Xcel Energy 2009 Annual Report Download - page 100

Download and view the complete annual report

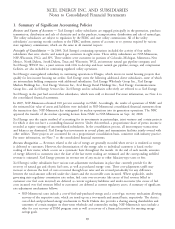

Please find page 100 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• NSP-Minnesota operates under various service quality standards, which could require customer refunds if certain

criteria are not met. NSP-Minnesota rates in Minnesota include monthly adjustments for recovery of

conservation and energy-management program costs, which are reviewed annually. NSP-Minnesota is allowed to

recover certain costs associated with new transmission facilities to deliver renewable energy resources and certain

costs associated with production facilities through rate riders.

• NSP-Wisconsin’s rates in Wisconsin include a cost-of-gas adjustment clause for purchased natural gas, but not

for purchased electric energy or electric fuel. Requests can be made for recovery of those electric costs

prospectively through the rate review process, which normally occurs every two years, or an interim fuel-cost

hearing process.

• PSCo generally recovers all prudently incurred electric fuel and purchased energy costs through the ECA for the

company’s retail jurisdiction. The ECA mechanism was extended in 2009 and went into effect in January 2010.

The ECA allows for sharing of margins on short term energy sales.

• PSCo generally recovers all purchased capacity costs through the PCCA for the company’s retail jurisdiction. The

PCCA mechanism is revised annually. The PCCA was recently extended by CPUC order in PSCo’s most recent

rate case.

• PSCo’s rates include annual adjustments for the recovery of conservation and energy-management program costs,

as well as a financial incentive based on its performance in achieving established goals. PSCo is allowed to

recover certain costs associated with renewable energy resources through a specific retail rate rider. In January

2008, a new recovery mechanism for transmission commenced. The TCA permits PSCo to recover costs

associated with investment in transmission facilities made after March 2007 through a rate rider.

• In Texas, SPS recovers fuel and purchased energy costs through a fixed fuel and purchased energy recovery factor,

which is part of SPS’ retail electric rates. The Texas retail fuel factors can change up to three times per year

based on the projected costs of natural gas. In January 2010, the PUCT approved recovery of certain

transmission investments and other transmission costs through the TCRF rider. In New Mexico, SPS has a

monthly fuel and purchased power cost-recovery factor.

• NSP-Minnesota, NSP-Wisconsin, PSCo and SPS sell firm power and energy in wholesale markets, which are

regulated by the FERC. Certain of these rates include monthly wholesale fuel cost-recovery mechanisms through

prices that are indexed to retail rates, including the monthly cost of fuel and purchased energy recovery

mechanisms.

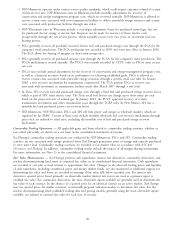

Commodity Trading Operations — All applicable gains and losses related to commodity trading activities, whether or

not settled physically, are shown on a net basis in the consolidated statements of income.

Xcel Energy’s commodity trading operations are conducted by NSP-Minnesota, PSCo and SPS. Commodity trading

activities are not associated with energy produced from Xcel Energy’s generation assets or energy and capacity purchased

to serve native load. Commodity trading contracts are recorded at fair market value in accordance with ASC 815

Derivatives and Hedging. In addition, commodity trading results include the impact of all margin-sharing mechanisms.

For more information, see Note 13 to the consolidated financial statements.

Fair Value Measurements — Xcel Energy presents cash equivalents, interest rate derivatives, commodity derivatives, and

nuclear decommissioning fund assets at estimated fair values in its consolidated financial statements. Cash equivalents

are recorded at cost plus accrued interest to approximate fair value. Changes in the observed trading prices and liquidity

of cash equivalents, including commercial paper and money market funds, are also monitored as additional support for

determining fair value and losses are recorded in earnings if fair value falls below recorded cost. For interest rate

derivatives, quoted prices based primarily on observable market interest rate curves are used as a primary input to

establish fair value. For commodity derivatives, the most observable inputs available are generally used to determine the

fair value of each contract. In the absence of a quoted price for an identical contract in an active market, Xcel Energy

may use quoted prices for similar contracts, or internally prepared valuation models to determine fair value. For the

nuclear decommissioning fund, published trading data and pricing models, generally using the most observable inputs

available, are utilized to estimate fair value for each class of security.

90