Xcel Energy 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The PSP awards have been historically settled partially in cash, and therefore, do not qualify as an equity award, but

rather are accounted for as a liability award. As liability awards, the fair value on which ratable expense is based, as

employees vest in their rights to those awards, is remeasured each period based on the current stock price and

performance conditions, and final expense is based on the market value of the shares on the date the award is settled.

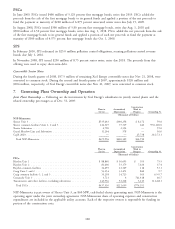

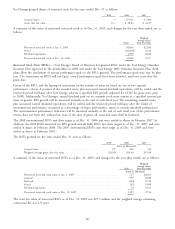

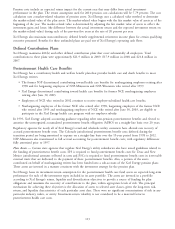

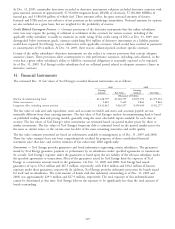

The compensation costs related to share-based awards for the years ended Dec. 31 were as follows:

2009 2008 2007

(Thousands of Dollars)

Compensation cost for share-based awards(a)(b) ............... $29,672 $23,912 $24,900

Tax benefit recognized in income ....................... 11,471 9,241 9,661

Total compensation cost capitalized ...................... 3,636 3,666 3,697

(a) Compensation costs for share-based payment arrangements is included in other O&M expense in the consolidated statements of income.

(b) Included in compensation cost for share-based awards are matching contributions related to the Xcel Energy 401(k) plan, which totaled $19.3 million,

$18.6 million and $15.2 million for the years ended 2009, 2008 and 2007, respectively.

The maximum aggregate number of shares of common stock available for issuance under the Xcel Energy Omnibus

Incentive Plan, approved in 2000, is 14.5 million, and 8.3 million shares were approved for issuance under the Xcel

Energy 2005 Omnibus Incentive Plan. Under the Executive Annual Incentive Plan approved in 2000, the total number

of shares approved for issuance is 1.5 million, and 1.2 million shares were approved for issuance under the Executive

Annual Incentive Plan in 2005.

As of Dec. 31, 2009 and 2008, there was approximately $17.9 million and $14.9 million, respectively, of total

unrecognized compensation cost related to non-vested share-based compensation awards. Xcel Energy expects to

recognize that cost over a weighted-average period of 1.88 years.

The amount of cash used to settle Xcel Energy’s PSP awards was $2.6 million and $3.1 million in 2009 and 2008,

respectively.

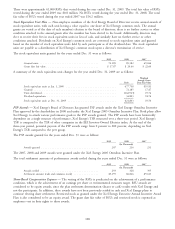

Cash received from stock options exercised and actual tax benefit realized for the tax deductions from stock options

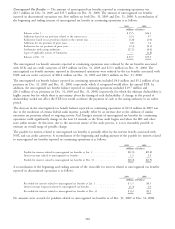

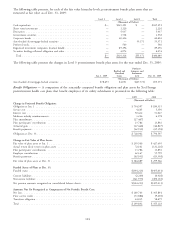

exercised during the years ended Dec. 31 were as follows:

2009 2008 2007

(Thousands of Dollars)

Cash received from stock options exercised .............................. $15,759 $214 $5,266

Tax benefit realized for the tax deductions from stock options exercised ............ 277 — —

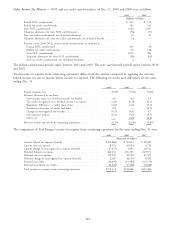

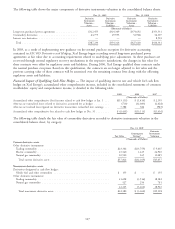

11. Benefit Plans and Other Postretirement Benefits

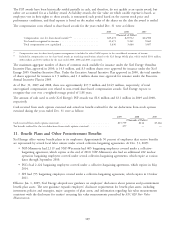

Xcel Energy offers various benefit plans to its employees. Approximately 50 percent of employees that receive benefits

are represented by several local labor unions under several collective-bargaining agreements. At Dec. 31, 2009:

• NSP-Minnesota had 2,119 and NSP-Wisconsin had 405 bargaining employees covered under a collective-

bargaining agreement, which expires at the end of 2010. NSP-Minnesota also had an additional 222 nuclear

operation bargaining employees covered under several collective-bargaining agreements, which expire at various

dates through September 2010.

• PSCo had 2,124 bargaining employees covered under a collective-bargaining agreement, which expires in May

2014.

• SPS had 795 bargaining employees covered under a collective-bargaining agreement, which expires in October

2011.

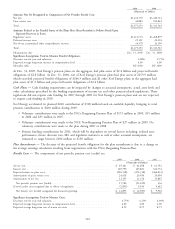

Effective Jan. 1, 2009, Xcel Energy adopted new guidance on employers’ disclosures about pension and postretirement

benefit plan assets. The new guidance expands employers’ disclosure requirements for benefit plan assets, including

investment policies and strategies, major categories of plan assets, and information regarding fair value measurements

consistent with the disclosures for entities’ recurring fair value measurements prescribed by ASC 820 Fair Value

Measurements.

109