Xcel Energy 2009 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

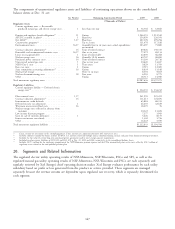

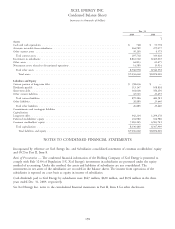

Given the similarity of the regulated electric utility operations of its utility subsidiaries, and the similarity of the

regulated natural gas utility operations of its utility subsidiaries, Xcel Energy has the following reportable segments:

regulated electric utility, regulated natural gas utility and all other.

• Xcel Energy’s regulated electric utility segment generates, transmits, and distributes electricity in Minnesota,

Wisconsin, Michigan, North Dakota, South Dakota, Colorado, Texas, and New Mexico. In addition, this

segment includes sales for resale and provides wholesale transmission service to various entities in the United

States. Regulated electric utility also includes commodity trading operations.

• Xcel Energy’s regulated natural gas utility segment transports, stores and distributes natural gas primarily in

portions of Minnesota, Wisconsin, North Dakota, Michigan and Colorado.

Revenues from operating segments not included above are below the necessary quantitative thresholds and are therefore

included in the all other category. Those primarily include steam revenue, appliance repair services, nonutility real estate

activities, revenues associated with processing solid waste into refuse-derived fuel and investments in rental housing

projects that qualify for low-income housing tax credits.

To report income from continuing operations for regulated electric and regulated natural gas utility segments, Xcel

Energy must assign or allocate all costs and certain other income. In general, costs are:

• Directly assigned wherever applicable;

• Allocated based on cost causation allocators wherever applicable; and

• Allocated based on a general allocator for all other costs not assigned by the above two methods.

The accounting policies of the segments are the same as those described in Note 1 to the consolidated financial

statements.

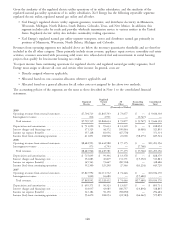

Regulated

Regulated Natural All Reconciling Consolidated

Electric Gas Other Eliminations Total

(Thousands of Dollars)

2009

Operating revenues from external customers .......... $7,704,723 $1,865,703 $ 73,877 $ — $ 9,644,303

Intersegment revenues ....................... 816 2,931 — (3,747) —

Total revenues ........................... $7,705,539 $1,868,634 $ 73,877 $ (3,747) $ 9,644,303

Depreciation and amortization .................. $ 711,090 $ 95,633 $ 11,329 $ — $ 818,052

Interest charges and financing costs ............... 371,525 44,572 109,844 (4,086) 521,855

Income tax expense (benefit) ................... 357,128 81,956 (67,770) — 371,314

Income (loss) from continuing operations ........... 611,851 108,948 23,000 (58,275) 685,524

2008

Operating revenues from external customers .......... $8,682,993 $2,442,988 $ 77,175 $ — $11,203,156

Intersegment revenues ....................... 973 6,793 — (7,766) —

Total revenues ........................... $8,683,966 $2,449,781 $ 77,175 $ (7,766) $11,203,156

Depreciation and amortization .................. $ 715,695 $ 99,306 $ 13,378 $ — $ 828,379

Interest charges and financing costs ............... 352,083 45,819 131,371 (15,392) 513,881

Income tax expense (benefit) ................... 345,543 73,647 (80,504) — 338,686

Income (loss) from continuing operations ........... 552,300 129,298 27,346 (63,224) 645,720

2007

Operating revenues from external customers .......... $7,847,992 $2,111,732 $ 74,446 $ — $10,034,170

Intersegment revenues ....................... 1,000 16,680 — (17,680) —

Total revenues ........................... $7,848,992 $2,128,412 $ 74,446 $(17,680) $10,034,170

Depreciation and amortization .................. $ 695,571 $ 96,323 $ 13,837 $ — $ 805,731

Interest charges and financing costs ............... 318,937 43,985 180,757 (14,834) 528,845

Income tax expense (benefit) ................... 343,184 50,150 (98,850) — 294,484

Income (loss) from continuing operations ........... 554,670 108,054 (22,583) (64,242) 575,899

148