Xcel Energy 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

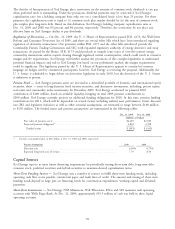

Effective Dec. 31, 2009, Xcel Energy reduced its initial medical trend assumption from 7.4 percent to 6.8 percent. The

ultimate trend assumption remained unchanged at 5.0 percent. The period until the ultimate rate is reached is three

years. Xcel Energy bases its medical trend assumption on the long-term cost inflation expected in the health care

market, considering the levels projected and recommended by industry experts, as well as recent actual medical cost

increases experienced by Xcel Energy’s retiree medical plan.

Xcel Energy contributed $62.2 million during 2009 and $55.6 million during 2008 to the postretirement health care

plans. Xcel Energy expects to contribute approximately $45.4 million during 2010.

See Note 11 to the consolidated financial statements for additional discussion of Xcel Energy’s benefit plans.

Nuclear Decommissioning

NSP-Minnesota owns nuclear generation facilities and regulations require NSP-Minnesota to decommission its nuclear

power plants after each facility is taken out of service. Xcel Energy records future plant removal obligations as a liability

at fair value. This liability will be increased over time by applying the interest method of accretion to the liability. Due

to regulation, depreciation expense is recorded to match the recovery of future cost of decommissioning, or retirement,

of its nuclear generating plants. This recovery is calculated using an annuity approach designed to provide for full rate

recovery of the future decommissioning costs.

Amounts recorded for nuclear AROs, in excess of decommissioning expense and investment returns, both realized and

unrealized, cumulatively are deferred through the establishment of a regulatory asset for future recovery pursuant to

ASC 980 Regulated Operations.

A portion of the rates charged to customers is deposited into an external trust fund, during the facilities’ operating lives,

in order to provide for this obligation. The fair value of external nuclear decommissioning trust fund investments are

estimated based on quoted market prices for those or similar investments. Realized investment returns from these

investments and recovery to date is used by regulators when determining future decommissioning recovery.

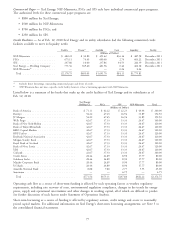

NSP-Minnesota conducts periodic decommissioning cost studies to estimate the costs that will be incurred to

decommission the facilities. The costs are initially presented in amounts prior to inflation adjustments and then inflated

to future periods using decommissioning specific cost inflators. Decommissioning of NSP-Minnesota’s nuclear facilities

is planned for the period from cessation of operations through 2067 assuming the prompt dismantlement method. The

following key assumptions have a significant effect on these estimates:

• Escalation Rate — The MPUC determines the escalation rate based on various presumptions surrounded by the

fact that associated costs will escalate at a certain rate over time. The most recent decommissioning study set the

escalation rate at 2.89 percent. An escalation rate for the cost of disposing of nuclear fuel waste was set at

6.0 percent. Over the short-term, these rates can differ from the set rates and accrual estimates can be

significantly affected by small changes in assumed escalation rates.

• Life Extension — Currently, decommissioning recovery periods end in 2030 for Monticello and in 2023 and

2024 for Prairie Island’s two facilities. Changes made to decommissioning cost estimates, the escalation rate and

the earnings rate can be affected by changes to these life periods. With the recent re-licensing of Monticello and

the application for the re-licensing of Prairie Island, any change in license life could have a material effect on the

accrual. Current decommissioning cost calculations for Monticello have assumed full life extension, which brings

the regulatory recovery period up to 2030. An application to extend the operating licenses for both reactors at

Prairie Island by 20 years was submitted to the NRC in 2008. The NRC is expected to decide on the

application in late 2010 or early in 2011. In the interim, the MPUC has extended the recovery period for Prairie

Island Unit 1 to 2023 and Unit 2 to 2024. These changes were effective Jan. 1, 2009.

As a result of the studies for Monticello and Prairie Island nuclear plants, the nuclear production decommissioning

ARO and related regulatory asset decreased by $128.5 million and $139.3 million, respectively, in the fourth quarter of

2008. It was further reduced by $315.9 million in the fourth quarter of 2009 for the Prairie Island nuclear plant

relating to the approved change in recovery period.

67