Xcel Energy 2009 Annual Report Download - page 105

Download and view the complete annual report

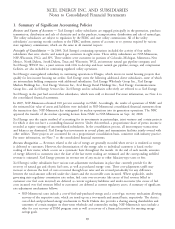

Please find page 105 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Accounting Pronouncements

Recently Adopted

Business Combinations — In December 2007, the FASB issued new guidance on business combinations which

establishes principles and requirements for how an acquirer in a business combination recognizes and measures in its

financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest; recognizes

and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and determines

what information to disclose to enable users of the financial statements to evaluate the nature and financial effects of

the business combination. This new guidance is to be applied prospectively to business combinations for which the

acquisition date is on or after the beginning of an entity’s fiscal year that begins on or after Dec. 15, 2008. Xcel Energy

implemented the guidance on Jan. 1, 2009, and the implementation did not have a material impact on its consolidated

financial statements.

Noncontrolling Interests — Also in December 2007, the FASB issued new guidance on noncontrolling interests in

consolidated financial statements which establishes accounting and reporting standards that require the ownership

interest in subsidiaries held by parties other than the parent be clearly identified and presented in the consolidated

balance sheets within equity, but separate from the parent’s equity; the amount of consolidated net income attributable

to the parent and the noncontrolling interest be clearly identified and presented on the face of the consolidated

statement of earnings; and changes in a parent’s ownership interest while the parent retains its controlling financial

interest in its subsidiary be accounted for consistently as equity transactions. This new guidance was effective for fiscal

years beginning on or after Dec. 15, 2008. Xcel Energy implemented the guidance on Jan. 1, 2009, and the

implementation did not have a material impact on its consolidated financial statements.

Derivatives and Hedging Disclosures — In March 2008, the FASB issued new guidance on disclosures about derivative

instruments and hedging activities which is intended to enhance disclosures to help users of the financial statements

better understand how derivative instruments and hedging activities affect an entity’s financial position, financial

performance and cash flows. The guidance amends and expands previous disclosure requirements for derivative

instruments and hedging activities, including disclosures of objectives and strategies for using derivatives, gains and

losses on derivative instruments, and credit-risk-related contingent features in derivative contracts. This new guidance

was effective for fiscal years and interim periods beginning after Nov. 15, 2008. Xcel Energy implemented the guidance

on Jan. 1, 2009, and the implementation did not have a material impact on its consolidated financial statements. For

further discussion and the required disclosures, see Note 13 to the consolidated financial statements.

Interim Fair Value Disclosures — In April 2009, the FASB issued new guidance on interim disclosures about fair value

of financial instruments which requires that disclosures regarding the fair value of financial instruments be included in

interim financial statements. This new guidance was effective for interim periods ending after June 15, 2009. Xcel

Energy implemented the guidance on April 1, 2009, and the implementation did not have a material impact on its

consolidated financial statements.

Fair Value in Inactive Markets — Also in April 2009, the FASB issued new guidance for identifying market

transactions that are not orderly and determining fair value when market trading activity has decreased significantly.

The new guidance emphasizes that even if there has been a significant decrease in the volume and level of market

activity for an asset or liability, fair value still represents the exit price in an orderly transaction between market

participants. This new guidance was effective for interim and annual periods ending after June 15, 2009. Xcel Energy

implemented the guidance on April 1, 2009, and the implementation did not have a material impact on its

consolidated financial statements.

Other-Than-Temporary Impairments — Additionally in April 2009, the FASB issued new guidance on recognition and

presentation of other-than-temporary impairments which changes the method for determining whether an

other-than-temporary impairment exists for debt securities, and also requires additional disclosures regarding

other-than-temporary impairments. This new guidance was effective for interim and annual periods ending after

June 15, 2009. Xcel Energy implemented the guidance on April 1, 2009, and the implementation did not have a

material impact on its consolidated financial statements.

95