Xcel Energy 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

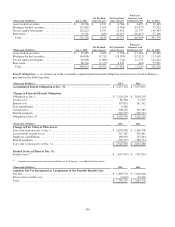

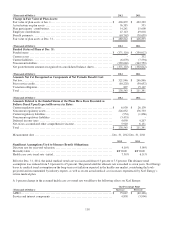

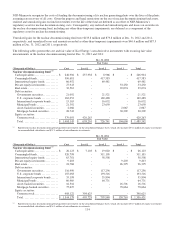

(Thousands of Dollars)

2012

2011

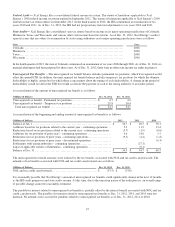

Amounts Related to the Funded Status of the Plans Have Been Recorded as

Follows Based Upon Expected Recovery in Rates:

Current regulatory assets ................................

.........................

$

115,811

$

123,814

Noncurrent regulatory assets................................

......................

1,606,524

1,435,372

Deferred income taxes ................................

...........................

31,075

28,759

Net-of-tax accumulated other comprehensive income

...............................

44,727

41,433

Total ................................................................

...........

$

1,798,137

$

1,629,378

Measurement date ................................

..............................

Dec. 31, 2012

Dec. 31, 2011

2012

2011

Significant Assumptions Used to Measure Benefit Obligations:

Discount rate for year-end valuation................................

...............

4.00

%

5.00

%

Expected average long-term increase in compensation level

.........................

3.75

4.00

Mortality table ................................................................

..

RP 2000 RP 2000

Cash Flows — Cash funding requirements can be impacted by changes to actuarial assumptions, actual asset levels and other

calculations prescribed by the funding requirements of income tax and other pension-related regulations. These regulations did

not require cash funding for 2008 through 2010 for Xcel Energy’s pension plans. Required contributions were made in 2011 and

2012 to meet minimum funding requirements.

The Pension Protection Act changed the minimum funding requirements for defined benefit pension plans beginning in 2008. The

following are the pension funding contributions, both voluntary and required, made by Xcel Energy for 2011 through January

2013:

• In January 2013, contributions of $191.5 million were made across four of Xcel Energy’s pension plans;

• In 2012, contributions of $198.1 million were made across four of Xcel Energy’s pension plans;

• In 2011, contributions of $137.3 million were made across three of Xcel Energy’s pension plans;

• For future years, Xcel Energy anticipates contributions will be made as necessary.

Plan Amendments — Xcel Energy amended the plan in 2012 to allow a one time transfer of a portion of qualifying obligations

from the nonqualified pension plan into the qualified pension plans. Xcel Energy also modified the benefit formula for

nonbargaining and some bargaining new hires beginning in 2012 to a reduced benefit level.

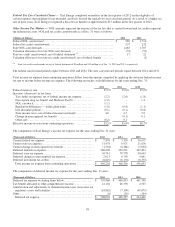

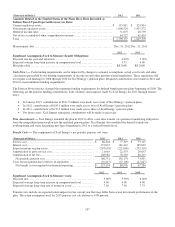

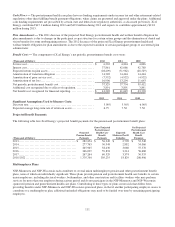

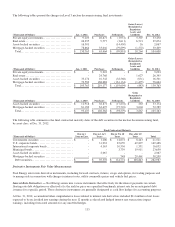

Benefit Costs — The components of Xcel Energy’s net periodic pension cost were:

(Thousands of Dollars)

2012

2011

2010

Service cost ................................

......................

$

86,364

$

77,319

$

73,147

Interest cost ................................

......................

157,035

161,412

165,010

Expected return on plan assets ................................

.....

(207,095

)

(221,600

)

(232,318

)

Amortization of prior service cost ................................

..

21,065

22,533

20,657

Amortization of net loss................................

...........

108,982

78,510

48,315

Net periodic pension cost................................

........

166,351

118,174

74,811

Costs not recognized due to effects of regulation

....................

(39,217

)

(37,198

)

(27,027

)

Net benefit cost recognized for financial reporting

.................

$

127,134

$

80,976

$

47,784

2012

2011

2010

Significant Assumptions Used to Measure Costs:

Discount rate ................................

.....................

5.00

%

5.50

%

6.00

%

Expected average long-term increase in compensation level

..........

4.00

4.00

4.00

Expected average long-term rate of return on assets

..................

7.10

7.50

7.79

Pension costs include an expected return impact for the current year that may differ from actual investment performance in the

plan. The return assumption used for 2013 pension cost calculations is 6.88 percent.