Xcel Energy 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

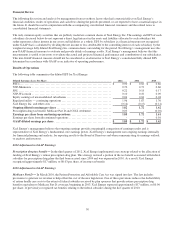

COLI settlement — During 2007, Xcel Energy Inc. and PSCo reached a settlement with the IRS related to a dispute associated

with its COLI program. These COLI policies were owned and managed by PSRI. As a follow on to the 2007 IRS COLI

settlement, during 2010, the IRS reached an agreement in principle of Xcel Energy Inc.’s and PSCo’s statements of account,

dating back to tax year 1993. Upon completion of this review, PSRI recorded a net non-recurring tax and interest charge of

approximately $9.4 million in 2010. The Tax Court proceedings were dismissed in December 2010 and January 2011. Upon final

cash settlement in 2011, Xcel Energy received $0.7 million and recognized a further reduction of expense of $0.3 million. A

closing agreement covering tax years 2003 through 2007 was finalized with the IRS in January 2012.

In 2010, Xcel Energy Inc., PSCo and PSRI entered into a settlement agreement with Provident related to all claims asserted by

Xcel Energy Inc., PSCo and PSRI against Provident in a lawsuit associated with the discontinued COLI program. Under the terms

of the settlement, Xcel Energy Inc., PSCo and PSRI were paid $25 million by Provident and Reassure America Life Insurance

Company resulting in approximately $0.05 of EPS in 2010. The $25 million proceeds were not subject to income taxes.

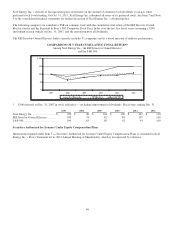

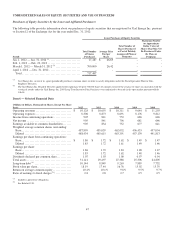

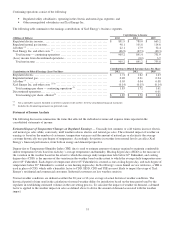

Earnings Adjusted for Certain Items (Ongoing Earnings)

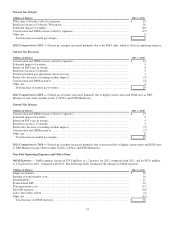

2012 Comparison with 2011

Xcel Energy — Overall, ongoing earnings increased $0.10 per share for 2012. Ongoing earnings increased largely due to

increases in electric margins driven by the conclusion of various rate cases, which reflect our continued investment in our utility

business and a lower ETR. Partially offsetting these positive factors were warmer than normal winter weather, increases in

depreciation expense, O&M expenses and property taxes.

PSCo — PSCo’s ongoing earnings increased $0.08 per share for 2012. The increase is primarily due to an electric rate increase,

effective May 2012, and the impact of warmer summer weather. The increase was partially offset by decreased wholesale revenue

due to the expiration of a long-term power sales agreement with Black Hills Corp, higher depreciation expense and O&M expenses.

NSP-Minnesota — NSP-Minnesota’s 2012 ongoing earnings decreased $0.03 per share. The decrease is primarily due to the

unfavorable impact of warmer than normal winter weather during the first quarter, electric sales decline, higher property taxes, higher

O&M expenses and depreciation expense. These decreases were partially offset by the 2012 rate increase and a lower ETR.

SPS — SPS’ ongoing earnings increased $0.04 per share for 2012. The increase is the result of rate increases in New Mexico and

Texas, effective January 2012, partially offset by the impact of milder weather during the second half of the year, higher

depreciation expense and property taxes.

NSP-Wisconsin — NSP-Wisconsin’s ongoing earnings were flat for 2012. Ongoing earnings were positively impacted by rate

increases, effective January 2012, offset by higher O&M expenses.

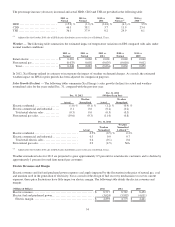

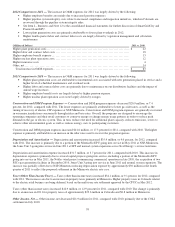

2011 Comparison with 2010

Xcel Energy — Overall, ongoing earnings increased $0.10 per share for 2011. Ongoing earnings increased primarily due to higher

electric margins as a result of warmer than normal summer weather across Xcel Energy’s service territories and rate increases in

various states. The higher margins were partially offset by expected increases in O&M expenses, depreciation, interest expense and

property taxes. The increase in expenses was largely driven by capital investment in Xcel Energy’s utility business.

PSCo — PSCo earnings decreased $0.04 per share for 2011. The decrease is due to the implementation of seasonal rates in June

2010 (seasonal rates were higher in the summer months and lower throughout the other months of the year), higher O&M expenses,

depreciation expense and property taxes, partially offset by the favorable impact of warmer temperatures in the summer.

NSP-Minnesota — NSP-Minnesota earnings increased $0.13 per share for 2011. The increase is primarily due to higher interim

electric rates effective in early 2011, subject to refund, in Minnesota and North Dakota, and conservation program incentives

partially offset by higher O&M expenses, depreciation expense (net of regulatory adjustments) and property taxes.

SPS — SPS earnings increased $0.01 per share for 2011. The increase is due to higher electric revenues, primarily due to the

Texas retail rate increase effective in the first quarter of 2011, and warmer summer weather, partially offset by higher O&M

expenses, depreciation expense and property taxes.

NSP-Wisconsin — NSP-Wisconsin earnings increased $0.01 per share for 2011. The increase is primarily due to higher electric

rates, partially offset by higher O&M expenses and depreciation expense.