Xcel Energy 2009 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

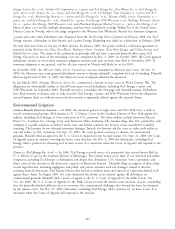

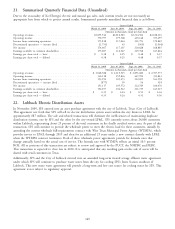

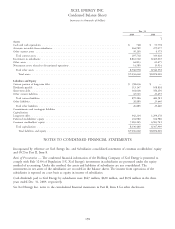

21. Summarized Quarterly Financial Data (Unaudited)

Due to the seasonality of Xcel Energy’s electric and natural gas sales, such interim results are not necessarily an

appropriate base from which to project annual results. Summarized quarterly unaudited financial data is as follows:

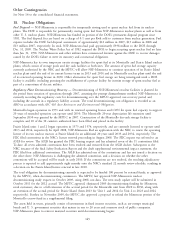

Quarter Ended

March 31, 2009 June 30, 2009 Sept. 30, 2009 Dec. 31, 2009

(Amounts in thousands, except per share data)

Operating revenues ................................ $2,695,542 $2,016,083 $2,314,562 $2,618,116

Operating income ................................ 370,797 279,368 465,148 353,259

Income from continuing operations ...................... 175,818 117,064 221,793 170,849

Discontinued operations — income (loss) .................. (1,751) 43 (965) (1,964)

Net income .................................... 174,067 117,107 220,828 168,885

Earnings available to common shareholders ................. 173,007 116,047 219,768 167,824

Earnings per share total — basic ....................... $ 0.38 $ 0.25 $ 0.48 $ 0.37

Earnings per share total — diluted ...................... 0.38 0.25 0.48 0.37

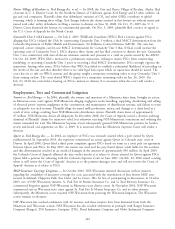

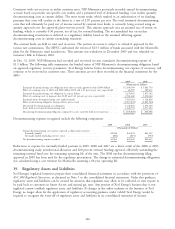

Quarter Ended

March 31, 2008 June 30, 2008 Sept. 30, 2008 Dec. 31, 2008

(Amounts in thousands, except per share data)

Operating revenues ................................ $3,028,388 $ 2,615,515 $ 2,851,680 $ 2,707,573

Operating income ................................ 330,118 259,836 447,994 352,843

Income from continuing operations ...................... 153,994 105,473 222,695 163,558

Discontinued operations — income (loss) .................. (877) 99 94 518

Net income .................................... 153,117 105,572 222,789 164,076

Earnings available to common shareholders ................. 152,057 104,512 221,729 163,015

Earnings per share total — basic ....................... $ 0.35 $ 0.24 $ 0.51 $ 0.36

Earnings per share total — diluted ...................... 0.35 0.24 0.51 0.36

22. Lubbock Electric Distribution Assets

In November 2009, SPS entered into an asset purchase agreement with the city of Lubbock, Texas (City of Lubbock).

This agreement sets forth that SPS will sell its electric distribution system assets within the city limits to LP&L for

approximately $87 million. The sale and related transactions will eliminate the inefficiencies of maintaining duplicate

distribution systems, one by SPS and the other by the city-owned LP&L. SPS currently serves about 24,000 customers

within Lubbock, representing about 25 percent of the total customers in the dually certified service area. As part of this

transaction, SPS will continue to provide the wholesale power to meet the electric load for these customers, initially by

amending the current wholesale full-requirements contract with West Texas Municipal Power Agency (WTMPA), which

provides service to LP&L through 2019 and then for an additional 25 years under a new contract directly with LP&L

when the WTMPA contract terminates. Both of these wholesale power agreements provide for formula rates that

change annually based on the actual cost of service. The formula rate with WTMPA reflects an initial 10.5 percent

ROE. All or portions of this transaction are subject to review and approval by the PUCT, the NMPRC and FERC.

This transaction is expected to close late in 2010. It is anticipated that any resulting gain on the sale of assets will be

shared with retail customers in Texas.

Additionally, SPS and the City of Lubbock entered into an amended long-term treated sewage effluent water agreement

under which SPS will continue to purchase waste water from the city for cooling SPS’s Jones Station southeast of

Lubbock. This new waste water agreement will provide a long-term and low cost source for cooling water for SPS. This

agreement is not subject to regulatory approval.

149