Xcel Energy 2009 Annual Report Download - page 82

Download and view the complete annual report

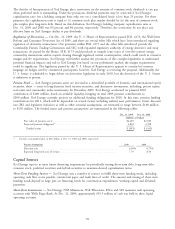

Please find page 82 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Xcel Energy also maintains trust funds, as required by the NRC, to fund costs of nuclear decommissioning. These trust

funds are subject to interest rate risk and equity price risk. At Dec. 31, 2009, these funds were invested in a diversified

portfolio of taxable and municipal fixed income securities and equity securities. These funds may be used only for

activities related to nuclear decommissioning. The accounting for nuclear decommissioning recognizes that costs are

recovered through rates; therefore, fluctuations in equity prices or interest rates do not have an impact on earnings.

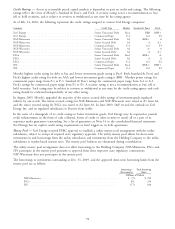

Credit Risk — Xcel Energy and its subsidiaries are also exposed to credit risk. Credit risk relates to the risk of loss

resulting from counterparties’ nonperformance on their contractual obligations. Xcel Energy and its subsidiaries

maintain credit policies intended to minimize overall credit risk and actively monitor these policies to reflect changes

and scope of operations.

At Dec. 31, 2009, a 10 percent increase in prices would have resulted in an increase in credit exposure of

$26.5 million, while a decrease of 10 percent in prices would have resulted in an increase in credit exposure of

$4.9 million.

Xcel Energy and its subsidiaries conduct standard credit reviews for all counterparties. Xcel Energy employs additional

credit risk control mechanisms when appropriate, such as letters of credit, parental guarantees, standardized master

netting agreements and termination provisions that allow for offsetting of positive and negative exposures. The credit

exposure is monitored and, when necessary, the activity with a specific counterparty is limited until credit enhancement

is provided. Distress in the financial markets could increase Xcel Energy’s credit risk.

Fair Value Measurements

Xcel Energy adopted new accounting and disclosure guidance on fair value measurements on Jan. 1, 2008 which

established a hierarchy for inputs used in measuring fair value, and generally requires that the most observable inputs

available be used for fair value measurements. Note 15 to the consolidated financial statements describes the fair value

hierarchy, and discloses the amounts of assets and liabilities measured at fair value that have been assigned to Level 3.

Commodity Derivatives — Xcel Energy continuously monitors the creditworthiness of the counterparties to its

commodity derivative contracts and assesses each counterparty’s ability to perform on the transactions set forth in the

contracts. Given this assessment and the typically short duration of these contracts, the impact of discounting

commodity derivative assets for counterparty credit risk was not material to the fair value of commodity derivative assets

at Dec. 31, 2009. Adjustments to fair value for credit risk of commodity trading instruments are recorded in electric

revenues. Credit risk adjustments for other commodity derivative instruments are deferred as OCI or regulatory assets

and liabilities. The classification as a regulatory asset or liability is based on commission approved regulatory recovery

mechanisms. Xcel Energy also assesses the impact of its own credit risk when determining the fair value of commodity

derivative liabilities. The impact of discounting commodity derivative liabilities for credit risk was immaterial to the fair

value of commodity derivative liabilities at Dec. 31, 2009.

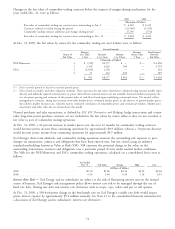

Commodity derivatives assets and liabilities assigned to Level 3 consist primarily of FTRs, as well as forwards and

options that are either long-term in nature or related to commodities and delivery points with limited observability.

Level 3 commodity derivative assets and liabilities represent approximately 3 percent and 53 percent of total assets and

liabilities measured at fair value, respectively, at Dec. 31, 2009.

Determining the fair value of a FTR requires numerous management forecasts that vary in observability, including

various forward commodity prices, retail and wholesale demand, generation and resulting transmission system

congestion. Given the limited observability of management’s forecasts for several of these inputs, these instruments have

been assigned a Level 3. Level 3 commodity derivatives assets and liabilities include $23.6 million and $3.3 million of

estimated fair values, respectively, for FTRs held at Dec. 31, 2009.

Determining the fair value of certain commodity forwards and options can require management to make use of

subjective forward price and volatility forecasts for commodities and locations with limited observability, or subjective

forecasts which extend to periods beyond those readily observable on active exchanges or quoted by brokers. When less

observable forward price and volatility forecasts are significant to determining the value of commodity forwards and

options, these instruments are assigned to Level 3. Level 3 commodity derivatives assets and liabilities include

$20.3 million and $12.6 million of estimated fair values, respectively, for commodity forwards and options held at

Dec. 31, 2009.

72