Xcel Energy 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

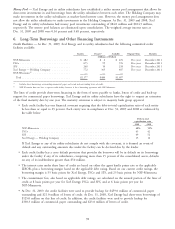

• NSP-Minnesota has authorization to issue long-term securities provided the equity-to-total capitalization ratio

remains between 45.99 percent and 56.21 percent and to issue short-term debt provided it does not exceed

15 percent of total capitalization. Total capitalization for NSP-Minnesota cannot exceed $7.5 billion.

Xcel Energy believes these authorizations are adequate and will seek additional authorization when necessary; however,

there can be no assurance that additional authorization will be granted on the timeframe or in the amounts requested.

The FERC has granted a blanket authorization for certain intra-system financings involving holding companies. The

utility subsidiaries participate in the money pool, in amounts ranging from $250 million for each of NSP-Minnesota

and PSCo, to $100 million for SPS and $100 million for NSP-Wisconsin to borrow only from NSP-Minnesota.

NSP-Wisconsin is not authorized and does not participate in the money pool.

10. Share-Based Compensation

Stock Options — Xcel Energy has incentive compensation plans under which stock options and other performance

incentives are awarded to key employees. Xcel Energy has not granted stock options since December 2001. The

weighted average number of common and potentially dilutive shares outstanding used to calculate Xcel Energy’s diluted

earnings per share include the dilutive effect of stock options and other stock awards based on the treasury stock

method. The options normally have a term of 10 years and generally become exercisable from three to five years after

grant date or upon specified circumstances.

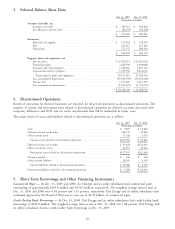

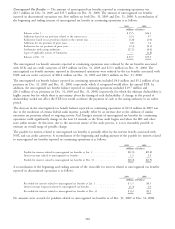

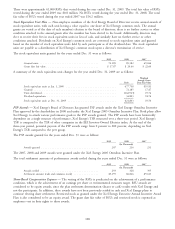

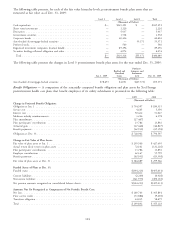

Activity in stock options was as follows for the years ended Dec. 31:

2009 2008 2007

Average Average Average

Awards Exercise Price Awards Exercise Price Exercise Price

(Awards in Thousands)

Outstanding beginning of year ...... 8,460 $27.05 9,547 $27.19 12,374 $27.36

Exercised ................... (794) 19.84 (12) 18.28 (266) 19.18

Forfeited ................... (11) 20.04 (67) 22.28 (50) 27.43

Expired .................... (998) 25.40 (1,008) 28.76 (2,511) 29.37

Outstanding at end of year ........ 6,657 28.17 8,460 27.05 9,547 27.19

Exercisable at end of year ......... 6,657 28.17 8,460 27.05 9,547 27.19

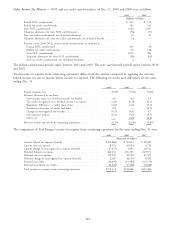

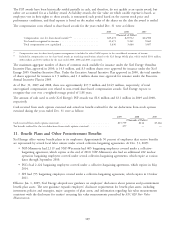

Range of Exercise Prices

$19.31 to $26.01 to $30.01 to

$26.00 $30.00 $51.25

Options outstanding and exercisable:

Number outstanding and exercisable ................... 1,761,774 4,371,680 523,083

Weighted average remaining contractual life (years) .......... 1.9 0.8 1.5

Weighted average exercise price ....................... $25.70 $26.97 $46.50

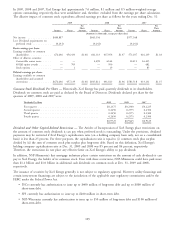

The total market value of stock options exercised and the total intrinsic value of options exercised were as follows for

the years ended Dec. 31:

2009 2008 2007

(Thousands of Dollars)

Market value of exercises ............................ $16,429 $250 $6,398

Intrinsic value of options exercised(a) ..................... 670 36 1,293

(a) Intrinsic value is calculated as market price at exercise date less the option exercise price.

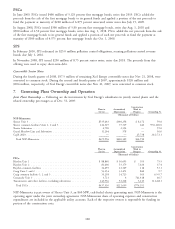

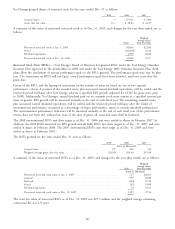

Restricted Stock — Certain employees may elect to receive shares of common or restricted stock under the Xcel Energy

Executive Annual Incentive Award Plan. Restricted stock vests and settles in equal annual installments over a three-year

period. Xcel Energy reinvests dividends on the restricted stock it holds while restrictions are in place. Restrictions also

apply to the additional shares of restricted stock acquired through dividend reinvestment. If the restricted shares are

forfeited, the employee is not entitled to the dividends on those shares. Restricted stock has a fair value equal to the

market trading price of Xcel Energy’s stock at the grant date.

106