Xcel Energy 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

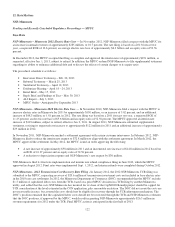

CapX2020 — CapX2020 is an alliance of electric cooperatives, municipals and investor-owned utilities in the upper Midwest,

including NSP System that has proposed several groups of transmission projects to be completed by 2020. Group 1 project

investments consist of four transmission lines. Major construction began in 2010 on the Group 1 transmission lines with an

expected completion date in 2015. NSP System’s investment depends on the routes and configurations approved by affected state

commissions and on the allocation of costs borne by other participating utilities in the upper Midwest.

CACJA — The CACJA required PSCo to file a plan to reduce annual emissions of NOx by at least 70 to 80 percent or greater

from 2008 levels by 2017 from the coal fired generation. In September 2012, the EPA formally approved the Colorado SIP for

regional haze, including changes to PSCo plants that include various projects including early shut down, fuel switching and SCR

installation.

PSCo Gas Transmission Integrity Management Programs – PSCo is proactively identifying and addressing the safety and

reliability of natural gas transmission pipelines. The pipeline integrity efforts include system renewal projects and increased

maintenance.

SPS Transmission NTC — SPS has accepted NTCs for several hundred miles of transmission line and related substation projects

based on needs identified through SPP’s various planning processes, including those associated with economics, reliability,

generator interconnection or the load addition processes. One of the major projects committed to is the TUCO to Woodward

District Extra High Voltage Interchange, a 345 kV transmission line. This line connects the TUCO substation near Lubbock,

Texas with the OGE substation in Woodward, Okla. The PUCT approved SPS’ CCN to build the line in 2012. It is anticipated to

be complete in 2014.

Fuel Contracts — Xcel Energy has entered into various long-term commitments for the purchase and delivery of a significant

portion of its current coal, nuclear fuel and natural gas requirements. These contracts expire in various years between 2013 and

2060. Xcel Energy is required to pay additional amounts depending on actual quantities shipped under these agreements.

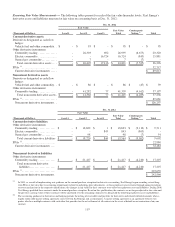

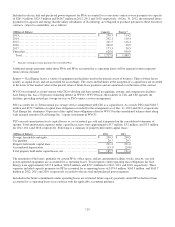

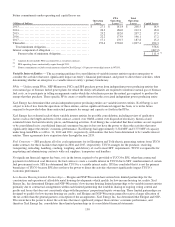

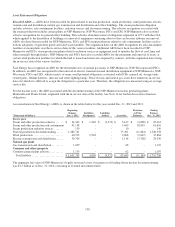

The estimated minimum purchases for Xcel Energy under these contracts as of Dec. 31, 2012 are as follows:

(Millions of Dollars)

Coal

Nuclear fuel

Natural gas supply

Natural gas

storage and

transportation

2013................................

...........................

$ 860.2

$ 92.3

$

426.9

$

273.0

2014................................

...........................

656.7

143.6

187.0

262.5

2015................................

...........................

532.0

86.5

177.8

256.7

2016................................

...........................

329.1

131.2

189.0

200.0

2017................................

...........................

310.8

128.9

196.2

157.6

Thereafter................................

......................

598.5

830.2

1,401.0

1,282.4

Total ................................

........................

$ 3,287.3

$ 1,412.7

$

2,577.9

$

2,432.2

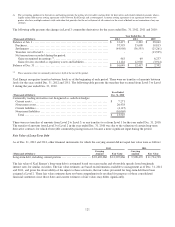

Estimated coal requirements at Dec. 31, 2012 have been adjusted to account for Sherco Unit 3, which was shut down in

November 2011 after experiencing a significant failure of its turbine, generator and exciter systems. Repairs to Sherco Unit 3 are

expected to be substantially complete in 2013, followed by an extended period of commissioning and testing. See Note 5 for

further discussion.

Additional expenditures for fuel and natural gas storage and transportation will be required to meet expected future electric

generation and natural gas needs. Xcel Energy’s risk of loss, in the form of increased costs from market price changes in fuel, is

mitigated through the use of natural gas and energy cost-rate adjustment mechanisms, which provide for pass-through of most

fuel, storage and transportation costs to customers.

PPAs — NSP Minnesota, PSCo and SPS have entered into PPAs with other utilities and energy suppliers with expiration dates

through 2033 for purchased power to meet system load and energy requirements, replace generation from company-owned units

under maintenance or during outages, and meet operating reserve obligations. In general, these agreements provide for energy

payments based on actual power taken under the contracts, as well as capacity payments. Certain PPAs accounted for as

executory contracts also contain minimum energy purchase commitments. Capacity and energy payments are typically contingent

on the independent power producing entity meeting certain contract obligations, including plant availability requirements. Certain

contractual payments are adjusted based on market indices; however, the effects of price adjustments are mitigated through

purchased energy cost recovery mechanisms.