Xcel Energy 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

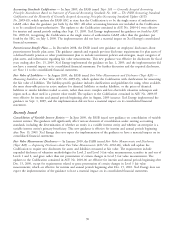

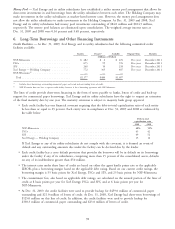

PSCo

In June 2009, PSCo issued $400 million of 5.125 percent first mortgage bonds, series due 2019. PSCo added the

proceeds from the sale of the first mortgage bonds to its general funds and applied a portion of the net proceeds to

fund the payment at maturity of $200 million of 6.875 percent unsecured senior notes due July 15, 2009.

In August 2008, PSCo issued $300 million of 5.80 percent first mortgage bonds, series due Aug. 1, 2018 and

$300 million of 6.50 percent first mortgage bonds, series due Aug. 1, 2038. PSCo added the net proceeds from the sale

of the first mortgage bonds to its general funds and applied a portion of such net proceeds to fund the payment at

maturity of $300 million of 4.375 percent first mortgage bonds due Oct. 1, 2008.

SPS

In February 2010, SPS redeemed its $25.0 million pollution control obligations, securing pollution control revenue

bonds, due July 1, 2016.

In November 2008, SPS issued $250 million of 8.75 percent senior notes, series due 2018. The proceeds from this

offering were used to repay short-term debt.

Convertible Senior Notes

During the fourth quarter of 2008, $57.5 million of remaining Xcel Energy convertible notes due Nov. 21, 2008, were

converted to common stock. During the second and fourth quarter of 2007, approximately $126 million and

$104 million, respectively, of Xcel Energy convertible notes due Nov. 21, 2007, were converted to common stock.

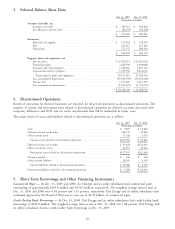

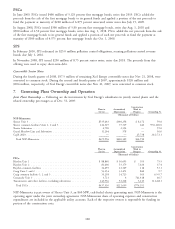

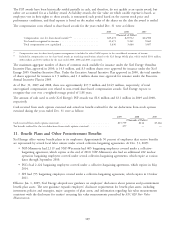

7. Generating Plant Ownership and Operation

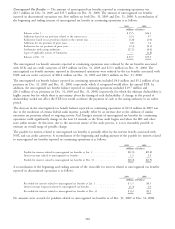

Joint Plant Ownership — Following are the investments by Xcel Energy’s subsidiaries in jointly owned plants and the

related ownership percentages as of Dec. 31, 2009:

Construction

Plant in Accumulated Work in

Service Depreciation Progress Ownership %

(Thousands of Dollars)

NSP-Minnesota

Sherco Unit 3 ..................................... $535,643 $340,258 $ 8,172 59.0

Sherco common facilities Units 1, 2 and 3 ................... 124,319 77,319 640 59.0-100.0

Sherco Substation ................................... 4,790 2,354 — 59.0

Grand Meadow Line and Substation ....................... 11,204 378 — 50.0

CapX 2020 ....................................... — — 25,738 26.2-72.1

Total NSP-Minnesota ............................... $675,956 $420,309 $34,550

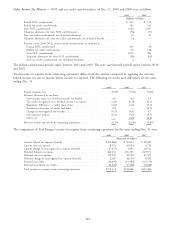

Construction

Plant in Accumulated Work in

Service Depreciation Progress Ownership %

(Thousands of Dollars)

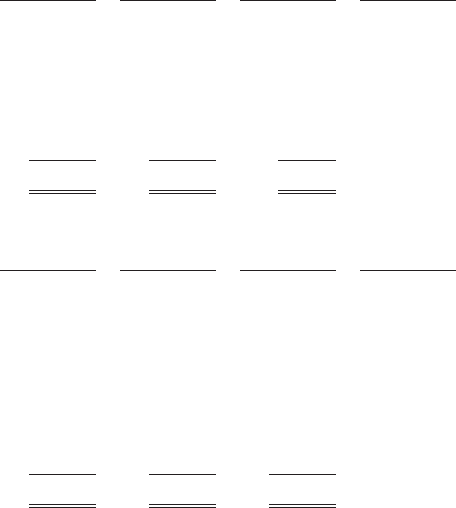

PSCo

Hayden Unit 1 .................................... $88,840 $ 56,695 $ 393 75.5

Hayden Unit 2 .................................... 81,606 53,179 7,624 37.4

Hayden common facilities ............................. 32,695 12,369 118 53.1

Craig Units 1 and 2 ................................. 53,254 31,471 860 9.7

Craig common facilities 1, 2 and 3 ........................ 33,258 14,723 565 6.5-9.7

Comanche Unit 3 .................................. 3,721 4 761,418 66.7

Transmission and other facilities, including substations ............ 143,936 53,218 3,213 11.6-68.1

Total PSCo ..................................... $437,310 $221,659 $774,191

NSP-Minnesota is part owner of Sherco Unit 3, an 860 MW, coal-fueled electric generating unit. NSP-Minnesota is the

operating agent under the joint ownership agreement. NSP-Minnesota’s share of operating expenses and construction

expenditures are included in the applicable utility accounts. Each of the respective owners is responsible for funding its

portion of the construction costs.

100