Xcel Energy 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

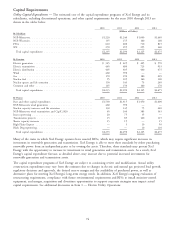

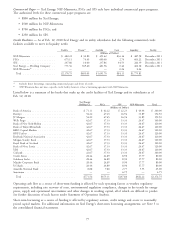

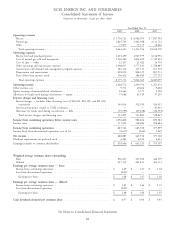

Capital Requirements

Utility Capital Expenditures — The estimated cost of the capital expenditure programs of Xcel Energy and its

subsidiaries, excluding discontinued operations, and other capital requirements for the years 2010 through 2013 are

shown in the tables below.

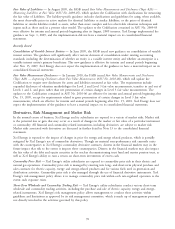

2010 2011 2012 2013

(Millions of Dollars)

By Subsidiary

NSP-Minnesota ..................................... $1,220 $1,240 $1,000 $1,440

NSP-Wisconsin ..................................... 135 155 160 160

PSCo ........................................... 610 600 710 815

SPS ............................................ 270 295 255 260

Total capital expenditures ............................. $2,235 $2,290 $2,125 $2,675

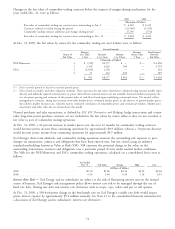

By Function 2010 2011 2012 2013

Electric generation ................................... $ 345 $ 425 $ 405 $ 570

Electric transmission .................................. 465 480 725 915

Electric distribution .................................. 405 405 440 475

Wind........................................... 460 390 — —

Gas ............................................ 170 190 180 205

Nuclear fuel ....................................... 95 105 140 100

Nuclear uprate and life extension .......................... 130 145 75 240

Common and other .................................. 165 150 160 170

Total capital expenditures ............................. $2,235 $2,290 $2,125 $2,675

By Project 2010 2011 2012 2013

Base and other capital expenditures ........................ $1,530 $1,415 $1,450 $1,600

NSP-Minnesota wind generation .......................... 460 390 — —

Nuclear capacity increases and life extension ................... 130 145 75 240

NSP-Minnesota wind transmission and CapX 2020 .............. 65 160 385 545

Jones repowering .................................... 20 75 35 —

Transmission projects ................................. 15 85 160 115

Sherco capacity increases ............................... 15 15 — 15

High Plains Express .................................. — 5 10 50

Black Dog repowering ................................. — — 10 110

Total capital expenditures ............................. $2,235 $2,290 $2,125 $2,675

Many of the states in which Xcel Energy operates have enacted RESs, which may require significant increases in

investment in renewable generation and transmission. Xcel Energy is able to meet these standards by either purchasing

renewable power from an independent party or by owning the assets. Therefore, these standards may present Xcel

Energy with the opportunity to increase its investment in wind generation and transmission assets. As a result, Xcel

Energy’s capital expenditure forecast, as detailed above, may increase due to potential increased investments for

renewable generation and transmission assets.

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility

construction expenditures may vary from the estimates due to changes in electric and natural gas projected load growth,

regulatory decisions and approvals, the desired reserve margin and the availability of purchased power, as well as

alternative plans for meeting Xcel Energy’s long-term energy needs. In addition, Xcel Energy’s ongoing evaluation of

restructuring requirements, compliance with future environmental requirements and RPSs to install emission-control

equipment, and merger, acquisition and divestiture opportunities to support corporate strategies may impact actual

capital requirements. See additional discussion in Item 1 — Electric Utility Operations.

74