Xcel Energy 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

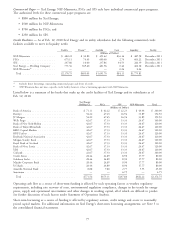

The Articles of Incorporation of Xcel Energy place restrictions on the amount of common stock dividends it can pay

when preferred stock is outstanding. Under the provisions, dividend payments may be restricted if Xcel Energy’s

capitalization ratio (on a holding company basis only, not on a consolidated basis) is less than 25 percent. For these

purposes, the capitalization ratio is equal to (i) common stock plus surplus divided by (ii) the sum of common stock

plus surplus plus long-term debt. Based on this definition, Xcel Energy’s holding company capitalization ratio at

Dec. 31, 2009 and 2008 was 85 percent and 84 percent, respectively. Therefore, the restrictions do not place any

effective limit on Xcel Energy’s ability to pay dividends.

Regulation of Derivatives — On Dec. 11, 2009, the U. S. House of Representatives passed H.R. 4173, the Wall Street

Reform and Consumer Protection Act of 2009, and there are several other bills which have been introduced regarding

regulation of derivative transactions. One provision within H.R. 4173 and the other bills introduced provide the

Commodity Futures Trading Commission and SEC with expanded regulatory authority of energy derivative and swap

transactions. As passed by the House, H.R. 4173 could preclude or impede some types of over-the-counter energy

commodity transactions and/or require clearing through regulated central counterparties, which could result in extensive

margin and fee requirements. Xcel Energy will further analyze the provisions of this complex legislation to understand

potential financial impacts and risk to Xcel Energy, but based on our preliminary analysis the margin requirements

could be significant. The legislation passed by the U. S. House of Representatives appears to contain less onerous

language on hedges used by commercial participants, however, Xcel Energy is reviewing the proposal. Additionally, the

U. S. Senate is scheduled to begin debate on derivatives legislation in early 2010, but the direction of the U. S. Senate

is unknown at present.

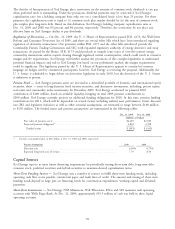

Pension Fund — Xcel Energy’s pension assets are invested in a diversified portfolio of domestic and international equity

securities, short — term to long-duration fixed income securities, and alternative investments, including, private equity,

real estate and commodity index investments. In December 2009, Xcel Energy accelerated its planned 2010

contribution of $100 million, based on available liquidity, bringing its total 2009 pension contributions to

$200 million. Xcel Energy currently projects no additional funding obligations for 2010. At this time, pension funding

contributions for 2011, which will be dependent on several factors including realized asset performance, future discount

rate, IRS and legislative initiatives as well as other actuarial assumptions, are estimated to range between $100 million

to $150 million. The funded status and pension assumptions are summarized in the following tables:

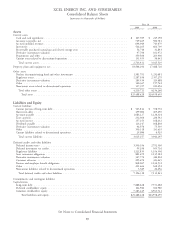

Dec. 31, 2009 Dec. 31, 2008

(Millions of Dollars)

Fair value of pension assets ...................................... $2,449 $2,185

Projected pension obligation(a) .................................... 2,830 2,598

Funded status ............................................ $(381) $ (413)

(a) Excludes non-qualified plan of $46 million at Dec. 31, 2009 and 2008, respectively.

Pension Assumptions 2010 2009

Discount rate .............................................. 6.00% 6.75%

Expected long-term rate of return ................................. 7.79 8.50

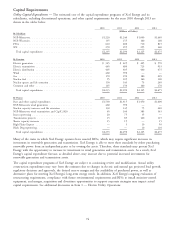

Capital Sources

Xcel Energy expects to meet future financing requirements by periodically issuing short-term debt, long-term debt,

common stock, preferred securities and hybrid securities to maintain desired capitalization ratios.

Short-Term Funding Sources — Xcel Energy uses a number of sources to fulfill short-term funding needs, including

operating cash flow, notes payable, commercial paper and bank lines of credit. The amount and timing of short-term

funding needs depend in large part on financing needs for construction expenditures, working capital and dividend

payments.

Short-Term Investments — Xcel Energy, NSP-Minnesota, NSP-Wisconsin, PSCo and SPS maintain cash operating

accounts with Wells Fargo Bank. At Dec. 31, 2009, approximately $35.5 million of cash was held in these liquid

operating accounts.

76