Xcel Energy 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

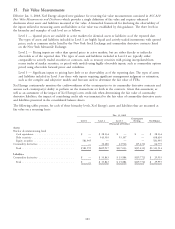

15. Fair Value Measurements

Effective Jan. 1, 2008, Xcel Energy adopted new guidance for recurring fair value measurements contained in ASC 820

Fair Value Measurements and Disclosures which provides a single definition of fair value and requires enhanced

disclosures about assets and liabilities measured at fair value. A hierarchal framework for disclosing the observability of

the inputs utilized in measuring assets and liabilities at fair value was established by this guidance. The three levels in

the hierarchy and examples of each level are as follows:

Level 1 — Quoted prices are available in active markets for identical assets or liabilities as of the reported date.

The types of assets and liabilities included in Level 1 are highly liquid and actively traded instruments with quoted

prices, such as common stocks listed by the New York Stock Exchange and commodity derivative contracts listed

on the New York Mercantile Exchange.

Level 2 — Pricing inputs are other than quoted prices in active markets, but are either directly or indirectly

observable as of the reported date. The types of assets and liabilities included in Level 2 are typically either

comparable to actively traded securities or contracts, such as treasury securities with pricing interpolated from

recent trades of similar securities, or priced with models using highly observable inputs, such as commodity options

priced using observable forward prices and volatilities.

Level 3 — Significant inputs to pricing have little or no observability as of the reporting date. The types of assets

and liabilities included in Level 3 are those with inputs requiring significant management judgment or estimation,

such as the complex and subjective models and forecasts used to determine the fair value of FTRs.

Xcel Energy continuously monitors the creditworthiness of the counterparties to its commodity derivative contracts and

assesses each counterparty’s ability to perform on the transactions set forth in the contracts. Given this assessment, as

well as an assessment of the impact of Xcel Energy’s own credit risk when determining the fair value of commodity

derivative liabilities, the impact of considering credit risk was immaterial to the fair value of commodity derivative assets

and liabilities presented in the consolidated balance sheets.

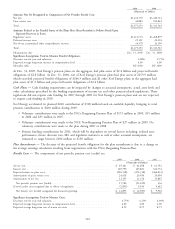

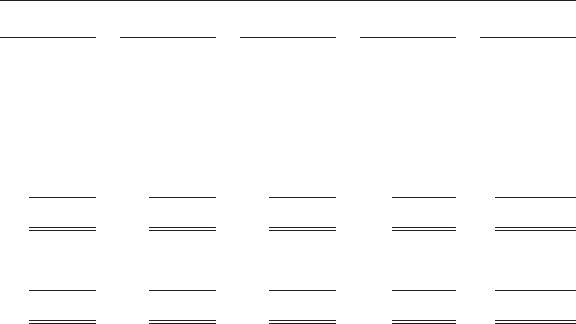

The following tables present, for each of these hierarchy levels, Xcel Energy’s assets and liabilities that are measured at

fair value on a recurring basis:

Dec. 31, 2009

Counterparty

Level 1 Level 2 Level 3 Netting Net Balance

(Thousands of Dollars)

Assets

Nuclear decommissioning fund

Cash equivalents ....................... $ — $ 28,134 $ — $ — $ 28,134

Debt securities ......................... — 545,503 93,107 — 638,610

Equity securities ........................ 581,995 — — — 581,995

Commodity derivatives ..................... — 36,280 43,926 (15,431) 64,775

Total ............................... $581,995 $609,917 $137,033 $(15,431) $1,313,514

Liabilities

Commodity derivatives ..................... $ — $ 33,843 $ 15,884 $(19,772) $ 29,955

Total ............................... $ — $33,843 $ 15,884 $(19,772) $ 29,955

121