Xcel Energy 2009 Annual Report Download - page 89

Download and view the complete annual report

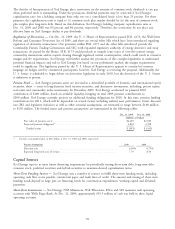

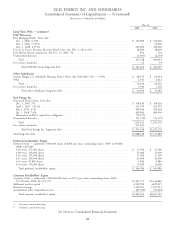

Please find page 89 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Registration Statements — Xcel Energy’s articles of incorporation authorize the issuance of 1 billion shares of common

stock. As of Dec. 31, 2009 and 2008, Xcel Energy had approximately 458 million shares and 454 million shares of

common stock outstanding, respectively. In addition, Xcel Energy’s articles of incorporation authorize the issuance of

7 million shares of $100 par value preferred stock. On Dec. 31, 2009 and 2008, Xcel Energy had approximately

1 million shares of preferred stock outstanding. Xcel Energy and its subsidiaries have the following registration

statements on file with the SEC, pursuant to which they may sell, from time to time, securities:

• Xcel Energy has an effective automatic shelf registration statement that does not contain a limit on issuance

capacity; however, Xcel Energy’s ability to issue securities is limited by authority granted by the Board of

Directors, which authority currently authorizes the issuance of up to an additional $1.5 billion of debt and

common equity securities.

• NSP-Minnesota has $700 million of debt securities available under its current effective registration statement.

• PSCo has approximately $400 million of debt securities available under its currently effective registration

statement.

• NSP-Wisconsin has $50 million remaining under its currently effective registration statement.

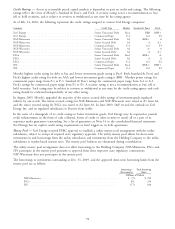

Long-Term Borrowings — See the Statement of Capitalization and a discussion of the long-term borrowings in Note 6

to the consolidated financial statements.

Financing Plans — Xcel Energy issues debt securities to refinance retiring maturities, reduce short-term debt, fund

construction programs and for other general corporate purposes. Xcel Energy plans to issue the following debt securities

in 2010:

• Up to $500 million of unsecured debt at the holding company, and

• Up to $500 million of first mortgage bonds at NSP-Minnesota.

Financing plans are subject to change, depending on capital expenditures, internal cash generation, interest rates, market

conditions and other factors.

Off-Balance-Sheet Arrangements

Xcel Energy does not have any off-balance-sheet arrangements, other than those currently disclosed, that have or are

reasonably likely to have a current or future effect on financial condition, changes in financial condition, revenues or

expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

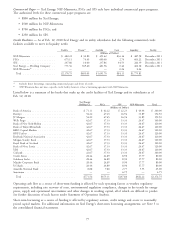

Earnings Guidance

Xcel Energy’s 2010 ongoing earnings guidance is $1.55 to $1.65 per share. Key assumptions are detailed below:

• Normal weather patterns are experienced for the year.

• Weather-adjusted retail electric utility sales grow approximately 1 percent.

• Weather-adjusted retail firm natural gas sales decline approximately 1 percent to 2 percent.

• Reflects increased revenue due to the full year impact of 2009 electric rate cases in Colorado, Texas and New

Mexico, along with the 2010 electric rate increase in Colorado.

• Constructive outcomes in the Minnesota natural gas rate and PSCo wholesale electric rate cases.

• Increased rider revenue recovery of approximately $30 million.

• O&M expenses are projected to increase $115 million to $135 million, or 6 percent to 7 percent.

• Depreciation expense is projected to increase by $40 million to $50 million.

• Interest expense is projected to increase approximately $15 million to $25 million.

• AFUDC-equity is projected to decrease $25 million to $30 million.

• The effective tax rate for continuing operations is approximately 34 percent to 36 percent.

• Average common stock and equivalents total approximately 460 million shares.

79