Xcel Energy 2012 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

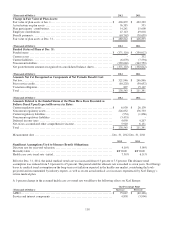

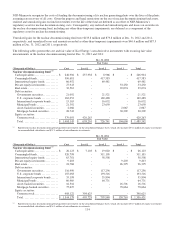

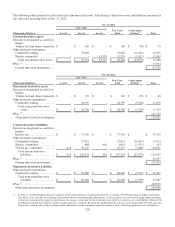

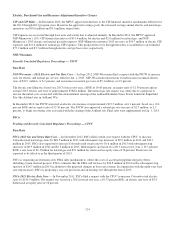

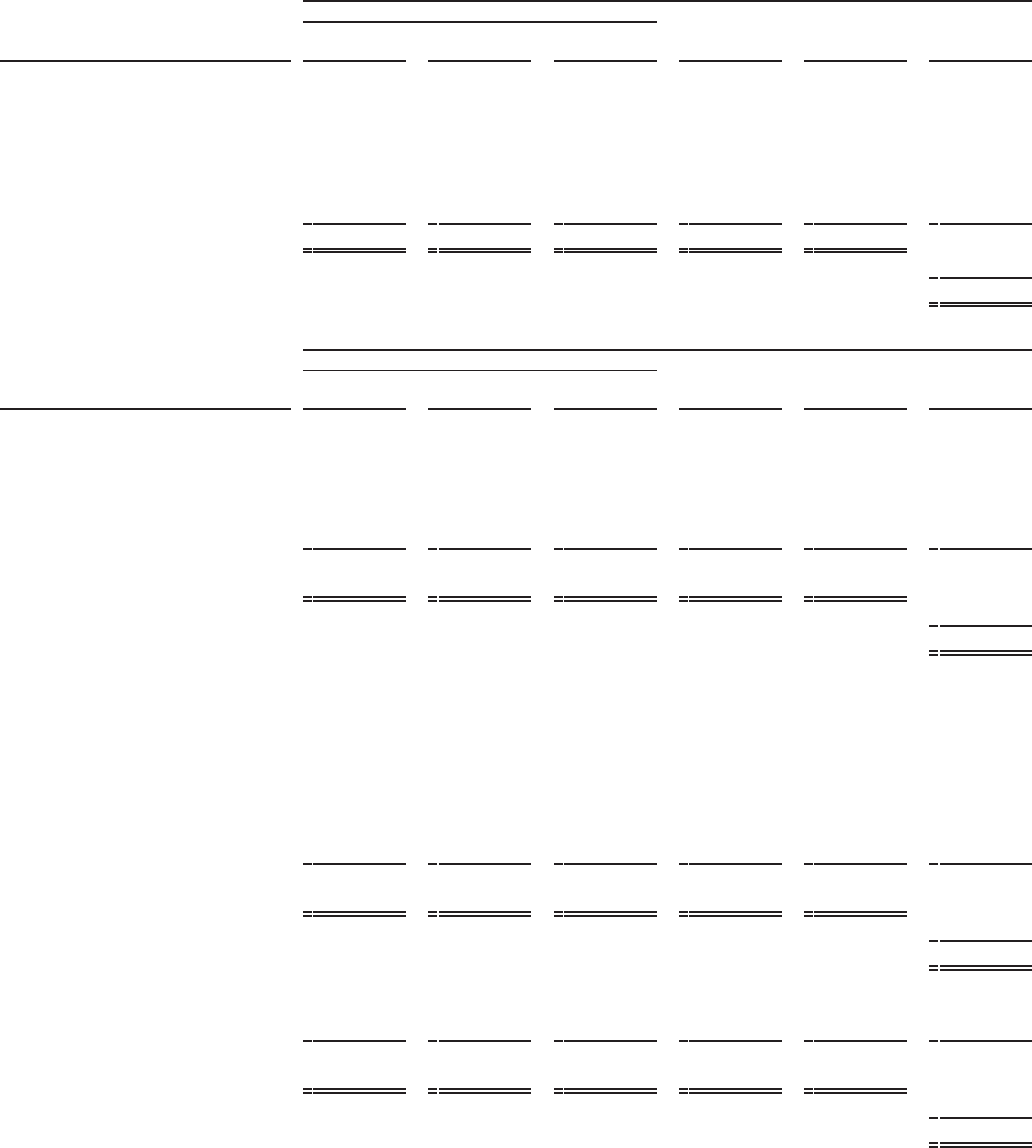

The following tables present for each of the fair value hierarchy levels, Xcel Energy’s derivative assets and liabilities measured at

fair value on a recurring basis at Dec. 31, 2011:

Dec. 31, 2011

Fair Value

Fair Value

Counterparty

(Thousands of Dollars)

Level 1

Level 2

Level 3

Total

Netting (b)

Total

Current derivative assets

Derivatives designated as cash flow

hedges:

Vehicle fuel and other commodity

$

-

$

169

$

-

$

169

$

(76)

$

93

Other derivative instruments:

Commodity trading

..............

-

32,682

-

32,682

(13,391)

19,291

Electric commodity

..............

-

-

13,333

13,333

(1,471)

11,862

Total current derivative assets

..

$

-

$

32,851

$

13,333

$

46,184

$

(14,938)

31,246

PPAs (a)

...........................

33,094

Current derivative instruments

....

$

64,340

Dec. 31, 2011

Fair Value

Fair Value

Counterparty

(Thousands of Dollars)

Level 1

Level 2

Level 3

Total

Netting (b)

Total

Noncurrent derivative assets

Derivatives designated as cash flow

hedges:

Vehicle fuel and other commodity

$

-

$

107

$

-

$

107

$

(59)

$

48

Other derivative instruments:

Commodity trading

..............

-

36,599

-

36,599

(5,540)

31,059

Total noncurrent derivative

assets

.......................

$

-

$

36,706

$

-

$

36,706

$

(5,599)

31,107

PPAs (a)

...........................

121,780

Noncurrent derivative instruments

$

152,887

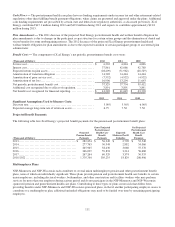

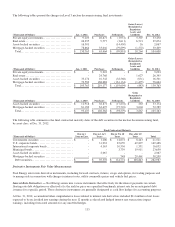

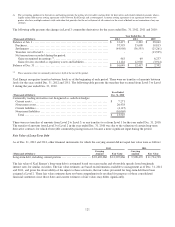

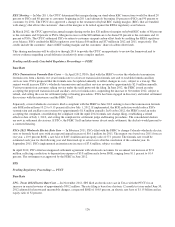

Current derivative liabilities

Derivatives designated as cash flow

hedges:

Interest rate

.....................

$

-

$

57,749

$

-

$

57,749

$

-

$

57,749

Other derivative instruments:

Commodity trading

..............

-

27,891

-

27,891

(14,417)

13,474

Electric commodity

..............

-

698

916

1,614

(1,471)

143

Natural gas commodity

..........

418

70,119

-

70,537

(7,486)

63,051

Total current derivative

liabilities

...................

$

418

$

156,457

$

916

$

157,791

$

(23,374)

134,417

PPAs (a)

..........................

22,997

Current derivative instruments

....

$

157,414

Noncurrent derivative liabilities

Other derivative instruments:

Commodity trading

..............

$

-

$

20,966

$

-

$

20,966

$

(5,599)

$

15,367

Total noncurrent derivative

liabilities

...................

$

-

$

20,966

$

-

$

20,966

$

(5,599)

15,367

PPAs (a)

...........................

248,539

Noncurrent derivative instruments

$

263,906

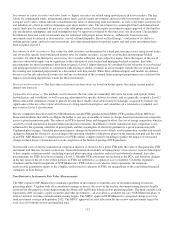

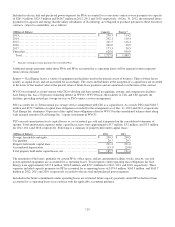

(a) In 2003, as a result of implementing new guidance on the normal purchase exception for derivative accounting, Xcel Energy began recording several long-

term PPAs at fair value due to accounting requirements related to underlying price adjustments. As these purchases are recovered through normal regulatory

recovery mechanisms in the respective jurisdictions, the changes in fair value for these contracts were offset by regulatory assets and liabilities. During 2006,

Xcel Energy qualified these contracts under the normal purchase exception. Based on this qualification, the contracts are no longer adjusted to fair value and

the previous carrying value of these contracts will be amortized over the remaining contract lives along with the offsetting regulatory assets and liabilities.