Xcel Energy 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

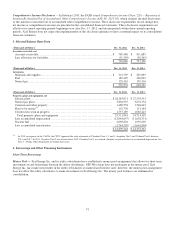

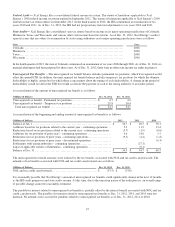

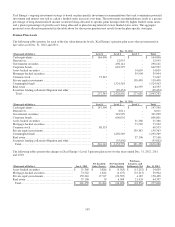

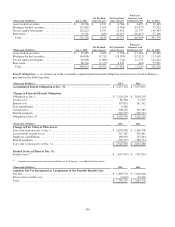

96

Construction

Plant in

Accumulated

Work in

(Thousands of Dollars)

Service

Depreciation

Progress

Ownership %

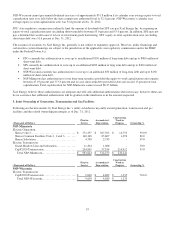

PSCo

Electric Generation:

Hayden Unit 1 ................................

....

$ 94,977

$ 61,576

$ -

75.5%

Hayden Unit 2 ................................

....

119,752

55,806

258

37.4

Hayden Common Facilities

........................

34,876

15,132

162

53.1

Craig Units 1 and 2

...............................

56,091

33,800

1,507

9.7

Craig Common Facilities 1, 2 and 3

................

35,921

16,655

510

6.5 - 9.7

Comanche Unit 3 ................................

.

875,745

46,609

890

66.7

Comanche Common Facilities

.....................

17,127

401

573

82.0

Electric Transmission:

Transmission and other facilities, including

substations................................

......

149,624

58,657

1,759

Various

Gas Transportation:

Rifle to Avon ................................

.....

16,278

6,324

-

60.0

Total PSCo ................................

.....

$ 1,400,391

$ 294,960

$ 5,659

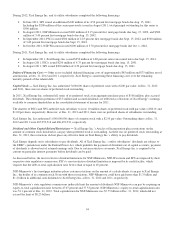

NSP-Minnesota and PSCo have approximately 500 MW and 830 MW of jointly owned generating capacity, respectively. NSP-

Minnesota’s and PSCo’s share of operating expenses and construction expenditures are included in the applicable utility accounts.

Each of the respective owners is responsible for providing its own financing.

NSP-Minnesota is part owner of Sherco Unit 3, an 860 MW, coal – fueled electric generating unit. NSP-Minnesota is the operating

agent under the joint ownership agreement. In November 2011, Sherco Unit 3 experienced a significant failure of its turbine,

generator, and exciter systems. Repairs to Sherco Unit 3 are expected to be substantially complete in 2013, followed by an extended

period of commissioning and testing. NSP-Minnesota maintains insurance policies for the entire unit, inclusive of the other joint

owner’s proportionate share. Replacement and repair of damaged systems, and other significant costs of the failure in excess of a

$1.5 million deductible are expected to be recovered through these insurance policies. For its proportionate share of expenditures in

excess of insurance recoveries for components of the jointly owned facility, NSP-Minnesota will recognize additions to property,

plant and equipment and O&M. Sherco Units 1 and 2, wholly owned by NSP-Minnesota, continue to operate.

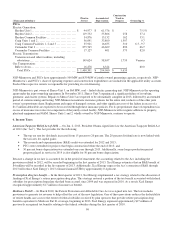

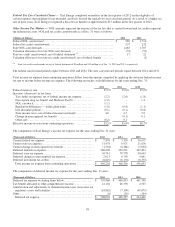

6. Income Taxes

American Taxpayer Relief Act of 2012 — On Jan. 2, 2013, President Obama signed into law the American Taxpayer Relief Act

of 2012 (the “Act”). The Act provides for the following:

• The top tax rate for dividends increased from 15 percent to 20 percent. The 20 percent dividend rate is now linked with

the tax rates for capital gains;

• The research and experimentation (R&E) credit was extended for 2012 and 2013;

• PTCs were extended for projects that begin construction before the end of 2013; and

• 50 percent bonus depreciation was extended one year through 2013. Additionally, some longer production period

property placed in service in 2014 is also eligible for 50 percent bonus depreciation.

Because a change in tax law is accounted for in the period of enactment, the accounting related to the Act, including the

provisions related to 2012, will be recorded beginning in the first quarter of 2013. Xcel Energy estimates that an R&E benefit of

$4 million will be recorded in the first quarter of 2013. Additionally, Xcel Energy expects the Act’s extension of R&E through

2013 will reduce Xcel Energy’s 2013 estimated annual ETR by approximately 0.4 percent.

Prescription drug tax benefit — In the third quarter of 2012, Xcel Energy implemented a tax strategy related to the allocation of

funding of Xcel Energy’s retiree prescription drug plan. This strategy restored a portion of the tax benefit associated with federal

subsidies for prescription drug plans that had been accrued since 2004 and was expensed in 2010. As a result, Xcel Energy

recognized approximately $17 million of income tax benefit.

Medicare Part D — In March 2010, the Patient Protection and Affordable Care Act was signed into law. The law includes

provisions to generate tax revenue to help offset the cost of the new legislation. One of these provisions reduces the deductibility

of retiree health care costs to the extent of federal subsidies received by plan sponsors that provide retiree prescription drug

benefits equivalent to Medicare Part D coverage, beginning in 2013. Xcel Energy expensed approximately $17 million of

previously recognized tax benefits relating to the federal subsidies during the first quarter of 2010.