Xcel Energy 2009 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

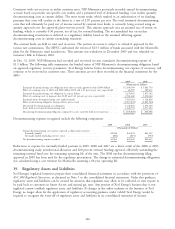

amount of removal costs accumulated through historic depreciation expense based on current factors used in the

existing depreciation rates.

Accordingly, the recorded amounts of estimated future removal costs are considered regulatory liabilities. Removal costs

by entity are as follows at Dec. 31:

2009 2008

(Millions of Dollars)

NSP-Minnesota ............................................ $372 $354

NSP-Wisconsin ............................................ 102 96

PSCo ................................................... 375 379

SPS.................................................... 93 96

Total Xcel Energy ......................................... $942 $925

Nuclear Insurance

NSP-Minnesota’s public liability for claims resulting from any nuclear incident is limited to $12.5 billion under the

Price-Anderson amendment to the Atomic Energy Act of 1954, as amended. NSP-Minnesota has secured $300 million

of coverage for its public liability exposure with a pool of insurance companies. The remaining $12.2 billion of

exposure is funded by the Secondary Financial Protection Program, available from assessments by the federal

government in case of a nuclear accident. NSP-Minnesota is subject to assessments of up to $117.5 million per reactor

per accident for each of its three licensed reactors, to be applied for public liability arising from a nuclear incident at

any licensed nuclear facility in the United States. The maximum funding requirement is $17.5 million per reactor

during any one year. These maximum assessment amounts are both subject to inflation adjustment by the NRC and

state premium taxes. The NRC’s last adjustment was effective Oct. 29, 2008. The next adjustment is due on or before

Oct. 29, 2013.

NSP-Minnesota purchases insurance for property damage and site decontamination cleanup costs from Nuclear Electric

Insurance Ltd. (NEIL). The coverage limits are $2.3 billion for each of NSP-Minnesota’s two nuclear plant sites. NEIL

also provides business interruption insurance coverage, including the cost of replacement power obtained during certain

prolonged accidental outages of nuclear generating units. Premiums are expensed over the policy term. All companies

insured with NEIL are subject to retroactive premium adjustments if losses exceed accumulated reserve funds. Capital

has been accumulated in the reserve funds of NEIL to the extent that NSP-Minnesota would have no exposure for

retroactive premium assessments in case of a single incident under the business interruption and the property damage

insurance coverage. However, in each calendar year, NSP-Minnesota could be subject to maximum assessments of

approximately $15.2 million for business interruption insurance and $30.9 million for property damage insurance if

losses exceed accumulated reserve funds.

Legal Contingencies

Lawsuits and claims arise in the normal course of business. Management, after consultation with legal counsel, has

recorded an estimate of the probable cost of settlement or other disposition of them. The ultimate outcome of these

matters cannot presently be determined. Accordingly, the ultimate resolution of these matters could have a material

adverse effect on Xcel Energy’s financial position and results of operations.

Gas Trading Litigation

e prime is a wholly owned subsidiary of Xcel Energy. Among other things, e prime was in the business of natural gas

trading and marketing. e prime has not engaged in natural gas trading or marketing activities since 2003. Thirteen

lawsuits have been commenced against e prime and Xcel Energy (and NSP-Wisconsin, in one instance); alleging fraud

and anticompetitive activities in conspiring to restrain the trade of natural gas and manipulate natural gas prices. Xcel

Energy, e prime, and NSP-Wisconsin deny these allegations and will vigorously defend against these lawsuits, including

seeking dismissal and summary judgment.

The initial gas-trading lawsuit, a purported class action brought by wholesale natural gas purchasers, was filed in

November 2003 in the United States District Court in the Eastern District of California. e prime is one of several

defendants named in the complaint. This case is captioned Texas-Ohio Energy vs. CenterPoint Energy et al. The other

twelve cases arising out of the same or similar set of facts are captioned Fairhaven Power Company vs. EnCana

Corporation et al.; Ableman Art Glass vs. EnCana Corporation et al.; Utility Savings and Refund Services LLP vs. Reliant

140