Xcel Energy 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

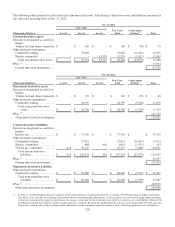

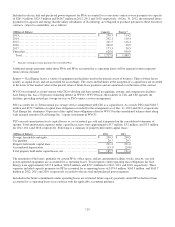

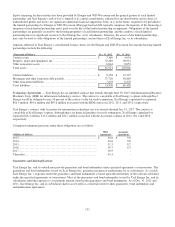

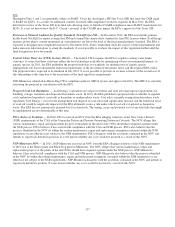

Future commitments under operating and capital leases are:

PPA

Total

Operating

Operating

Operating

(Millions of Dollars)

Leases

Leases (a) (b)

Leases

Capital Leases

2013................................

..........................

$ 27.1

$

181.4

$

208.5

$ 18.0

2014................................

..........................

26.3

186.0

212.3

18.0

2015................................

..........................

25.2

182.0

207.2

17.9

2016................................

..........................

22.2

173.9

196.1

17.2

2017................................

..........................

17.1

170.7

187.8

15.2

Thereafter................................

.....................

159.4

1,738.0

1,897.4

292.3

Total minimum obligation................................

....

378.6

Interest component of obligation

................................

(267.2)

Present value of minimum obligation

........................

$ 111.4

(c)

(a) Amounts do not include PPAs accounted for as executory contracts.

(b) PPA operating leases contractually expire through 2033.

(c) Future commitments exclude certain amounts related to Xcel Energy’s 50 percent ownership interest in WYCO.

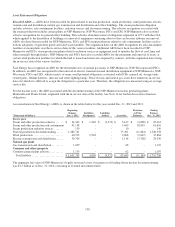

Variable Interest Entities — The accounting guidance for consolidation of variable interest entities requires enterprises to

consider the activities that most significantly impact an entity’s financial performance, and power to direct those activities, when

determining whether an enterprise is a variable interest entity’s primary beneficiary.

PPAs — Under certain PPAs, NSP-Minnesota, PSCo and SPS purchase power from independent power producing entities that

own natural gas or biomass fueled power plants for which the utility subsidiaries are required to reimburse natural gas or biomass

fuel costs, or to participate in tolling arrangements under which the subsidiaries procure the natural gas required to produce the

energy that they purchase. These specific PPAs create a variable interest in the associated independent power producing entity.

Xcel Energy has determined that certain independent power producing entities are variable interest entities. Xcel Energy is not

subject to risk of loss from the operations of these entities, and no significant financial support has been, or is in the future

required to be provided other than contractual payments for energy and capacity set forth in the PPAs.

Xcel Energy has evaluated each of these variable interest entities for possible consolidation, including review of qualitative

factors such as the length and terms of the contract, control over O&M, control over dispatch of electricity, historical and

estimated future fuel and electricity prices, and financing activities. Xcel Energy has concluded that these entities are not required

to be consolidated in its consolidated financial statements because it does not have the power to direct the activities that most

significantly impact the entities’ economic performance. Xcel Energy had approximately 3,324 MW and 3,773 MW of capacity

under long-term PPAs as of Dec. 31, 2012 and 2011, respectively, with entities that have been determined to be variable interest

entities. These agreements have expiration dates through the year 2033.

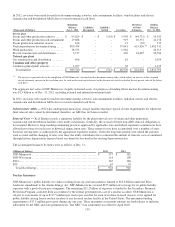

Fuel Contracts — SPS purchases all of its coal requirements for its Harrington and Tolk electric generating stations from TUCO

under contracts for those facilities that expire in 2016 and 2017, respectively. TUCO arranges for the purchase, receiving,

transporting, unloading, handling, crushing, weighing, and delivery of coal to meet SPS’ requirements. TUCO is responsible for

negotiating and administering contracts with coal suppliers, transporters and handlers.

No significant financial support has been, or is in the future, required to be provided to TUCO by SPS, other than contractual

payments for delivered coal. However, the fuel contracts create a variable interest in TUCO due to SPS’ reimbursement of certain

fuel procurement costs. SPS has determined that TUCO is a variable interest entity. SPS has concluded that it is not the primary

beneficiary of TUCO because SPS does not have the power to direct the activities that most significantly impact TUCO’s

economic performance.

Low-Income Housing Limited Partnerships — Eloigne and NSP-Wisconsin have entered into limited partnerships for the

construction and operation of affordable rental housing developments which qualify for low-income housing tax credits. Xcel

Energy Inc. has determined Eloigne and NSP-Wisconsin’s low-income housing limited partnerships to be variable interest entities

primarily due to contractual arrangements within each limited partnership that establish sharing of ongoing voting control and

profits and losses that does not consistently align with the partners’ proportional equity ownership. These limited partnerships are

designed to qualify for low-income housing tax credits, and Eloigne and NSP-Wisconsin generally receive a larger allocation of

the tax credits than the general partners at inception of the arrangements. Xcel Energy Inc. has determined that Eloigne and NSP-

Wisconsin have the power to direct the activities that most significantly impact these entities’ economic performance, and

therefore Xcel Energy Inc. consolidates these limited partnerships in its consolidated financial statements.