Xcel Energy 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

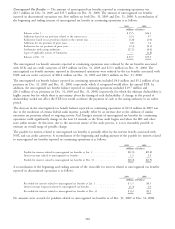

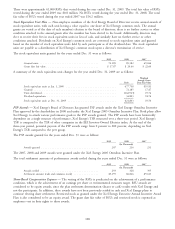

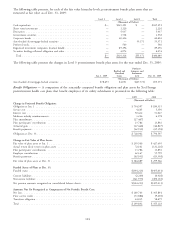

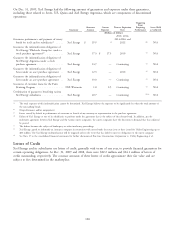

2009 2008

(Thousands of Dollars)

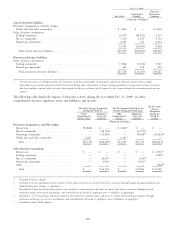

Amounts Not Yet Recognized as Components of Net Periodic Benefit Cost:

Net loss ............................................................ $1,432,370 $1,220,721

Prior service cost ...................................................... 42,883 102,842

Total .............................................................. $1,475,253 $1,323,563

Amounts Related to the Funded Status of the Plans Have Been Recorded as Follows Based Upon

Expected Recovery in Rates:

Regulatory assets ...................................................... $1,413,774 $1,268,879

Deferred income taxes ................................................... 25,101 22,294

Net-of-tax accumulated other comprehensive income ................................ 36,378 32,390

Total .............................................................. $1,475,253 $1,323,563

Measurement date ...................................................... Dec. 31, 2009 Dec. 31, 2008

Significant Assumptions Used to Measure Benefit Obligations:

Discount rate for year-end valuation .......................................... 6.00% 6.75%

Expected average long-term increase in compensation level ............................. 4.00 4.00

Mortality table ........................................................ RP 2000 RP 2000

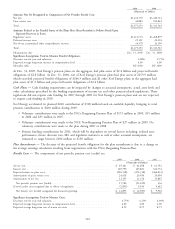

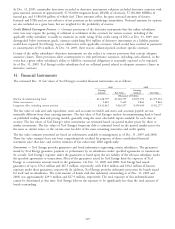

At Dec. 31, 2009, Xcel Energy’s pension plans, in the aggregate, had plan assets of $2.4 billion and projected benefit

obligations of $2.8 billion. At Dec. 31, 2008, one of Xcel Energy’s pension plans had plan assets of $259.9 million,

which exceeded projected benefit obligations of $244.3 million and all other Xcel Energy plans in the aggregate had

plan assets of $1.9 billion and projected benefit obligations of $2.4 billion.

Cash Flows — Cash funding requirements can be impacted by changes to actuarial assumptions, actual asset levels and

other calculations prescribed by the funding requirements of income tax and other pension-related regulations. These

regulations did not require cash funding for 2007 through 2009 for Xcel Energy’s pension plans and are not expected

to require cash funding in 2010.

Xcel Energy accelerated its planned 2010 contribution of $100 million based on available liquidity, bringing its total

pension contributions to $200 million during 2009.

• Voluntary contributions were made to the PSCo Bargaining Pension Plan of $173 million in 2009, $35 million

in 2008 and $35 million in 2007.

• Voluntary contributions were made to the NCE Non-Bargaining Pension Plan of $27 million in 2009. No

voluntary contributions were made to the plan during 2007 or 2008.

• Pension funding contributions for 2011, which will be dependent on several factors including, realized asset

performance, future discount rate, IRS and legislative initiatives as well as other actuarial assumptions, are

estimated to range between $100 million to $150 million.

Plan Amendments — The decrease of the projected benefit obligation for the plan amendment is due to a change in

the average earnings calculation resulting from negotiations with the PSCo Bargaining Pension Plan.

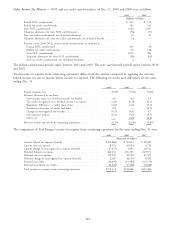

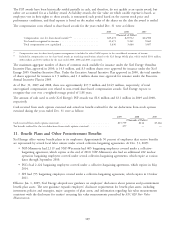

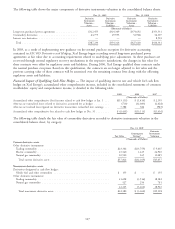

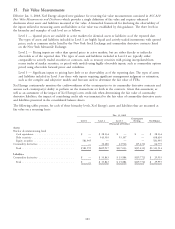

Benefit Costs — The components of net periodic pension cost (credit) are:

2009 2008 2007

(Thousands of Dollars)

Service cost ................................................. $ 65,461 $ 62,698 $ 61,392

Interest cost ................................................. 169,790 167,881 162,774

Expected return on plan assets ..................................... (256,538) (274,338) (264,831)

Amortization of prior service cost ................................... 24,618 20,584 25,056

Amortization of net loss ......................................... 12,455 11,156 15,845

Net periodic pension cost (credit) .................................. 15,786 (12,019) 236

(Costs) credits not recognized due to effects of regulation .................... (2,891) 9,034 9,682

Net benefit cost (credit) recognized for financial reporting ................... $ 12,895 $ (2,985) $ 9,918

Significant Assumptions Used to Measure Costs:

Discount rate for year-end valuation .................................. 6.75% 6.25% 6.00%

Expected average long-term increase in compensation level .................... 4.00 4.00 4.00

Expected average long-term rate of return on assets ........................ 8.50 8.75 8.75

112