Xcel Energy 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

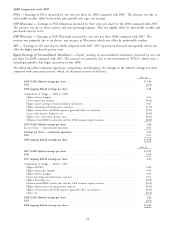

Holding Company and Other Results

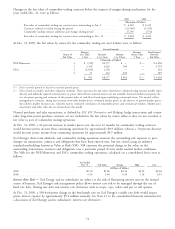

The following tables summarize the net income and earnings per share contributions of the continuing operations of

Xcel Energy’s nonregulated businesses and Holding Company results:

Contribution to Xcel Energy’s Earnings

2009 2008 2007

(Millions of Dollars)

Financing costs and preferred dividends — Holding Company ..... $(65.6) $(69.7) $(71.9)

Eloigne ....................................... (4.7) 1.5 2.6

Holding Company, taxes and other results ................. 7.8 5.3 9.2

Total Holding Company and other loss — continuing operations . $(62.5) $(62.9) $(60.1)

Contribution to Xcel Energy’s Earnings Per Share

2009 2008 2007

(Dollars per Share)

Financing costs and preferred dividends — Holding Company ..... $(0.14) $(0.15) $(0.15)

Eloigne ....................................... (0.01) — —

Holding Company, taxes and other results ................. 0.01 0.01 0.03

Total Holding Company and other loss per share — continuing

operations .................................. $(0.14) $(0.14) $(0.12)

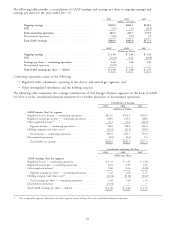

Financing Costs and Preferred Dividends — Holding Company and other results include interest expense and the

earnings per share impact of preferred dividends, which are incurred at the Xcel Energy and intermediate holding

company levels, and are not directly assigned to individual subsidiaries.

Eloigne — Eloigne contributed a loss of approximately $4.7 million which was primarily attributed to the sale of

property in 2009.

Factors Affecting Results of Continuing Operations

Xcel Energy’s utility revenues depend on customer usage, which varies with weather conditions, general business

conditions and the cost of energy services. Various regulatory agencies approve the prices for electric and natural gas

service within their respective jurisdictions and affect Xcel Energy’s ability to recover its costs from customers. The

historical and future trends of Xcel Energy’s operating results have been, and are expected to be, affected by a number

of factors, including those listed below.

General Economic Conditions

Economic conditions may have a material impact on Xcel Energy’s operating results. Management cannot predict the

impact of a prolonged economic recession, fluctuating energy prices, terrorist activity, war or the threat of war.

However, Xcel Energy could experience a material adverse impact to its results of operations, future growth or ability to

raise capital resulting from a sustained general slowdown in future economic growth or a significant increase in interest

rates.

Fuel Supply and Costs

Xcel Energy’s operating utilities have varying dependence on coal, natural gas and uranium. Changes in commodity

prices are generally recovered through fuel recovery mechanisms and have very little impact on earnings. However,

availability of supply, the potential implementation of a carbon tax and unanticipated changes in regulatory recovery

mechanisms could impact our operations. See additional discussion of fuel supply and costs under Item 1 — Electric

Utility Operations.

Pension Plan Costs and Assumptions

Xcel Energy has significant net pension and postretirement benefit costs that are measured using actuarial valuations.

Inherent in these valuations are key assumptions including discount rates and expected return on plan assets. Xcel

Energy evaluates these key assumptions at least annually by analyzing current market conditions, which include changes

in interest rates and market returns. Changes in the related net pension and postretirement benefits costs and funding

requirements may occur in the future due to changes in assumptions. For further discussion and a sensitivity analysis on

these assumptions, see ‘‘Employee Benefits’’ under Critical Accounting Policies and Estimates.

62