Xcel Energy 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fair Value of Liabilities — In August 2009, the FASB issued Fair Value Measurements and Disclosures (Topic 820) —

Measuring Liabilities at Fair Value (ASU No. 2009-05), which updates the Codification with clarifications for measuring

the fair value of liabilities. The liability-specific guidance includes clarifications and guidelines for using, when available,

the most observable prices in active markets for identical liabilities or similar liabilities, or the prices of identical

liabilities or similar liabilities traded as assets, rather than more complex and less observable valuation techniques and

inputs such as those used in a present value model. The updates to the Codification contained in ASU No. 2009-05

were effective for interim and annual periods beginning after its August, 2009 issuance. Xcel Energy implemented the

guidance on Sept. 1, 2009, and the implementation did not have a material impact on its consolidated financial

statements.

Recently Issued

Consolidation of Variable Interest Entities — In June 2009, the FASB issued new guidance on consolidation of variable

interest entities. The guidance will significantly affect various elements of consolidation under existing accounting

standards, including the determination of whether an entity is a variable interest entity and whether an enterprise is a

variable interest entity’s primary beneficiary. This new guidance is effective for interim and annual periods beginning

after Nov. 15, 2009. Xcel Energy does not expect the implementation of the guidance to have a material impact on its

consolidated financial statements.

Fair Value Measurement Disclosures — In January 2010, the FASB issued Fair Value Measurements and Disclosures

(Topic 820) — Improving Disclosures about Fair Value Measurements (ASU No. 2010-06), which will update the

Codification to require new disclosures for assets and liabilities measured at fair value. The requirements include

expanded disclosure of valuation methodologies for Level 2 and Level 3 fair value measurements, transfers in and out of

Levels 1 and 2, and gross rather than net presentation of certain changes in Level 3 fair value measurements. The

updates to the Codification contained in ASU No. 2010-06 are effective for interim and annual periods beginning after

Dec. 15, 2009, except for requirements related to gross presentation of certain changes in Level 3 fair value

measurements, which are effective for interim and annual periods beginning after Dec. 15, 2010. Xcel Energy does not

expect the implementation of the guidance to have a material impact on its consolidated financial statements.

Derivatives, Risk Management and Market Risk

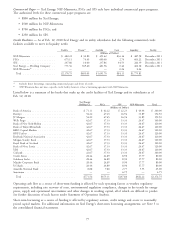

In the normal course of business, Xcel Energy and its subsidiaries are exposed to a variety of market risks. Market risk

is the potential loss or gain that may occur as a result of changes in the market or fair value of a particular instrument

or commodity. All financial and commodity-related instruments, including derivatives, are subject to market risk.

Market risks associated with derivatives are discussed in further detail in Note 13 to the consolidated financial

statements.

Xcel Energy is exposed to the impact of changes in price for energy and energy related products, which is partially

mitigated by Xcel Energy’s use of commodity derivatives. Though no material non-performance risk currently exists

with the counterparties to Xcel Energy’s commodity derivative contracts, distress in the financial markets may in the

future impact that risk to the extent it impacts those counterparties. Distress in the financial markets may also impact

the fair value of the debt and equity securities in the nuclear decommissioning trust fund and master pension trust, as

well as Xcel Energy’s ability to earn a return on short-term investments of excess cash.

Commodity Price Risk — Xcel Energy’s utility subsidiaries are exposed to commodity price risk in their electric and

natural gas operations. Commodity price risk is managed by entering into long- and short-term physical purchase and

sales contracts for electric capacity, energy and energy-related products and for various fuels used in generation and

distribution activities. Commodity price risk is also managed through the use of financial derivative instruments. Xcel

Energy’s risk management policy allows it to manage commodity price risk within each rate-regulated operation to the

extent such exposure exists.

Short-Term Wholesale and Commodity Trading Risk — Xcel Energy’s utility subsidiaries conduct various short-term

wholesale and commodity trading activities, including the purchase and sale of electric capacity, energy and energy-

related instruments. Xcel Energy’s risk management policy allows management to conduct these activities within

guidelines and limitations as approved by its risk management committee, which is made up of management personnel

not directly involved in the activities governed by this policy.

70