Xcel Energy 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

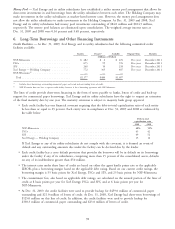

Long-Term Borrowings

All property of NSP-Minnesota and NSP-Wisconsin and the electric property of PSCo are subject to the liens of their

first mortgage indentures. In addition, certain SPS payments under its pollution-control obligations are pledged to

secure obligations of the Red River Authority of Texas.

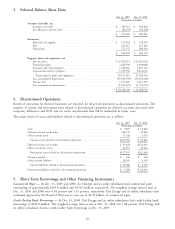

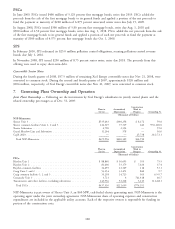

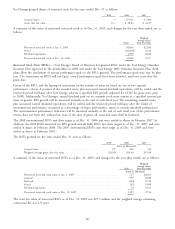

Maturities of long-term debt are:

(Millions of Dollars)

2010 ....................................................... $ 544

2011 ....................................................... 54

2012 ....................................................... 1,060

2013 ....................................................... 258

2014 ....................................................... 284

Xcel Energy

On Jan. 16, 2008, Xcel Energy issued $400 million of 7.6 percent junior subordinated notes (Junior Notes) due 2068.

Due to certain features, rating agencies consider the Junior Notes to be hybrid debt instruments with a combination of

debt and equity characteristics. The Junior Notes are not redeemable by Xcel Energy prior to 2013 without payment of

a make-whole premium.

Interest payments on the Junior Notes may be deferred on one or more occasions for up to 10 consecutive years. If the

interest payments on the Junior Notes are deferred, Xcel Energy may not declare or pay any dividends or distributions,

or redeem, purchase, acquire, or make a liquidation payment on, any shares of its capital stock. Also during the deferral

period, Xcel Energy may not make any principal or interest payments on, or repay, purchase or redeem any of its debt

securities that are equal in right of payment with, or subordinated to, the Junior Notes. Xcel Energy also may not make

payments on any guarantees equal in right of payment with, or subordinated to, the Junior Notes.

In connection with the completion of this offering, Xcel Energy entered into a Replacement Capital Covenant (RCC).

Under the terms of the RCC, Xcel Energy agrees not to redeem or repurchase all or part of the Junior Notes prior to

2038 unless qualifying securities are issued to non-affiliates in a replacement offering in the 180 days prior to the

redemption or repurchase date. Qualifying securities include those that have equity-like characteristics that are the same

as, or more equity-like than, the applicable characteristics of the Junior Notes at the time of redemption or repurchase.

NSP-Minnesota

In November 2009, NSP-Minnesota issued $300 million of 5.35 percent first mortgage bonds, series due Nov. 1, 2039.

NSP-Minnesota added the net proceeds from the sale of the first mortgage bonds to its general funds and applied a

portion of the proceeds to the repayment of commercial paper and borrowings under the utility money pool

arrangement incurred to fund the repayment at maturity of $250 million of 6.875 percent unsecured senior notes due

Aug. 1, 2009.

In March 2008, NSP-Minnesota issued $500 million of 5.25 percent first mortgage bonds, series due March 1, 2018.

NSP-Minnesota added the net proceeds from the sale of the first mortgage bonds to its general funds and applied a

portion of the proceeds to the repayment of commercial paper and borrowings under the utility money pool

arrangement.

NSP-Wisconsin

In March 2009, NSP-Wisconsin redeemed its 7.375 percent $65.0 million first mortgage bonds due Dec. 1, 2026.

In September 2008, NSP-Wisconsin issued $200 million of 6.375 percent first mortgage bonds, series due Sept. 1,

2038. NSP-Wisconsin added the net proceeds from the sale of the first mortgage bonds to its general funds and applied

a portion of such net proceeds to fund the payment at maturity of $80 million of 7.64 percent senior notes due

Oct. 1, 2008. The balance of the net proceeds was used for the repayment of short-term debt (including notes payable

to affiliates) and for general corporate purposes.

99