Xcel Energy 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

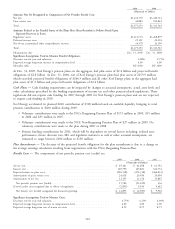

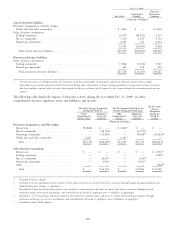

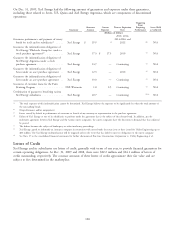

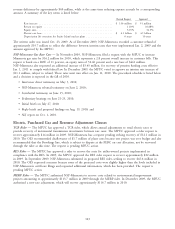

On Dec. 31, 2009, Xcel Energy had the following amount of guarantees and exposure under these guarantees,

including those related to Seren, UE, Quixx and Xcel Energy Argentina, which are components of discontinued

operations:

Triggering

Event

Guarantee Current Term or Expiration Requiring Assets Held

Guarantor Amount Exposure Date Performance as Collateral

(Millions of Dollars)

2010, 2012,

Guarantee performance and payment of surety 2014-2016 and

bonds for itself and its subsidiaries(f) ..... Xcel Energy $ 29.9 (a) 2022 (d) N/A

Guarantee the indemnification obligations of

Xcel Energy Wholesale Group Inc. under a

stock purchase agreement(g) ........... Xcel Energy 17.5 $ 17.5 2010 (c) N/A

Guarantee the indemnification obligations of

Xcel Energy Argentina under a stock

purchase agreement ................ Xcel Energy 14.7 — Continuing (c) N/A

Guarantee the indemnification obligations of

Seren under an asset purchase agreement . . Xcel Energy 12.5 — 2010 (c) N/A

Guarantee the indemnification obligations of

Seren under an asset purchase agreement . . Xcel Energy 10.0 — Continuing (c) N/A

Guarantee of customer loans for the Farm

Rewiring Program ................ NSP-Wisconsin 1.0 0.5 Continuing (e) N/A

Combination of guarantees benefiting various

Xcel Energy subsidiaries ............. Xcel Energy 20.7 — Continuing (b)(c) N/A

(a) The total exposure of this indemnification cannot be determined. Xcel Energy believes the exposure to be significantly less than the total amount of

the outstanding bonds.

(b) Nonperformance and/or nonpayment.

(c) Losses caused by default in performance of covenants or breach of any warranty or representation in the purchase agreement.

(d) Failure of Xcel Energy or one of its subsidiaries to perform under the agreement that is the subject of the relevant bond. In addition, per the

indemnity agreement between Xcel Energy and the various surety companies, the surety companies have the discretion to demand that that collateral

be posted.

(e) The debtor becomes the subject of bankruptcy or other insolvency proceedings.

(f) Xcel Energy agreed to indemnify an insurance company in connection with surety bonds they may issue or have issued for Utility Engineering up to

$80 million. The Xcel Energy indemnification will be triggered only in the event that has failed to meet its obligations to the surety company.

(g) See Note 17 to the consolidated financial statements for further discussion of Fru-Con Construction Corporation vs. Utility Engineering et al.

Letters of Credit

Xcel Energy and its subsidiaries use letters of credit, generally with terms of one year, to provide financial guarantees for

certain operating obligations. At Dec. 31, 2009 and 2008, there were $22.2 million and $24.1 million of letters of

credit outstanding, respectively. The contract amounts of these letters of credit approximate their fair value and are

subject to fees determined in the marketplace.

120