Xcel Energy 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

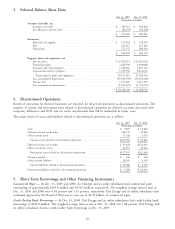

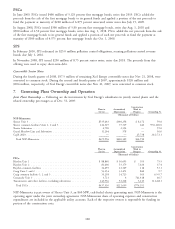

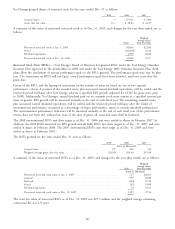

Other Income Tax Matters — NOL and tax credit carryforwards as of Dec. 31, 2009 and 2008 were as follows:

2009 2008

(Millions of Dollars)

Federal NOL carryforward ...................................... $ 523 $ 127

Federal tax credit carryforwards ................................... 183 223

State NOL carryforwards ...................................... 1,244 1,097

Valuation allowances for state NOL carryforwards ....................... (76) (37)

State tax credit carryforwards, net of federal detriment .................... 19 17

Valuation allowances for state tax credit carryforwards, net of federal benefit ....... (5) —

Portions of the above NOL and tax credit carryforwards are included in

Federal NOL carryforward .................................... 229 49

Federal tax credit carryforwards ................................. 70 126

State NOL carryforwards ..................................... 1,052 980

Valuation allowances for state NOL carryforwards ..................... (58) (34)

State tax credit carryforwards, net of federal detriment ................... 2 2

The federal carryforward periods expire between 2021 and 2029. The state carryforward periods expire between 2010

and 2029.

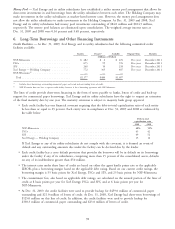

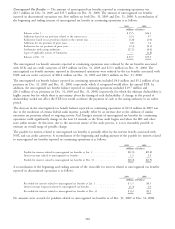

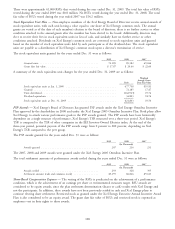

Total income tax expense from continuing operations differs from the amount computed by applying the statutory

federal income tax rate to income before income tax expense. The following reconciles such differences for the years

ending Dec. 31:

2009 2008 2007

Federal statutory rate ............................... 35.0% 35.0% 35.0%

Increases (decreases) in tax from:

State income taxes, net of federal income tax benefit ......... 4.0 4.4 4.5

Tax credits recognized, net of federal income tax expense ....... (2.0) (1.8) (2.5)

Regulatory differences — utility plant items ............... (2.0) (2.1) (1.1)

Resolution of income tax audits and other ................ 0.8 — (0.7)

Change in unrecognized tax benefits ................... (0.5) (0.1) 3.1

Life insurance policies ............................ (0.2) (0.2) (3.7)

Other, net .................................... — (0.8) (0.8)

Effective income tax rate from continuing operations ........... 35.1% 34.4% 33.8%

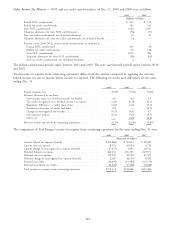

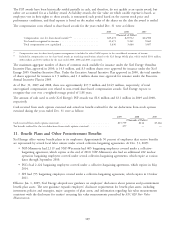

The components of Xcel Energy’s income tax expense from continuing operations for the years ending Dec. 31 were:

2009 2008 2007

(Thousands of Dollars)

Current federal tax expense (benefit) ..................... $(39,886) $ 56,044 $ 10,649

Current state tax expense ............................ 8,672 26,904 6,726

Current change in unrecognized tax expense (benefit) .......... (7,627) 3,891 20,512

Deferred federal tax expense .......................... 360,252 236,307 225,971

Deferred state tax expense ........................... 69,947 38,758 47,555

Deferred change in unrecognized tax expense (benefit) .......... 2,387 (4,535) 6,926

Deferred tax credits ............................... (16,005) (11,485) (15,175)

Deferred investment tax credits ........................ (6,426) (7,198) (8,680)

Total income tax expense from continuing operations .......... $371,314 $338,686 $294,484

103