Xcel Energy 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Money Pool — Xcel Energy and its utility subsidiaries have established a utility money pool arrangement that allows for

short-term investments in and borrowings from the utility subsidiaries between each other. The Holding Company may

make investments in the utility subsidiaries at market-based interest rates. However, the money pool arrangement does

not allow the utility subsidiaries to make investments in the Holding Company. At Dec. 31, 2009 and 2008, Xcel

Energy and its utility subsidiaries had money pool investments outstanding of $84.0 million and $104.5 million,

respectively. The money pool balances are eliminated upon consolidation. The weighted average interest rates at

Dec. 31, 2009 and 2008 were 0.36 percent and 3.48 percent, respectively.

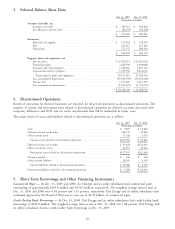

6. Long-Term Borrowings and Other Financing Instruments

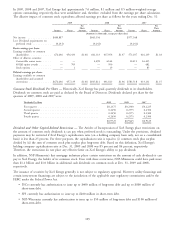

Credit Facilities — At Dec. 31, 2009, Xcel Energy and its utility subsidiaries had the following committed credit

facilities available:

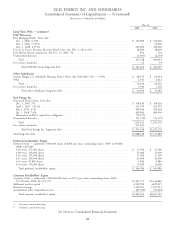

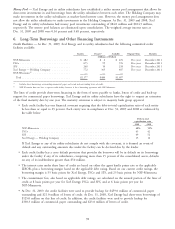

Facility Drawn(a) Available Original Term Maturity

(Millions of Dollars)

NSP-Minnesota ....................... $ 482 $ 6 $ 476 Five year December 2011

PSCo .............................. 675 99 576 Five year December 2011

SPS............................... 248 10 238 Five year December 2011

Xcel Energy — Holding Company ........... 772 365 407 Five year December 2011

NSP-Wisconsin(b) ......................———

Total ............................. $2,177 $480 $1,697

(a) Includes direct borrowings, outstanding commercial paper and issued and outstanding letters of credit.

(b) NSP-Wisconsin does not have a separate credit facility; however, it has a borrowing agreement with NSP-Minnesota.

The lines of credit provide short-term financing in the form of notes payable to banks, letters of credit and back-up

support for commercial paper borrowings. Xcel Energy and its utility subsidiaries have the right to request an extension

of the final maturity date by one year. The maturity extension is subject to majority bank group approval.

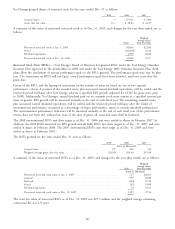

• Each credit facility has one financial covenant requiring that the debt-to-total-capitalization ratio of each entity

be less than or equal to 65 percent. Each entity was in compliance at Dec. 31, 2009 and 2008 as evidenced by

the table below:

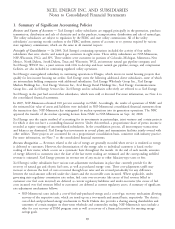

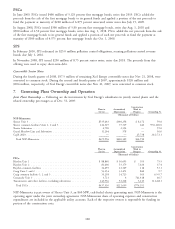

Debt-to-total

capitalization ratio

2009 2008

NSP-Minnesota ..................................................... 48% 50%

PSCo ............................................................ 45 42

SPS............................................................. 49 52

Xcel Energy — Holding Company ......................................... 15 16

If Xcel Energy or any of its utility subsidiaries do not comply with the covenant, it is deemed an event of

default and any outstanding amounts due under the facility can be declared due by the lender.

• Each credit facility has a cross default provision that provides the borrower will be in default on its borrowings

under the facility if any of its subsidiaries, comprising more than 15 percent of the consolidated assets, defaults

on any of its indebtedness greater than $50 million.

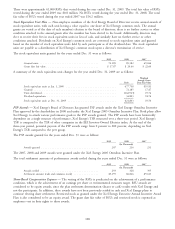

• The interest rates under these lines of credit are based on either the agent bank’s prime rate or the applicable

LIBOR, plus a borrowing margin based on the applicable debt rating. Based on our current credit ratings, the

borrowing margin is 35 basis points for Xcel Energy, PSCo and SPS, and 25 basis points for NSP-Minnesota.

• The commitment fees, also based on applicable debt ratings, are calculated on the unused portion of the lines of

credit at 8 basis points per year for Xcel Energy, PSCo and SPS, and at 6 basis points per year for

NSP-Minnesota.

• At Dec. 31, 2009, the credit facilities were used to provide backup for $459.0 million of commercial paper

outstanding and $21.0 million of letters of credit. At Dec. 31, 2008, Xcel Energy had short-term borrowings of

$125.0 million on this line of credit. In addition, the credit facilities were used to provide backup for

$330.3 million of commercial paper outstanding and $23.0 million of letters of credit.

98