Xcel Energy 2009 Annual Report Download - page 104

Download and view the complete annual report

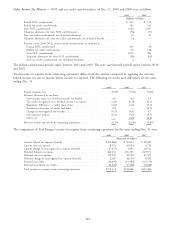

Please find page 104 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Estimates of recovering deferred costs and returning deferred credits are based on specific ratemaking decisions or

precedent for each item. Regulatory assets and liabilities are amortized consistent with the period of expected regulatory

treatment.

If restructuring or other changes in the regulatory environment occur, regulated utility subsidiaries may no longer be

eligible to apply this accounting treatment, and may be required to eliminate such regulatory assets and liabilities from

their balance sheets. Such changes could have a material effect on Xcel Energy’s results of operations in the period the

write-offs are recorded. See more discussion of regulatory assets and liabilities in Note 19 to the consolidated financial

statements.

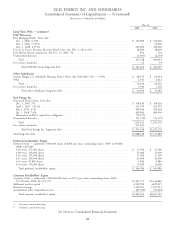

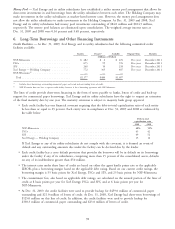

Deferred Financing Costs — Other assets included deferred financing costs, net of amortization, of approximately

$69 million at Dec. 31, 2009 and 2008. Xcel Energy is amortizing these financing costs over the remaining maturity

periods of the related debt.

Debt premiums, discounts and expenses are amortized over the life of the related debt. The premiums, discounts and

expenses associated with refinanced debt are deferred and amortized over the life of the related new issuance, in

accordance with regulatory guidelines.

Accounts Receivable and Allowance for Bad Debts — Accounts receivable are stated at the actual billed amount net of

write-offs and an allowance for bad debts. Xcel Energy establishes an allowance for uncollectible receivables based on a

reserve policy that reflects its expected exposure to the credit risk of customers.

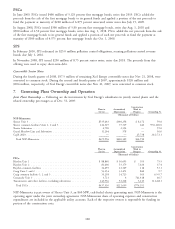

Renewable Energy Credits — RECs are marketable environmental commodities that represent proof that energy was

generated from eligible renewable energy sources. RECs are awarded upon delivery of the associated energy and can be

bought and sold. RECs are typically used as a form of measurement of compliance to RPSs enacted by those states that

are encouraging construction and consumption of renewable energy, but can also be sold separately from the energy

produced. Currently, utility subsidiaries acquire RECs from the generation or purchase of renewable power.

When RECs are acquired in the course of generation or purchase as a result of meeting load obligations, they are

recorded as inventory at cost. RECs acquired for trading purposes are recorded as other investments and are also

recorded at cost. The cost of RECs that are retired for compliance purposes is recorded as electric fuel and purchased

power expense. The net margin on sales of RECs for trading purposes is recorded as electric utility operating revenues,

net of any margin sharing requirements. As a result of state regulatory orders, Xcel Energy reduces recoverable fuel costs

for the value of certain RECs and records the cost of RECs to satisfy future compliance requirements that are

recoverable in future rates as regulatory assets.

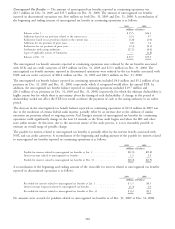

Emission Allowances — Emission allowances are recorded at cost, including the annual SO2 and NOx emission

allowance entitlement received at no cost from the EPA. Xcel Energy follows the inventory accounting model for all

allowances. The sales of allowances are reported in the operating activities section of the consolidated statements of cash

flows. The net margin on sales of emission allowances is included in electric utility operating revenues as it is integral

to the production process of energy and our revenue optimization strategy for our utility operations.

Reclassifications — Equity earnings of unconsolidated subsidiaries were reclassified from other income into a separate

line item on the consolidated statements of income. Conservation and demand side management program expenses

were reclassified as a separate item from depreciation and amortization within the consolidated statements of cash flows.

Pension and employee benefit obligations were reclassified as a separate item from change in other noncurrent liabilities

within the consolidated statements of cash flows. These reclassifications did not have an impact on net income, earnings

per share, or net cash provided by operating activities.

Subsequent Events — Management has evaluated the impact of events occurring after Dec. 31, 2009 up to the date of

issuance of these consolidated financial statements. These statements contain all necessary adjustments and disclosures

resulting from that evaluation.

94