to be probable, Xcel Energy would be required to charge these assets to

current net income or OCI. There are no current or expected proposals or changes in the regulatory environment that impact the

probability of future recovery of these assets. However, if the SEC should mandate the use of IFRS and the lack of an accounting

standard for rate-regulated entities under IFRS could require us to charge certain regulatory assets and regulatory liabilities to net

income or OCI. See Note 15 to the consolidated financial statements for further discussion of regulatory assets and liabilities.

Income Tax Accruals

Judgment, uncertainty, and estimates are a significant aspect of the income tax accrual process that accounts for the effects of

current and deferred income taxes. Uncertainty associated with the application of tax statutes and regulations and the outcomes of

tax audits and appeals require that judgment and estimates be made in the accrual process and in the calculation of the ETR.

Changes in tax laws and rates may affect recorded deferred tax assets and liabilities and our ETR in the future.

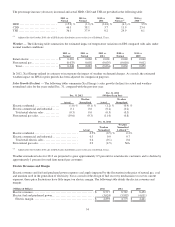

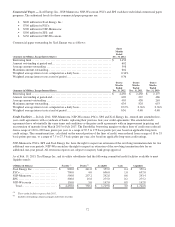

ETRs are also highly impacted by assumptions. ETR calculations are revised every quarter based on best available year end tax

assumptions (income levels, deductions, credits, etc.); adjusted in the following year after returns are filed, with the tax accrual

estimates being trued-up to the actual amounts claimed on the tax returns; and further adjusted after examinations by taxing

authorities have been completed.

In accordance with the interim period reporting guidance, income tax expense for the first three quarters in a year are based on the

forecasted ETR.

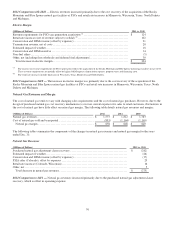

Accounting for income taxes also requires that only tax benefits that meet the more likely than not recognition threshold can be

recognized or continue to be recognized. The change in the unrecognized tax benefits needs to be reasonably estimated based on

evaluation of the nature of uncertainty, the nature of event that could cause the change and an estimated range of reasonably

possible changes. At any period end, and as new developments occur, management will use prudent business judgment to

derecognize appropriate amounts of tax benefits. Unrecognized tax benefits can be recognized as issues are favorably resolved

and loss exposures decline.

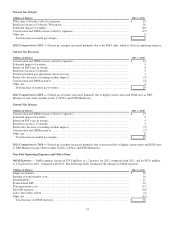

As disputes with the IRS and state tax authorities are resolved over time, we may adjust our unrecognized tax benefits and interest

accruals to the updated estimates needed to satisfy tax and interest obligations for the related issues. These adjustments may

increase or decrease earnings. See Note 6 to the consolidated financial statements for further discussion.