Xcel Energy 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Higher 2009 ongoing earnings were primarily due to improved electric margins as a result of constructive rate case

outcomes in Minnesota, Colorado, Texas, New Mexico and Wisconsin, which were partially mitigated by the negative

impact of weather, lower sales and higher purchase capacity power costs. Offsetting stronger electric margins were higher

operating and maintenance expenses, resulting from increased employee benefit costs as well as higher nuclear expenses,

and dilution from the issuance of equity to fund the capital investment program.

Earnings from continuing operations for 2008 were higher than in 2007 primarily attributed to lower O&M expense,

higher electric and gas margins, and higher AFUDC — equity. Partially offsetting these positive factors were higher

depreciation and amortization, higher conservation and DSM program expenses, increased interest expense and a higher

ETR.

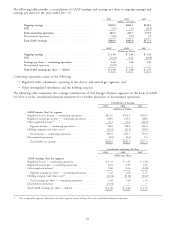

Statement of Operations Analysis — Continuing Operations

The following discussion summarizes the items that affected the individual revenue and expense items reported in the

consolidated statements of income.

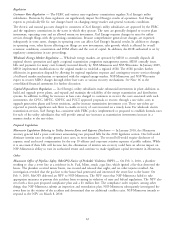

Weather — Xcel Energy’s earnings can be significantly affected by weather. Unseasonably hot summers or cold winters

increase electric and natural gas sales, but also can increase O&M expenses. Unseasonably mild weather reduces electric

and natural gas sales, but may not reduce O&M expenses. The impact of weather on earnings is based on the number

of customers, temperature variances and the amount of natural gas or electricity the average customer historically uses

per degree of temperature.

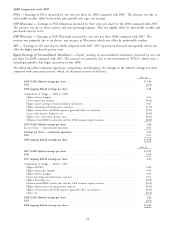

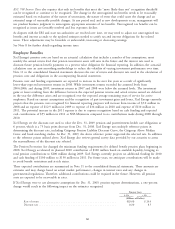

Estimated Impact of Temperature Changes on Regulated Earnings — The following table summarizes the estimated

impact on earnings per share of temperature variations compared with sales under normal weather conditions.

2009 vs. Normal 2008 vs. Normal 2009 vs. 2008 2007 vs. Normal 2008 vs. 2007

Retail electric ............ $(0.05) $(0.01) $(0.04) $0.06 $(0.07)

Firm natural gas .......... — 0.01 (0.01) — 0.01

Total ................. $(0.05) $ — $(0.05) $0.06 $(0.06)

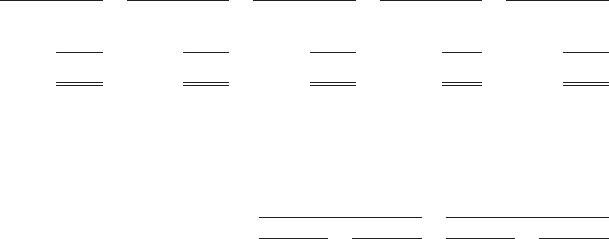

Sales Growth (Decline) — The following table summarizes Xcel Energy’s regulated sales growth (decline) for actual and

weather-normalized energy sales for the years ended Dec. 31, compared with the previous year. The year-end sales

growth amounts for 2008 have been adjusted for leap year.

2009 2008

Actual Normalized Actual Normalized

Electric residential ............................... (1.4)% 0.7% (2.0)% —%

Electric commercial and industrial ..................... (3.3) (2.7) 1.5 2.4

Total retail electric sales .......................... (2.7) (1.8) 0.5 1.7

Firm natural gas sales ............................. (2.6) 0.1 4.9 1.9

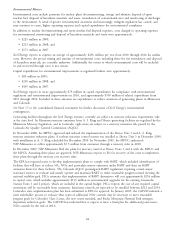

During 2009, we experienced lower than anticipated actual electric residential sales, and a decline in electric commercial

and industrial sales on a weather-adjusted basis, which we believe was driven by overall economic conditions and to a

lesser degree, increased conservation efforts. The declines in MwH sales to the commercial and industrial customer

class, which are directly related to the economic downturn, are partially offset by demand charges, which mitigate, to a

certain degree, the impact of the lower MwH sales. We anticipate that sales will grow in the future at a slower rate than

historical levels in part due to increased conservation activities. Weather-normalized sales for 2010 are projected to grow

approximately 1 percent for retail electric customers and to decline approximately 1 percent to 2 percent for retail firm

natural gas customers.

56