Xcel Energy 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

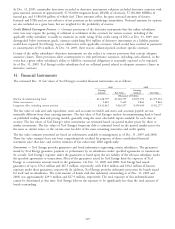

At Dec. 31, 2009, commodity derivatives recorded to derivative instruments valuation included derivative contracts with

gross notional amounts of approximately 37,932,000 megawatt hours (MwH) of electricity, 57,181,000 MMBtu of

natural gas, and 3,580,000 gallons of vehicle fuel. These amounts reflect the gross notional amounts of futures,

forwards and FTRs and are not reflective of net positions in the underlying commodities. Notional amounts for options

are also included on a gross basis, but are weighted for the probability of exercise.

Credit Related Contingent Features — Contract provisions of the derivative instruments that the utility subsidiaries

enter into may require the posting of collateral or settlement of the contracts for various reasons, including if the

applicable utility subsidiary is unable to maintain its credit rating. If the credit rating of PSCo at Dec. 31, 2009 were

downgraded below investment grade, contracts underlying $0.6 million of derivative instruments in a liability position

would have required Xcel Energy to post collateral or settle applicable contracts, which would have resulted in payments

to counterparties of $3.4 million. At Dec. 31, 2009, there was no collateral posted on these specific contracts.

Certain of the utility subsidiaries’ derivative instruments are also subject to contract provisions that contain adequate

assurance clauses. These provisions allow counterparties to seek performance assurance, including cash collateral, in the

event that a given utility subsidiary’s ability to fulfill its contractual obligations is reasonably expected to be impaired.

As of Dec. 31, 2009, Xcel Energy’s utility subsidiaries had no collateral posted related to adequate assurance clauses in

derivative contracts.

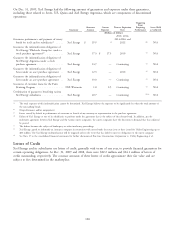

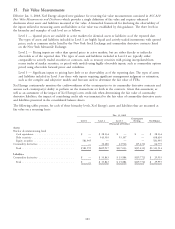

14. Financial Instruments

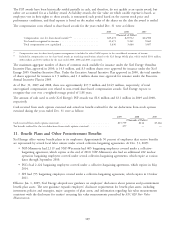

The estimated Dec. 31 fair values of Xcel Energy’s recorded financial instruments are as follows:

2009 2008

Carrying Carrying

Amount Fair Value Amount Fair Value

(Thousands of Dollars)

Nuclear decommissioning fund .......................... $1,248,739 $1,248,739 $1,075,294 $1,075,294

Other investments .................................. 9,649 9,649 9,864 9,864

Long-term debt, including current portion ................... 8,432,442 9,026,257 8,290,460 8,562,277

The fair value of cash and cash equivalents, notes and accounts receivable and notes and accounts payable are not

materially different from their carrying amounts. The fair value of Xcel Energy’s nuclear decommissioning fund is based

on published trading data and pricing models, generally using the most observable inputs available for each class of

security. The fair values of Xcel Energy’s other investments are estimated based on quoted market prices for those or

similar investments. The fair values of Xcel Energy’s long-term debt is estimated based on the quoted market prices for

the same or similar issues, or the current rates for debt of the same remaining maturities and credit quality.

The fair value estimates presented are based on information available to management as of Dec. 31, 2009 and 2008.

These fair value estimates have not been comprehensively revalued for purposes of these consolidated financial

statements since that date, and current estimates of fair values may differ significantly.

Guarantees — Xcel Energy provides guarantees and bond indemnities supporting certain subsidiaries. The guarantees

issued by Xcel Energy guarantee payment or performance by its subsidiaries under specified agreements or transactions.

As a result, Xcel Energy’s exposure under the guarantees is based upon the net liability of the relevant subsidiary under

the specified agreements or transactions. Most of the guarantees issued by Xcel Energy limit the exposure of Xcel

Energy to a maximum amount stated in the guarantees. On Dec. 31, 2009 and 2008, Xcel Energy had issued

guarantees of up to $76.4 million and $67.5 million, respectively, with $18.0 million and $18.2 million of known

exposure under these guarantees, respectively. In addition, Xcel Energy provides indemnity protection for bonds issued

for itself and its subsidiaries. The total amount of bonds with this indemnity outstanding as of Dec. 31, 2009 and

2008, was approximately $29.9 million and $27.9 million, respectively. The total exposure of this indemnification

cannot be determined at this time. Xcel Energy believes the exposure to be significantly less than the total amount of

bonds outstanding.

119