Xcel Energy 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

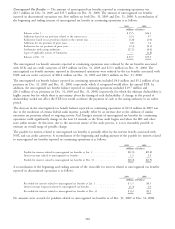

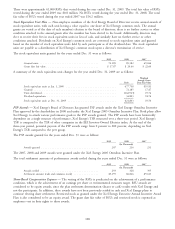

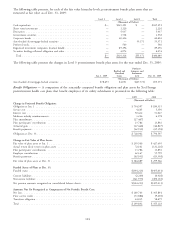

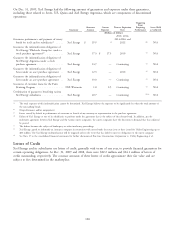

Pension Plan Assets

The following table presents, for each of the fair value hierarchy levels, pension plan assets that are measured at fair

value as of Dec. 31, 2009:

Level 1 Level 2 Level 3 Total

(Thousands of Dollars)

Cash equivalents ................................... $ — $ 221,971 $ — $ 221,971

Short-term investments & money market securities .............. — 324,683 — 324,683

Derivatives ....................................... — 11,606 — 11,606

Government securities ................................ — 94,949 — 94,949

Corporate bonds ................................... — 522,403 — 522,403

Asset-backed & mortgage-backed securities ................... — — 191,831 191,831

Common stock .................................... 89,260 — — 89,260

Private equity investments .............................. — — 82,098 82,098

Commingled equity and bond funds ....................... — 1,014,072 — 1,014,072

Real estate ....................................... — — 66,704 66,704

Securities lending collateral obligation and other ................ — (170,251) — (170,251)

Total ......................................... $89,260 $2,019,433 $340,633 $2,449,326

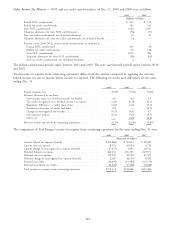

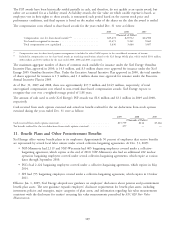

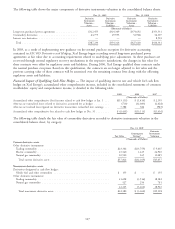

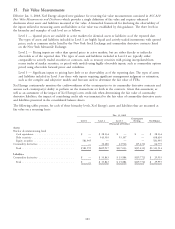

The following table presents the changes in Level 3 pension plan assets for the year ended Dec. 31, 2009:

Purchases,

Realized and Issuances, and

Unrealized Settlements

Jan. 1, 2009 Gains (Losses) (net) Dec. 31, 2009

(Thousands of Dollars)

Asset-backed & mortgage-backed securities ................... $244,008 $151,755 $(203,932) $191,831

Real estate ....................................... 109,289 (43,207) 622 66,704

Private equity investments .............................. 81,034 (5,682) 6,746 82,098

Total ......................................... $434,331 $102,866 $(196,564) $340,633

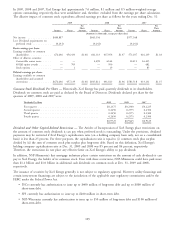

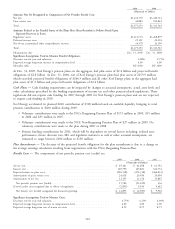

Benefit Obligations — A comparison of the actuarially computed pension-benefit obligation and plan assets, on a

combined basis, is presented in the following table:

2009 2008

(Thousands of Dollars)

Accumulated Benefit Obligation at Dec. 31 ..................................... $2,676,174 $2,435,513

Change in Projected Benefit Obligation:

Obligation at Jan. 1 .................................................... $2,598,032 $2,662,759

Service cost .......................................................... 65,461 62,698

Interest cost ......................................................... 169,790 167,881

Plan amendments ...................................................... (35,341) —

Actuarial loss (gain) ..................................................... 223,122 (47,509)

Benefit payments ...................................................... (191,433) (247,797)

Obligation at Dec. 31 ................................................... $2,829,631 $2,598,032

Change in Fair Value of Plan Assets:

Fair value of plan assets at Jan. 1 ............................................ $2,185,203 $3,186,273

Actual return (loss) on plan assets ............................................ 255,556 (788,273)

Employer contributions .................................................. 200,000 35,000

Benefit payments ...................................................... (191,433) (247,797)

Fair value of plan assets at Dec. 31 ........................................... $2,449,326 $2,185,203

Funded Status of Plans at Dec. 31:

Funded status ........................................................ $(380,305) $ (412,829)

Noncurrent assets ...................................................... — 15,612

Noncurrent liabilities .................................................... (380,305) (428,441)

Net pension amounts recognized on consolidated balance sheets ......................... $(380,305) $ (412,829)

111