Xcel Energy 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nuclear Decommissioning Fund — Nuclear decommissioning fund assets assigned to Level 3 consist of asset-backed and

mortgage-backed securities. To the extent appropriate, observable market inputs are utilized to estimate the fair value of

these securities, however, less observable and subjective risk-based adjustments to estimated yield and forecasted

prepayments are often significant to these valuations. Therefore, estimated fair values for all asset-backed and mortgage-

backed securities totaling $93.1 million in the nuclear decommissioning fund at Dec. 31, 2009 (approximately

7 percent of total assets measured at fair value), are assigned to Level 3. Realized and unrealized gains and losses on

nuclear decommissioning fund investments are deferred as a component of a nuclear decommissioning regulatory asset.

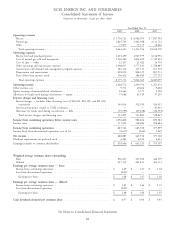

Liquidity and Capital Resources

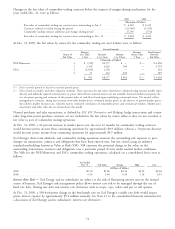

Cash Flows

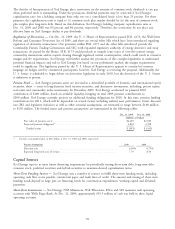

2009 2008 2007

(Millions of Dollars)

Cash provided by (used in) operating activities

Continuing operations .............................. $1,946 $1,683 $1,560

Discontinued operations ............................. (28) (3) 72

Total ....................................... $1,918 $1,680 $1,632

Cash provided by operating activities for continuing operations increased by $263 million for 2009 as compared to

2008. The increase was primarily attributable to higher net income, changes in working capital due to the timing of

accounts receivable, accounts payable and inventory as a result of natural gas prices and an increase in plant-related

deferred income taxes. The increase was partially offset by increased pension contributions made in 2009 and higher

AFUDC due primarily to the construction of Comanche Unit 3, a power facility located in Colorado.

Cash provided by operating activities for continuing operations increased by $123 million for 2008 as compared to

2007. The increase is primarily attributable to higher net income, changes in other current liabilities due to timing for

interest payable and accounts payable and an increase in recoverable gas and electric costs. This increase was partially

offset by changes in working capital activity due to increased inventory, contributions for pension and non-pension

postretirement benefits, and an increase in net regulatory assets and liabilities. The increased inventory reflects the

higher cost of natural gas combined with an increase in storage contracts. The increase in net regulatory assets and

liabilities reflects the increase in pension funding obligation, and the decrease in fair value of the investments in the

decommissioning fund, partially offset by the decrease in the asset retirement obligation for the extended life of the

nuclear facilities. Cash provided by operating activities for discontinued operations decreased $75 million, primarily due

to decreased income taxes received during 2008.

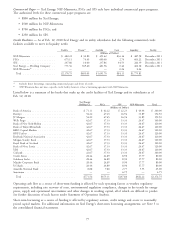

2009 2008 2007

(Millions of Dollars)

Cash used in investing activities ........................ $(1,735) $(2,156) $(2,082)

Cash used in investing activities for continuing operations decreased by $421 million during 2009, primarily due to

reduced capital expenditures; a withdrawal of funds, to refund customers, from the external decommissioning fund as

approved by the MPUC; as well as reduced investment in the WYCO natural gas pipeline and storage project. No cash

was provided by investing activities for discontinued operations.

Cash used in investing activities for continuing operations increased by $74 million during 2008, primarily due to

increased capital expenditures, and the continued investment in the WYCO natural gas pipeline and storage project.

2009 2008 2007

(Millions of Dollars)

Cash provided by (used in) financing activities ............... $(322) $671 $483

Cash used in financing activities related to continuing operations increased by $993 million during 2009, primarily due

to lower proceeds from the issuances of long-term debt and common stock and an increase in dividends, partially offset

by lower repayments of short-term borrowings.

Cash provided by financing activities related to continuing operations increased by $188 million during 2008 due to

the issuance of long-term debt and approximately 17.3 million shares of common stock in 2008. This was partially

offset by repayments of short-term borrowings.

See discussion of trends, commitments and uncertainties with the potential for future impact on cash flow and liquidity

under Capital Sources.

73