Xcel Energy 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.90

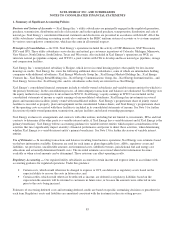

Estimated remediation costs, excluding inflationary increases, are recorded. The estimates are based on experience, an assessment

of the current situation and the technology currently available for use in the remediation. The recorded costs are regularly adjusted

as estimates are revised and remediation proceeds. If other participating PRPs exist and acknowledge their potential involvement

with a site, costs are estimated and recorded only for Xcel Energy’s expected share of the cost. Any future costs of restoring sites

where operation may extend indefinitely are treated as a capitalized cost of plant retirement. The depreciation expense levels

recoverable in rates include a provision for removal expenses, which may include final remediation costs. Removal costs

recovered in rates are classified as a regulatory liability.

See Note 13 for further discussion of environmental costs.

Benefit Plans and Other Postretirement Benefits — Xcel Energy maintains pension and postretirement benefit plans for eligible

employees. Recognizing the cost of providing benefits and measuring the projected benefit obligation of these plans under

applicable accounting guidance requires management to make various assumptions and estimates.

Based on the regulatory recovery mechanisms of Xcel Energy Inc.’s utility subsidiaries, certain unrecognized actuarial gains and

losses and unrecognized prior service costs or credits are recorded as regulatory assets and liabilities, rather than OCI.

See Note 9 for further discussion of benefit plans and other postretirement benefits.

Guarantees — Xcel Energy recognizes, upon issuance or modification of a guarantee, a liability for the fair market value of the

obligation that has been assumed in issuing the guarantee. This liability includes consideration of specific triggering events and

other conditions which may modify the ongoing obligation to perform under the guarantee.

The obligation recognized is reduced over the term of the guarantee as Xcel Energy is released from risk under the guarantee. See

Note 13 for specific details of issued guarantees.

Subsequent Events — Management has evaluated the impact of events occurring after Dec. 31, 2012 up to the date of issuance of these

consolidated financial statements. These statements contain all necessary adjustments and disclosures resulting from that evaluation.

2. Accounting Pronouncements

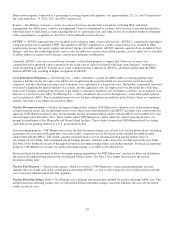

Recently Adopted

Fair Value Measurement — In May 2011, the FASB issued Fair Value Measurement (Topic 820) — Amendments to Achieve

Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs (ASU No. 2011-04), which provides

clarifications regarding existing fair value measurement principles and disclosure requirements, and also specific new guidance

for items such as measurement of instruments classified within stockholders’ equity. These requirements were effective for

interim and annual periods beginning after Dec. 15, 2011. Xcel Energy implemented the accounting and disclosure guidance

effective Jan. 1, 2012, and the implementation did not have a material impact on its consolidated financial statements. For

required fair value measurement disclosures, see Notes 9 and 11.

Presentation of Comprehensive Income — In June 2011, the FASB issued Comprehensive Income (Topic 220) — Presentation of

Comprehensive Income (ASU No. 2011-05), which requires the presentation of the components of net income, the components of

OCI and total comprehensive income in either a single continuous financial statement of comprehensive income or in two separate,

but consecutive financial statements of net income and comprehensive income. These updates do not affect the items reported in OCI

or the guidance for reclassifying such items to net income. These requirements were effective for interim and annual periods

beginning after Dec. 15, 2011. Xcel Energy implemented the financial statement presentation guidance effective Jan. 1, 2012.

Recently Issued

Balance Sheet Offsetting — In December 2011, the FASB issued Balance Sheet (Topic 210) — Disclosures about Offsetting

Assets and Liabilities (ASU No. 2011-11), which requires disclosures regarding netting arrangements in agreements underlying

derivatives, certain financial instruments and related collateral amounts, and the extent to which an entity’s financial statement

presentation policies related to netting arrangements impact amounts recorded to the financial statements. In January 2013, the

FASB issued Balance Sheet (Topic 210) – Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities (ASU 2013-

01) to clarify the specific instruments and activities that should be considered in these disclosures. These disclosure requirements

do not affect the presentation of amounts in the consolidated balance sheets, and are effective for annual reporting periods

beginning on or after Jan. 1, 2013, and interim periods within those annual reporting periods. Xcel Energy does not expect the

implementation of this disclosure guidance to have a material impact on its consolidated financial statements.