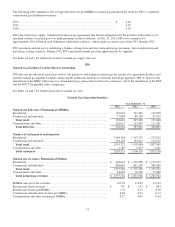

Xcel Energy 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

Increased risks of regulatory penalties could negatively impact our business.

The Energy Act increased the FERC’s civil penalty authority for violation of FERC statutes, rules and orders. The FERC can now

impose penalties of $1 million per violation per day. In addition, electric reliability standards are now mandatory and subject to

potential financial penalties by regional entities, the NERC or the FERC for violations. If a serious reliability incident did occur, it

could have a material effect on our operations or financial results.

The FERC has provided NOVs of its market manipulation rules to several market participants during the year. The potential

penalties in one pending case exceed $400 million. As with all regulatory requirements, we attempt to mitigate this risk through

formal training on such prohibited practices and a compliance function that reviews our interaction with the markets under FERC

and CFTC jurisdictions. However, there is no guarantee our compliance program will be sufficient to ensure against violations.

Macroeconomic Risks

Economic conditions could negatively impact our business.

Our operations are affected by local, national and worldwide economic conditions. The consequences of a prolonged economic

recession and uncertainty of recovery may result in a sustained lower level of economic activity and uncertainty with respect to

energy prices and the capital and commodity markets. A sustained lower level of economic activity may also result in a decline in

energy consumption, which may adversely affect our revenues and future growth. Instability in the financial markets, as a result

of recession or otherwise, also may affect the cost of capital and our ability to raise capital, which are discussed in greater detail in

the capital market risk section above.

Current economic conditions may be exacerbated by insufficient financial sector liquidity leading to potential increased unemployment,

which may impact customers’ ability to pay timely, increase customer bankruptcies, and may lead to increased bad debt.

Further, worldwide economic activity has an impact on the demand for basic commodities needed for utility infrastructure, such

as steel, copper, aluminum, etc., which may impact our ability to acquire sufficient supplies. Additionally, the cost of those

commodities may be higher than expected.

Our operations could be impacted by war, acts of terrorism, threats of terrorism or disruptions in normal operating conditions

due to localized or regional events.

Our generation plants, fuel storage facilities, transmission and distribution facilities and information systems may be targets of

terrorist activities that could disrupt our ability to produce or distribute some portion of our energy products. Any such disruption

could result in a significant decrease in revenues and significant additional costs to repair and insure our assets, which could have

a material impact on our financial condition and results of operations. The potential for terrorism has subjected our operations to

increased risks and could have a material effect on our business. While we have already incurred increased costs for security and

capital expenditures in response to these risks, we may experience additional capital and operating costs to implement security for

our plants, including our nuclear power plants under the NRC’s design basis threat requirements, such as additional physical plant

security and additional security personnel. We have also already incurred increased costs for compliance with NERC reliability

standards associated with critical infrastructure protection, and may experience additional capital and operating costs to comply

with the NERC critical infrastructure protection standards as they are implemented and clarified.

The insurance industry has also been affected by these events and the availability of insurance may decrease. In addition, the

insurance we are able to obtain may have higher deductibles, higher premiums and more restrictive policy terms. For example,

wildfire events, particularly in the geographic areas we serve, may cause insurance for wildfire losses to become difficult or

expensive to obtain.

A disruption of the regional electric transmission grid, interstate natural gas pipeline infrastructure or other fuel sources, could

negatively impact our business. Because our generation, transmission systems and local natural gas distribution companies are

part of an interconnected system, we face the risk of possible loss of business due to a disruption caused by the actions of a

neighboring utility or an event (severe storm, severe temperature extremes, generator or transmission facility outage, pipeline

rupture, railroad disruption, sudden and significant increase or decrease in wind generation, or any disruption of work force such

as may be caused by flu epidemic) within our operating systems or on a neighboring system. Any such disruption could result in a

significant decrease in revenues and significant additional costs to repair assets, which could have a material impact on our

financial condition and results.