Xcel Energy 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

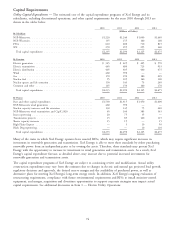

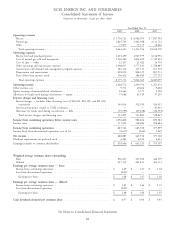

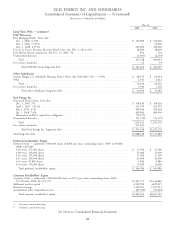

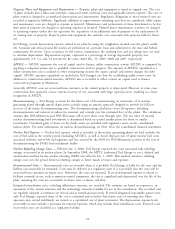

XCEL ENERGY INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(amounts in thousands of dollars)

Year Ended Dec. 31

2009 2008 2007

Operating activities

Net income .................................................... $ 680,887 $ 645,554 $ 577,348

Remove loss (income) from discontinued operations ............................. 4,637 166 (1,449)

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation and amortization ........................................ 835,597 843,461 834,455

Conservation and demand side management program expenses ..................... 29,418 39,931 21,442

Nuclear fuel amortization ........................................... 80,104 64,203 53,453

Deferred income taxes ............................................ 416,581 259,045 265,277

Amortization of investment tax credits ................................... (6,426) (7,198) (8,680)

Allowance for equity funds used during construction ........................... (75,686) (63,519) (37,207)

Equity earnings of unconsolidated subsidiaries ............................... (24,664) (3,571) (1,900)

Dividends from equity method investees .................................. 29,059 — —

Provision for bad debts ............................................ 49,023 63,407 57,434

Share-based compensation expense ..................................... 29,672 25,511 22,871

Net realized and unrealized hedging and derivative transactions ..................... 39,029 (31,895) 6,463

Changes in operating assets and liabilities:

Accounts receivable ............................................. 122,785 (14,108) (136,807)

Accrued unbilled revenues ......................................... 49,430 (11,520) (217,659)

Inventories .................................................. 100,504 (135,099) (25,464)

Recoverable purchased natural gas and electric energy costs ...................... (23,901) 33,947 185,185

Other current assets ............................................ (48,097) 11,937 (9,922)

Accounts payable .............................................. (50,015) 28,422 (10,018)

Net regulatory assets and liabilities .................................... (24,379) (70,993) 27,428

Other current liabilities .......................................... 37,701 48,819 52,771

Pension and other employee benefit obligations ............................. (246,002) (104,972) (96,930)

Change in other noncurrent assets ..................................... (9,451) 54,327 3,265

Change in other noncurrent liabilities ................................... (49,119) 6,984 (2,168)

Operating cash flows (used in) provided by discontinued operations .................... (28,223) (3,323) 72,346

Net cash provided by operating activities ................................ 1,918,464 1,679,516 1,631,534

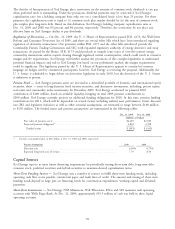

Investing activities

Utility capital/construction expenditures .................................. (1,786,902) (2,113,246) (2,096,857)

Allowance for equity funds used during construction ........................... 75,686 63,519 37,207

Purchase of investments in external decommissioning fund ....................... (1,644,278) (957,752) (712,462)

Proceeds from the sale of investments in external decommissioning fund ............... 1,664,957 914,514 669,070

Investment in WYCO Development LLC ................................. (42,490) (97,924) (29,659)

Change in restricted cash ........................................... 264 32,008 (9,190)

Cash obtained from consolidation of NMC ................................ — — 38,950

Other investments ............................................... (1,904) 2,564 20,832

Net cash used in investing activities ................................... (1,734,667) (2,156,317) (2,082,109)

Financing activities

Proceeds (repayment) of short-term borrowings, net ........................... 3,750 (633,310) 462,260

Proceeds from issuance of long-term debt ................................. 689,915 1,915,060 1,162,272

Repayment of long-term debt, including reacquisition premiums .................... (621,296) (581,313) (768,146)

Proceeds from issuance of common stock ................................. 20,133 352,871 10,539

Dividends paid ................................................. (414,922) (382,282) (378,892)

Early participation payment on debt exchange ............................... — — (4,859)

Net cash (used in) provided by financing activities ........................... (322,420) 671,026 483,174

Net increase (decrease) in cash and cash equivalents ............................. (138,623) 194,225 32,599

Net increase (decrease) in cash and cash equivalents — discontinued operations ............. (2,786) 3,853 (18,937)

Cash and cash equivalents at beginning of period .............................. 249,198 51,120 37,458

Cash and cash equivalents at end of period .................................. $ 107,789 $ 249,198 $ 51,120

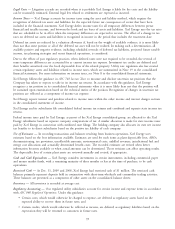

Supplemental disclosure of cash flow information:

Cash paid for interest (net of amounts capitalized) ............................ $ (514,675) $ (485,373) $ (469,142)

Cash received (paid) for income taxes, net ................................. 21,154 (94,744) (6,467)

Supplemental disclosure of non-cash investing transactions:

Property, plant and equipment additions in accounts payable ...................... $ 68,417 $ 55,715 $ 39,681

Storage assets under capital lease ....................................... 71,553 — —

Supplemental disclosure of non-cash financing transactions:

Issuance of common stock for reinvested dividends and 401(k) plans .................. $ 54,638 $ 56,009 $ 53,105

Issuance of common stock for senior convertible notes .......................... — 57,500 229,623

See Notes to Consolidated Financial Statements

84