Xcel Energy 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

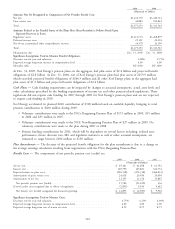

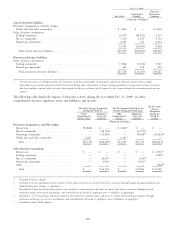

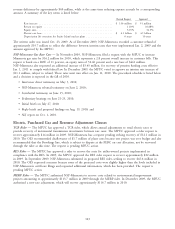

Dec. 31, 2008

Counterparty

Level 1 Level 2 Level 3 Netting Net Balance

(Thousands of Dollars)

Assets

Cash equivalents ......................... $ — $50,000 $ — $ — $ 50,000

Nuclear decommissioning fund ................ —

Cash equivalents ....................... — 8,449 — — 8,449

Debt securities ......................... — 491,486 109,423 — 600,909

Equity securities ........................ 465,936 — — — 465,936

Commodity derivatives ..................... — 29,648 39,565 (16,245) 52,968

Total ............................... $465,936 $579,583 $148,988 $(16,245) $1,178,262

Liabilities

Commodity derivatives ..................... $ 600 $78,714 $ 16,344 $(41,351) $ 54,307

Interest rate derivatives ..................... — 8,503 — — 8,503

Total ............................... $ 600 $ 87,217 $ 16,344 $(41,351) $ 62,810

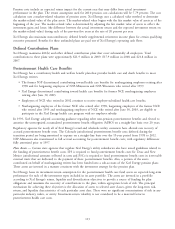

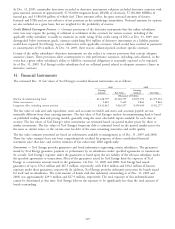

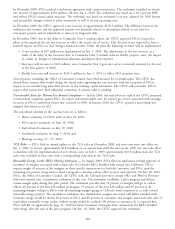

The following table presents the changes in Level 3 recurring fair value measurements for the year ended Dec. 31:

2009 2008

Commodity Nuclear Commodity Nuclear

Derivatives, Decommissioning Derivatives, Decommissioning

Net Fund Net Fund

(Thousands of Dollars)

Balance at Jan. 1 ................................. $23,221 $109,423 $19,466 $108,656

Purchases, issuances, and settlements, net ................. (4,143) (28,356) (5,981) 12,198

Transfers into (out of) Level 3 ....................... 1,280 — (3,962) —

(Losses) gains recognized in earnings ................... (581) — 2,129 —

Gains (losses) recognized as regulatory assets and liabilities ...... 8,265 12,040 11,569 (11,431)

Balance at Dec. 31 ................................ $28,042 $ 93,107 $23,221 $109,423

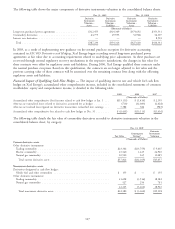

Losses on Level 3 commodity derivatives recognized in earnings for the year ended Dec. 31, 2009, include $8.2 million

of net unrealized gains relating to commodity derivatives held at Dec. 31, 2009. Gains on Level 3 commodity

derivatives recognized in earnings for the year ended Dec. 31, 2008, include $3.7 million of net unrealized gains

relating to commodity derivatives held at Dec. 31, 2008. Realized and unrealized gains and losses on commodity

trading activities are included in electric revenues. Realized and unrealized gains and losses on non-trading derivative

instruments are recorded in OCI or deferred as regulatory assets and liabilities. The classification as a regulatory asset or

liability is based on the commission approved regulatory recovery mechanisms. Realized and unrealized gains and losses

on nuclear decommissioning fund investments are deferred as a component of a nuclear decommissioning regulatory

asset.

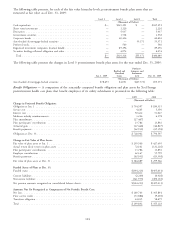

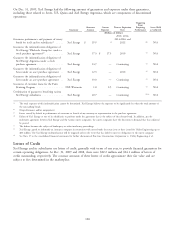

16. Rate Matters

NSP-Minnesota

Pending and Recently Concluded Regulatory Proceedings — MPUC

Base Rate

NSP-Minnesota Electric Rate Case — In November 2008, NSP-Minnesota filed a request with the MPUC to increase

Minnesota electric rates by $156 million annually. This request was later modified to $136 million.

In September 2009, the MPUC voted to approve a rate increase of approximately $91.4 million. As part of its decision,

the MPUC approved a 10-year life extension of the Prairie Island nuclear plant for purposes of determining

depreciation and decommissioning expenses, effective Jan. 1, 2009. This decision reduced NSP-Minnesota’s overall

122