Xcel Energy 2009 Annual Report Download - page 61

Download and view the complete annual report

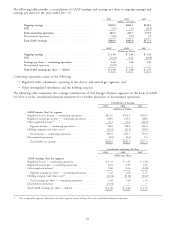

Please find page 61 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Achieving Financial Objectives

Xcel Energy’s financial objectives of Building the Core also have three phases: obtaining legislative and regulatory

support for large investment initiatives, investing in the utility business and earning a fair return on utility system

investments.

The first phase, as noted above, is obtaining legislative and regulatory support for large investment initiatives, prior to

making the investment. To avoid excessive risk, it is critical that Xcel Energy reduce regulatory uncertainty before

making large capital investments. Xcel Energy has accomplished this for both the MERP in Minnesota and Comanche

Unit 3 in Colorado. Transmission legislation has been passed in Minnesota, Colorado, Texas and several other

jurisdictions where Xcel Energy operates. In addition, various jurisdictions have adopted legislation allowing for rider

recovery of investments in renewable energy.

The second phase is investing in the utility business. In addition to Xcel Energy’s normal level of capital investment,

Xcel Energy expects to have significant investment opportunity, in part attributable to the environmental strategy

described above. Those opportunities include the following:

• NSP-Minnesota has made, as part of our MERP program, nearly $1 billion of improvements at three Twin

Cities coal-fired generating plants, A. S. King, High Bridge and Riverside, to significantly reduce air emissions

from those facilities while increasing the amount of electricity they can produce by approximately 300 MW. New

state-of-the-art emission control equipment was placed in service for the A. S. King plant in 2007 and the

existing High Bridge facility was replaced with a 575 MW natural gas combined-cycle unit that went into service

in May 2008. The final phase of the MERP, the new Riverside combined-cycle plant, was placed in service in

May 2009.

• Invest approximately $1.4 billion for Comanche Unit 3, a project to build a new 750 MW supercritical coal unit

in Colorado. The CPUC has approved PSCo sharing one-third ownership of this plant with other parties.

Consequently, PSCo’s investment in Comanche Unit 3 will be approximately $1 billion. Comanche Unit 3 is

expected to achieve commercial operations by the end of the first quarter of 2010.

• Invest $156 million for the addition of two gas fired units totaling 300 MW at the PSCo Fort St. Vrain

generating facility, located in Colorado. These units went into service in April 2009.

• Invest over a $1 billion through 2015 to extend the lives and increase the output of NSP-Minnesota’s two

nuclear facilities, Monticello and Prairie Island.

• Invest approximately $900 million over three years for the 201 MW Nobles Wind project located in

southwestern Minnesota Project, and the 150 MW Merricourt Wind project located in southeastern North

Dakota, expected to be operational by the end of 2010 and 2011, respectively.

• Investment by the CapX 2020 coalition of utilities of approximately $1.7 billion to expand the transmission

system in the upper Midwest with major construction targeted to begin in 2010 and ending three to five years

later, of which Xcel Energy’s share of the investment is expected to be approximately $900 million, depending on

the route and configuration approved by the MPUC.

As a result of these investments, as well as continued investments in the transmission and distribution system, Xcel

Energy expects that the rate base, or the amount on which Xcel Energy earns a return, will grow annually, on average,

approximately 7 percent from 2009 through 2013.

The third phase is earning a fair return on utility system investments. To this end, the regulatory strategy is to receive

regulatory approval for rate riders and DSM incentives, as well as general rate cases. A rate rider is a mechanism that

allows recovery of certain costs and returns on investments without the costs and delays of filing a rate case. These

riders allow for timely revenue recovery of the costs of large projects or other costs that vary over time. DSM

incentives, which exist in Colorado and Minnesota, allow Xcel Energy to earn from helping our customers reduce

energy. The incentive plans are designed to reward Xcel Energy for achieving performance at or above the approved

savings goals.

51