Xcel Energy 2009 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

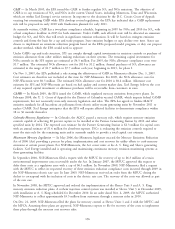

Consistent with cost-recovery in utility customer rates, NSP-Minnesota previously recorded annual decommissioning

accruals based on periodic site-specific cost studies and a presumed level of dedicated funding. Cost studies quantify

decommissioning costs in current dollars. The most recent study, which resulted in an authorization of no funding,

presumes that costs will escalate in the future at a rate of 2.89 percent per year. The total estimated decommissioning

costs that will ultimately be paid, net of income earned by external trust funds, is currently being accrued using an

annuity approach over the approved plant-recovery period. This annuity approach uses an assumed rate of return on

funding, which is currently 6.30 percent, net of tax, for external funding. The net unrealized loss on nuclear

decommissioning investments is deferred as a regulatory liability based on the assumed offsetting against

decommissioning costs in current ratemaking treatment.

The external funds are held in trust and in escrow. The portion in escrow is subject to refund if approved by the

various rate commissions. The MPUC authorized the return of $23.5 million of funds associated with the Monticello

plant for the Minnesota retail jurisdictions. This amount was withdrawn in December 2009 and was refunded on

customer’s bills in February 2010.

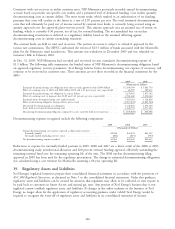

At Dec. 31, 2009, NSP-Minnesota had recorded and recovered in rates cumulative decommissioning expense of

$1.3 billion. The following table summarizes the funded status of NSP-Minnesota’s decommissioning obligation based

on approved regulatory recovery parameters. Xcel Energy believes future decommissioning cost expense, if necessary, will

continue to be recovered in customer rates. These amounts are not those recorded in the financial statements for the

ARO.

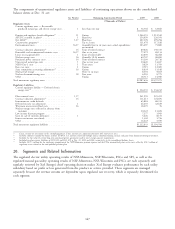

2009 2008

(Thousands of Dollars)

Estimated decommissioning cost obligation from most recently approved study (2008 dollars) .... $2,308,196 $ 1,683,750

Effect of escalating costs to 2009 and 2008 dollars (2.89 and 3.61 percent per year, respectively) . . 66,707 189,012

Estimated decommissioning cost obligation in current dollars ....................... 2,374,903 1,872,762

Effect of escalating costs to payment date (2.89 and 3.61 percent per year, respectively) ....... 2,741,460 1,254,064

Estimated future decommissioning costs (undiscounted) .......................... 5,116,363 3,126,826

Effect of discounting obligation (using risk-free interest rate) ....................... (3,973,493) (1,847,526)

Discounted decommissioning cost obligation ................................ 1,142,870 1,279,300

Assets held in external decommissioning trust ................................ 1,248,739 1,075,294

Discounting decommissioning obligation compared to assets currently held in external trust ..... $ (105,869) $ 204,006

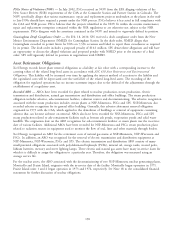

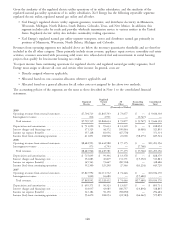

Decommissioning expenses recognized include the following components:

2009 2008 2007

(Thousands of Dollars)

Annual decommissioning cost expense reported as depreciation expense:

Externally funded ................................... $2,849 $43,239 $43,392

Internally funded (including interest costs) ..................... (884) (819) (759)

Net decommissioning expense recorded ........................ $1,965 $42,420 $42,633

Reductions to expense for internally-funded portions in 2009, 2008 and 2007 are a direct result of the 2008 or 2005

decommissioning study jurisdictional allocation and 100 percent external funding approval, effectively unwinding the

remaining internal fund over the remaining operating life of the unit. The 2008 nuclear decommissioning filing

approved in 2009 has been used for the regulatory presentation. The change in estimated decommissioning obligations

was calculated using a cost estimate for Monticello assuming a 60-year operating life.

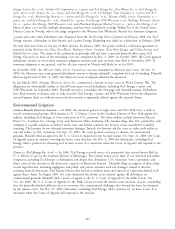

19. Regulatory Assets and Liabilities

Xcel Energy’s regulated businesses prepare their consolidated financial statements in accordance with the provisions of

ASC 980 Regulated Operations, as discussed in Note 1 to the consolidated financial statements. Under this guidance,

regulatory assets and liabilities can be created for amounts that regulators may allow to be collected, or may require to

be paid back to customers in future electric and natural gas rates. Any portion of Xcel Energy’s business that is not

regulated cannot establish regulatory assets and liabilities. If changes in the utility industry or the business of Xcel

Energy no longer allow for the application of regulatory accounting guidance under GAAP, Xcel Energy would be

required to recognize the write-off of regulatory assets and liabilities in its consolidated statement of income.

146