Xcel Energy 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONNECTED

2009 ANNUAL REPORT

•

Table of contents

-

Page 1

CON NEC T ED 2 0 0 9 A N N UA L R EP O R T -

Page 2

...electric and natural gas company, with annual revenues of $9.6 billion. Based in Minneapolis, Minn., Xcel Energy operates in eight states. The company provides a comprehensive portfolio of energy-related products and services to 3.4 million electricity customers and 1.9 million natural gas customers... -

Page 3

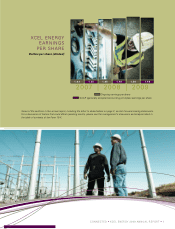

... accounting principles) earnings per share Some of the sections in this annual report, including the letter to shareholders on page 2, contain forward-looking statements. For a discussion of factors that could affect operating results, please see the management's discussion and analysis listed... -

Page 4

... to affect energy sales, 2009 was a good year for Xcel Energy. The company met its ï¬nancial goals, achieved outstanding operational results and stayed true to its commitments to the environment and the community. Most important, we delivered value for you with a strong and growing dividend. MEE... -

Page 5

... G OPER AT IO N A L E XCEL LEN CE As we've reported for several years, Xcel Energy's corporate strategy is to meet customer needs and grow our businesses through environmental leadership. In 2009, we completed several major construction projects, which enabled us to deliver on those strategic goals... -

Page 6

... specialist B, (left) and Ron Lungu, superintendent, supplemental maintenance and construction, at the Comanche generating station Opposite page: Employees Fred Arellano, plant director, Comanche station, (left) and Tim Farmer, Comanche unit 3 project director, at the Comanche generating station -

Page 7

...the solar energy front, we are No. 5 in the nation for solar capacity and manage a fast-growing program called Solar*Rewards that offers rebates to residential and business customers for installing on-site solar systems. In 2009, we announced a partnership to build a 17-megawatt solar power plant in... -

Page 8

..., the plant's license renewal application awaits action by the federal Nuclear Regulatory Commission (NRC), which is expected in 2010. If approved, we will then ask permission of the NRC to increase generating capacity. Reliability and customer satisfaction illustrate operational excellence... -

Page 9

Employees Ellen Stein, scheduler and planner, and Josh Foss, engineer, at the Riverside plant C o n n e C t e d ฀ • ฀ X C e l ฀ e n e r gy ฀ 2 0 0 9 ฀ A n n u A l ฀ r e p o r t ฀• 7 -

Page 10

... and operator, at the Riverside plant CO N N EC T ED We invite you to view Connected, a DVD that features Xcel Energy employees who are committed to a clean energy future, to their customers and to their communities. The DVD also includes proï¬les of Chairman and CEO Dick Kelly, President and... -

Page 11

... 414 Nicollet Mall Minneapolis, MN 55401 (Address of principal executive offices) Registrant's telephone number, including area code: 612-330-5500 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Xcel Energy Inc. Common Stock... -

Page 12

...Energy Electric Operating Statistics ...NATURAL GAS UTILITY OPERATIONS ...Natural Gas Utility Trends ...NSP-Minnesota ...NSP-Wisconsin ...PSCo ...Xcel Energy Natural Gas Operating Statistics ...ENVIRONMENTAL MATTERS ...CAPITAL SPENDING AND FINANCING ...EMPLOYEES ...EXECUTIVE OFFICERS ...Risk Factors... -

Page 13

... life insurance policies Southwestern Public Service Co., a New Mexico corporation Utility Engineering Corporation, an engineering, construction and design company NSP-Minnesota, NSP-Wisconsin, PSCo, SPS WestGas InterState, Inc., a Colorado corporation operating an interstate natural gas pipeline... -

Page 14

... in purchased gas costs. Open Access Transmission Tariff Purchased capacity cost adjustment. Allows PSCo to recover from retail customers for all purchased capacity payments to power suppliers, effective Jan. 1, 2007. Capacity charges are not included in PSCo's electric rates or other recovery... -

Page 15

... test, an electric quality of service plan and a natural gas quality of service plan established by the CPUC. Private Fuel Storage, LLC. A consortium of private parties (including NSP-Minnesota) working to establish a private facility for interim storage of spent nuclear fuel. Prairie Island Indian... -

Page 16

... a scheduled payment under a contract. An electric service wherein high-voltage transmission facilities of one utility system are used to transmit power generated within or purchased from another system. Funds necessary to meet operating expenses. Billion cubic feet British thermal unit. A standard... -

Page 17

... operations. Xcel Energy was incorporated under the laws of Minnesota in 1909. Xcel Energy's executive offices are located at 414 Nicollet Mall, Minneapolis, Minn. 55401. Its website address is www.xcelenergy.com. Xcel Energy makes available, free of charge through its website, its annual report... -

Page 18

... million customers and natural gas utility service to approximately 1.3 million customers. All of PSCo's retail electric operating revenues were derived from operations in Colorado during 2009. Generally, PSCo's earnings range from approximately 45 percent to 55 percent of Xcel Energy's consolidated... -

Page 19

...open access transmission planning processes for the Xcel Energy operating companies and the RTOs serving the NSP-Minnesota, NSP-Wisconsin and SPS systems (MISO and SPP, respectively). • NSP-Minnesota received MPUC approval in 2008 to construct three new 115 KV transmission lines in 2009 to deliver... -

Page 20

...-income customer co-pay program designed to reduce natural gas service disconnections. • MCR - The MCR recovers costs related to reducing Mercury emissions at two NSP-Minnesota fossil fuel power plants. • RDF - The RDF allocates money to support development of renewable energy projects research... -

Page 21

... energy management program expenditures. NSP-Minnesota is required to request a new cost-recovery level annually. While this law changed to a savings-based requirement beginning in 2010, the costs of providing qualified conservation improvement programs will continue to be recoverable through a rate... -

Page 22

... in NSP-Minnesota's next resource plan, which is to be filed no later than Aug. 1, 2010. RES - In 2007, the Minnesota legislature changed the state's renewable energy objective into a standard that requires NSP-Minnesota to generate or cause to be generated electricity from renewable resources... -

Page 23

... plans are approved, NSP-Minnesota expects to file for recovery of the costs to implement these plans through the mercury cost rider. Nuclear Power Operations and Waste Disposal - NSP-Minnesota owns two nuclear generating plants: the Monticello plant and the Prairie Island plant, which has two units... -

Page 24

..., paper, protective clothing, rags, tools and equipment that have become contaminated through use in the plant. LLW Disposal - Federal law places responsibility on each state for disposal of LLW generated within its borders. LLW from NSP-Minnesota's Monticello and Prairie Island nuclear plants is... -

Page 25

... session, the MPUC decision on dry spent fuel storage capacity to support life extension will go into effect on June 1, 2010. In April 2008, NSP-Minnesota filed an application with the NRC to renew the operating license of its two nuclear reactors at Prairie Island for an additional 20 years, until... -

Page 26

...the FERC to make wholesale electric sales at market-based prices (see Market Based Rate Rules discussion) and is a transmission-owning member of the MISO RTO. The PSCW has a biennial base-rate filing requirement. By June of each odd-numbered year, NSP-Wisconsin must submit a rate filing for the test... -

Page 27

... include an FCA to provide for adjustments to billings and revenues for changes in the cost of fuel and purchased energy. NSP-Wisconsin's retail electric rate schedules for Michigan customers include power supply cost recovery factors, which are based on 12-month projections. After each 12-month... -

Page 28

...from the FERC to make wholesale electricity sales at market-based prices; however, PSCo withdrew its market-based rate authority with respect to sales in its own and affiliated operating company control areas. Fuel, Purchased Energy and Conservation Cost-Recovery Mechanisms - PSCo has several retail... -

Page 29

... system peak demand for PSCo occurred on Aug. 12, 2009. Energy Sources and Related Transmission Initiatives PSCo expects to meet its system capacity requirements through existing electric generating stations, power purchases, new generation facilities, DSM options and phased expansion of... -

Page 30

... PSCo's 2009 RES compliance plan in August 2009. The 2010 compliance plan was filed in October 2009. San Luis Valley-Calumet-Comanche Unit 3 Transmission Project - PSCo and Tri-State Generation and Transmission Association filed a joint application with the CPUC for a certificate of need and public... -

Page 31

... Commodity Marketing Operations PSCo conducts various wholesale marketing operations, including the purchase and sale of electric capacity, energy and energy related products. PSCo uses physical and financial instruments to minimize commodity price and credit risk and hedge supplies and purchases... -

Page 32

... 2009 under the NMPRC's rule. Renewable Energy Portfolio Plan - SPS is required to develop and implement a renewable portfolio plan in New Mexico in which six percent of its energy to serve its New Mexico retail customers is produced by renewable resources in 2010. The renewable standard increases... -

Page 33

... five sites (10 MW each) in New Mexico and signed contracts in 2009, and a request for approval was filed in January 2010. Purchased Transmission Services - SPS has contractual arrangements with SPP and regional transmission service providers to deliver power and energy to its native load customers... -

Page 34

... transmission service in interstate commerce and electricity sold at wholesale, hydro facility licensing, natural gas transportation, accounting practices and certain other activities of Xcel Energy's utility subsidiaries, including enforcement of NERC mandatory electric reliability standards. State... -

Page 35

...the Xcel Energy utility subsidiaries may not sell power at market-based rates within the PSCo and SPS balancing authorities, where they have been found to have market power under the FERC's applicable analysis. Both PSCo and SPS have cost-based coordination tariffs that they may use to make sales in... -

Page 36

... accounting and reporting regulations related to the calculation of the NSP-Minnesota and NSP-Wisconsin wholesale FCA for the period commencing Jan. 1, 2008. The audit is a periodic financial audit, and Xcel Energy is fully cooperating with the audit. Xcel Energy Electric Operating Statistics 2009... -

Page 37

...required by Minnesota law to spend a minimum of 0.5 percent of Minnesota natural gas revenue on conservation improvement programs in the state of Minnesota. These costs are recovered from Minnesota customers through an annual cost-recovery mechanism for natural gas conservation and energy management... -

Page 38

... Gas Supply and Costs NSP-Minnesota actively seeks natural gas supply, transportation and storage alternatives to yield a diversified portfolio that provides increased flexibility, decreased interruption and financial risk, and economical rates. In addition, NSP-Minnesota conducts natural gas price... -

Page 39

... plants provide a cost-effective alternative to annual fixed pipeline transportation charges to meet the peaks caused by firm space heating demand on extremely cold winter days. NSP-Wisconsin is required to file a natural gas supply plan with the PSCW annually to change natural gas supply contract... -

Page 40

... capacity was converted to firm transportation with balancing service attached. In addition, PSCo operates three company-owned underground storage facilities, which provide about 41,000 MMBtu of natural gas supplies on a peak day. The balance of the quantities required to meet firm peak day sales... -

Page 41

... of existing or planned facilities will be required as a result of changes to environmental regulations, interpretations or enforcement policies or, what effect future laws or regulations may have upon Xcel Energy's operations. For more information on environmental contingencies, see Notes 17 and 18... -

Page 42

..., Chief Operating Officer, PSCo, November 2009 to December 2009; President and Director, SPS, December 2006 to November 2009; Chief Executive Officer, SPS, August 2006 to November 2009; Vice President of Resource Planning and Acquisition, Xcel Energy Inc., November 2002 to July 2006 and Managing... -

Page 43

...Chief Executive Officer, NSP-Wisconsin, February 2002 to present. Previously, State Vice President for North Dakota and South Dakota, August 2000 to February 2002. George E. Tyson II, 44, Vice President and Treasurer, Xcel Energy Inc., May 2004 to present. Previously, Managing Director and Assistant... -

Page 44

... operations, including siting and construction of facilities, customer service and the rates that we can charge customers. The FERC has jurisdiction, among other things, over wholesale rates for electric transmission service, the sale of electric energy in interstate commerce and certain natural gas... -

Page 45

... rating agencies. For example, Standard & Poor's calculates an imputed debt associated with capacity payments from purchase power contracts. An increase in the overall level of capacity payments would increase the amount of imputed debt, based on Standard & Poor's methodology. Therefore, Xcel Energy... -

Page 46

... potentially result in economic losses. Potential market supply shortages may not be fully resolved through alternative supply sources and such interruptions may cause short-term disruptions in our ability to provide electric and/or natural gas services to our customers. The impact of these cost... -

Page 47

... to increased system stresses, including service interruptions. Weather conditions outside of our service territory could also have an impact on our revenues. We buy and sell electricity depending upon system needs and market opportunities. Extreme weather conditions creating high energy demand on... -

Page 48

... operators with applicable regulations or the occurrence of a serious nuclear incident at other facilities could result in increased regulation of the industry as a whole, which could then increase NSP-Minnesota's compliance costs and impact the results of operations of its facilities. Economic... -

Page 49

..., our utility operations file long-term resource plans with our regulators. These plans are based on numerous assumptions over the relevant planning horizon such as: sales growth, economic activity, costs, regulatory mechanisms, impact of technology on sales and production, customer response and... -

Page 50

...defined benefit pension and postretirement plans that cover substantially all of our employees. Assumptions related to future costs, return on investments, interest rates and other actuarial assumptions have a significant impact on our funding requirements related to these plans. These estimates and... -

Page 51

... regulated by various state utility commissions, which generally possess broad powers to ensure that the needs of the utility customers are being met. If our utility subsidiaries were to cease making dividend payments, our ability to pay dividends on our common stock and preferred stock or otherwise... -

Page 52

...-Minnesota Station, City and Unit Fuel Installed Summer 2009 Net Dependable Capability (MW) Steam: Sherburne-Becker, Minn. Unit 1 ...Unit 2 ...Unit 3 ...Prairie Island-Welch, Minn. Unit 1 ...Unit 2 ...Monticello-Monticello, Minn . King-Bayport, Minn ...Black Dog-Burnsville, Minn. 2 Units ...2 Units... -

Page 53

...., 4 Units ...Comanche-Pueblo, Colo., 2 Units ...Craig-Craig, Colo., 2 Units ...Hayden-Hayden, Colo., 2 Units ...Pawnee-Brush, Colo ...Valmont-Boulder, Colo ...Zuni-Denver, Colo., 2 Units ...Combustion Turbine: Fort St. Vrain-Platteville, Colo., 6 Units ...Various Locations, 6 Units ...Hydro: Cabin... -

Page 54

... 221 437 Natural gas utility mains at Dec. 31, 2009: Miles NSP-Minnesota NSP-Wisconsin PSCo WGI Transmission ...Distribution ... 135 9,586 - 2,202 2,301 21,242 12 - Item 3 - Legal Proceedings In the normal course of business, various lawsuits and claims have arisen against Xcel Energy. After... -

Page 55

...Equity Securities Quarterly Stock Data Xcel Energy's common stock is listed on the New York Stock Exchange (NYSE). The trading symbol is XEL. The following are the reported high and low sales prices based on the NYSE Composite Transactions for the quarters of 2009 and 2008 and the dividends declared... -

Page 56

... including reinvestment of dividends. Fiscal years ending Dec. 31. 2004 2005 2006 2007 2008 2009 Xcel Energy ...EEI Investor-Owned Electrics ...S&P 500 ... $100 100 100 $106 116 105 $139 140 121 $141 163 128 $122 121 81 $147 134 102 See Item 12 for information concerning securities authorized... -

Page 57

Item 6 - Selected Financial Data 2009 2008 2007 2006 (Millions of Dollars, Except Share and Per Share Data) 2005 Operating revenues ...Operating expenses ...Income from continuing operations ...Net income ...Earnings available to common shareholders ...Weighted average common shares outstanding: ... -

Page 58

... Continuing Operations Xcel Energy is a public utility holding company. In 2009, Xcel Energy's continuing operations included the activity of four utility subsidiaries that serve electric and natural gas customers in eight states. These utility subsidiaries are NSP-Minnesota, NSP-Wisconsin, PSCo and... -

Page 59

... Boulder, Colo. • Xcel Energy is a leader in promoting new clean energy technologies for the future. Pursuant to state statute, NSP-Minnesota manages a renewable development fund derived from customer renewable energy charges in Minnesota that allows it to promote renewable technology advancement... -

Page 60

...our utility companies operating in Minnesota, Colorado, and New Mexico use a carbon proxy cost mandated by the state commissions to evaluate the impact of potential future GHG regulation on its future resource acquisition plans. Xcel Energy publishes a Corporate Responsibility Report annually, which... -

Page 61

... facilities while increasing the amount of electricity they can produce by approximately 300 MW. New state-of-the-art emission control equipment was placed in service for the A. S. King plant in 2007 and the existing High Bridge facility was replaced with a 575 MW natural gas combined-cycle unit... -

Page 62

... the Building the Core strategy. Even though Xcel Energy ultimately manages the business based on the revenue streams provided by electric and natural gas, Xcel Energy continues to evolve the management of the portfolio of utility investments. While Xcel Energy has four separate operating companies... -

Page 63

... a natural gas pipeline in Colorado that began operations in late 2008 as well as a gas storage facility that commenced operations in July 2009. PSRI - PSRI is a wholly owned subsidiary of PSCo. During 2007, Xcel Energy resolved a dispute with the IRS regarding its COLI program. The 2009 impact is... -

Page 64

... sales growth and a gas rate increase. NSP-Minnesota - Earnings at NSP-Minnesota increased by three cents per share for the 2008 compared with 2007. The increase was due to lower interest and non-operating expenses. This was slightly offset by unfavorable weather and purchased capacity costs. NSP... -

Page 65

...: • Regulated utility subsidiaries, operating in the electric and natural gas segments; and • Other nonregulated subsidiaries and the holding company. The following table summarizes the earnings contributions of Xcel Energy's business segments on the basis of GAAP. See Note 4 to the consolidated... -

Page 66

...Minnesota, Colorado, Texas, New Mexico and Wisconsin, which were partially mitigated by the negative impact of weather, lower sales and higher purchase capacity power costs. Offsetting stronger electric margins were higher operating and maintenance expenses, resulting from increased employee benefit... -

Page 67

... Dec. 31: Electric Revenues 2009 vs. 2008 (Millions of Dollars) Fuel and purchased power cost recovery ...Trading ...Estimated impact of weather ...Retail sales decline (excluding weather impact) ...Retail rate increases (Colorado, Minnesota, Texas, New Mexico and Wisconsin) ...Conservation and... -

Page 68

... ... 2009 Comparison to 2008 - The increase in electric margin was due to electric rate increases in Colorado, Minnesota, Texas, New Mexico and Wisconsin, higher conservation and DSM revenue and non-fuel riders. This was partially offset by higher purchase capacity costs and a negative impact of... -

Page 69

...) 2009 Comparison to 2008 - Natural gas margins decreased mainly due to milder than normal temperatures. 2008 vs. 2007 (Millions of Dollars) Base rate changes (Colorado and Wisconsin) ...Estimated impact of weather ...Sales growth (excluding impact of weather) ...Conservation revenues ...Increased... -

Page 70

... 2007. 2009 vs. 2008 (Millions of Dollars) Higher employee benefit costs ...Nuclear outage costs, net of deferral Higher nuclear plant operation costs Higher plant generation costs ...Higher insurance costs ...Higher information technology costs Higher labor costs ...Lower consulting costs ...Lower... -

Page 71

... of Comanche Unit 3, a power facility located in Colorado, as well as other construction projects. Interest Charges - Interest charges increased by approximately $8.7 million, or 1.6 percent, for 2009, compared with 2008. The increase was primarily the result of increased debt levels to fund new... -

Page 72

...in 2009. Factors Affecting Results of Continuing Operations Xcel Energy's utility revenues depend on customer usage, which varies with weather conditions, general business conditions and the cost of energy services. Various regulatory agencies approve the prices for electric and natural gas service... -

Page 73

... these regulators can significantly impact Xcel Energy's results of operations. Xcel Energy expects to periodically file for rate changes based on changing energy market and general economic conditions. The electric and natural gas rates charged to customers of Xcel Energy's utility subsidiaries are... -

Page 74

...in December 2009, with installation at A. S. King scheduled for December 2010. In November 2009, the MPUC authorized NSP-Minnesota to collect approximately $3.5 million from customers through a mercury rider in 2010. In December 2009, NSP-Minnesota filed the plans for mercury control at Sherco Units... -

Page 75

... and services required to deliver electric and natural gas services to customers. These potential cost increases could in turn lead to increased prices to customers. CRITICAL ACCOUNTING POLICIES AND ESTIMATES Preparation of the consolidated financial statements and related disclosures in compliance... -

Page 76

...The potential increase in the 2011 expense is due to expense recognition based on cash funding and expected cash contributions of $55 million in 2011 at NSP-Minnesota compared to no contributions made during 2008 through 2010. Xcel Energy set the discount rate used to value the Dec. 31, 2009 pension... -

Page 77

... discussion of Xcel Energy's benefit plans. Nuclear Decommissioning NSP-Minnesota owns nuclear generation facilities and regulations require NSP-Minnesota to decommission its nuclear power plants after each facility is taken out of service. Xcel Energy records future plant removal obligations... -

Page 78

...the storage of spent nuclear fuel. NSP-Minnesota has funded its portion of the DOE's permanent disposal program since 1981. The spent fuel storage assumptions have a significant influence on the decommissioning cost estimate. The manner in which spent nuclear fuel is managed and the assumptions used... -

Page 79

... securities, and also requires additional disclosures regarding other-than-temporary impairments. This new guidance was effective for interim and annual periods ending after June 15, 2009. Xcel Energy implemented the guidance on April 1, 2009, and the implementation did not have a material impact... -

Page 80

.... Commodity Price Risk - Xcel Energy's utility subsidiaries are exposed to commodity price risk in their electric and natural gas operations. Commodity price risk is managed by entering into long- and short-term physical purchase and sales contracts for electric capacity, energy and energy-related... -

Page 81

...for the NSP-Minnesota and PSCo commodity trading operations, calculated on a consolidated basis, were as follows: Year Ended Dec. 31 VaR Limit Average (Millions of Dollars) High Low 2009 ...2008 ... $0.50 0.30 $5.00 5.00 $0.44 0.30 $2.02 1.14 $0.06 0.01 Interest Rate Risk - Xcel Energy and its... -

Page 82

Xcel Energy also maintains trust funds, as required by the NRC, to fund costs of nuclear decommissioning. These trust funds are subject to interest rate risk and equity price risk. At Dec. 31, 2009, these funds were invested in a diversified portfolio of taxable and municipal fixed income securities... -

Page 83

... of natural gas prices and an increase in plant-related deferred income taxes. The increase was partially offset by increased pension contributions made in 2009 and higher AFUDC due primarily to the construction of Comanche Unit 3, a power facility located in Colorado. Cash provided by operating... -

Page 84

... due to potential increased investments for renewable generation and transmission assets. The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility construction expenditures may vary from the estimates due to changes in electric and natural gas... -

Page 85

...coal, nuclear fuel and natural gas requirements. Additionally, the utility subsidiaries of Xcel Energy have entered into agreements with utilities and other energy suppliers for purchased power to meet system load and energy requirements, replace generation from company-owned units under maintenance... -

Page 86

...flow, notes payable, commercial paper and bank lines of credit. The amount and timing of short-term funding needs depend in large part on financing needs for construction expenditures, working capital and dividend payments. Short-Term Investments - Xcel Energy, NSP-Minnesota, NSP-Wisconsin, PSCo and... -

Page 87

... of such factors under Statement of Operations Analysis. Short-term borrowing as a source of funding is affected by regulatory actions, credit ratings and access to reasonably priced capital markets. For additional information on Xcel Energy's short-term borrowing arrangements, see Note 5 to the... -

Page 88

... rating agency. As of Feb. 12, 2010, the following represents the credit ratings assigned to various Xcel Energy companies: Company Credit Type Moody's Standard & Poor's Fitch Xcel Energy . . Xcel Energy . . NSP-Minnesota NSP-Minnesota NSP-Minnesota NSP-Wisconsin NSP-Wisconsin PSCo ...PSCo ...PSCo... -

Page 89

... sales decline approximately 1 percent to 2 percent. • Reflects increased revenue due to the full year impact of 2009 electric rate cases in Colorado, Texas and New Mexico, along with the 2010 electric rate increase in Colorado. • Constructive outcomes in the Minnesota natural gas rate and PSCo... -

Page 90

... based on those criteria. Xcel Energy's independent auditors have issued an audit report on the company's internal control over financial reporting. Their report appears herein. /s/ RICHARD C. KELLY Richard C. Kelly Chairman and Chief Executive Officer February 26, 2010 /s/ DAVID M. SPARBY David... -

Page 91

... management. Our responsibility is to express an opinion on the financial statements and financial statement schedules based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan... -

Page 92

... responsibility is to express an opinion on the Company's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit... -

Page 93

...097 1,351,073 9,048 1,900 37,207 Operating expenses Electric fuel and purchased power ...Cost of natural gas sold and transported ...Cost of sales - other ...Other operating and maintenance expenses ...Conservation and demand side management program expenses . Depreciation and amortization ...Taxes... -

Page 94

... receivable ...Accrued unbilled revenues ...Inventories ...Recoverable purchased natural gas and electric energy costs ...Other current assets ...Accounts payable ...Net regulatory assets and liabilities ...Other current liabilities ...Pension and other employee benefit obligations ...Change in... -

Page 95

XCEL ENERGY INC. AND SUBSIDIARIES Consolidated Balance Sheets (amounts in thousands of dollars) Dec. 31 2009 2008 Assets Current assets Cash and cash equivalents ...Accounts receivable, net ...Accrued unbilled revenues ...Inventories ...Recoverable purchased natural gas and electric energy ... -

Page 96

... retiree medical benefits, net of tax of $(2,203) . . Net derivative instrument fair value changes during the period, net of tax of $4,224 ...Unrealized gain - marketable securities, net of tax of $284 ...Comprehensive income for 2009 Dividends declared: Cumulative preferred stock . . Common stock... -

Page 97

XCEL ENERGY INC. AND SUBSIDIARIES Consolidated Statements of Capitalization (amounts in thousands of dollars) Dec. 31 2009 2008 Long-Term Debt NSP-Minnesota First Mortgage Bonds, Series due: Aug. 1, 2010, 4.75% ...Aug. 28, 2012, 8% ...March 1, 2018, 5.25% ...March 1, 2019, 8.5%(b) ...Sept. 1, 2019,... -

Page 98

XCEL ENERGY INC. AND SUBSIDIARIES Consolidated Statements of Capitalization - (Continued) (amounts in thousands of dollars) Dec. 31 2009 2008 Long-Term Debt - continued NSP-Wisconsin First Mortgage Bonds, Series due: Oct. 1, 2018, 5.25% ...Dec. 1, 2026, 7.375% ...Sept. 1, 2038, 6.375% ...City of La... -

Page 99

...subsidiaries are NSP-Minnesota, NSP-Wisconsin, PSCo and SPS. These utilities serve customers in portions of Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas and Wisconsin. WGI, an interstate natural gas pipeline company, and Xcel Energy WYCO Inc., a joint venture with CIG... -

Page 100

...-Minnesota operates under various service quality standards, which could require customer refunds if certain criteria are not met. NSP-Minnesota rates in Minnesota include monthly adjustments for recovery of conservation and energy-management program costs, which are reviewed annually. NSP-Minnesota... -

Page 101

... normal purchases and normal sales designation requirements. None of the contracts entered into within the commodity trading operations qualify for a normal purchases and normal sales designation. For further discussion of Xcel Energy's risk management and derivative activities, see Note 13 to the... -

Page 102

..., and extends over the estimated lives of the plants. The calculation assumes that NSP-Minnesota and NSP-Wisconsin will recover those costs through rates. The fair value of external nuclear decommissioning fund investments is determined based on quoted market prices for those or similar investments... -

Page 103

... from business operations, Xcel Energy uses estimates based on the best information available. Estimates are used for such items as plant depreciable lives, AROs, decommissioning, tax provisions, uncollectible amounts, environmental costs, unbilled revenues, jurisdictional fuel and energy cost... -

Page 104

... compliance purposes is recorded as electric fuel and purchased power expense. The net margin on sales of RECs for trading purposes is recorded as electric utility operating revenues, net of any margin sharing requirements. As a result of state regulatory orders, Xcel Energy reduces recoverable fuel... -

Page 105

... securities, and also requires additional disclosures regarding other-than-temporary impairments. This new guidance was effective for interim and annual periods ending after June 15, 2009. Xcel Energy implemented the guidance on April 1, 2009, and the implementation did not have a material impact... -

Page 106

...Benefit Plans - In December 2008, the FASB issued new guidance on employers' disclosures about postretirement benefit plan assets. The guidance amends and expands previous disclosure requirements for plan assets of a defined benefit pension or other postretirement plan to include investment policies... -

Page 107

... interest rates at Dec. 31, 2009 and 2008 were 0.36 percent and 3.53 percent, respectively. Xcel Energy and its utility subsidiaries have combined approval by the Board of Directors to issue up to $2.25 billion of commercial paper. Credit Facility Bank Borrowings - At Dec. 31, 2008, Xcel Energy and... -

Page 108

... for NSP-Minnesota. • The commitment fees, also based on applicable debt ratings, are calculated on the unused portion of the lines of credit at 8 basis points per year for Xcel Energy, PSCo and SPS, and at 6 basis points per year for NSP-Minnesota. • At Dec. 31, 2009, the credit facilities were... -

Page 109

... of its capital stock. Also during the deferral period, Xcel Energy may not make any principal or interest payments on, or repay, purchase or redeem any of its debt securities that are equal in right of payment with, or subordinated to, the Junior Notes. Xcel Energy also may not make payments on any... -

Page 110

... MW, coal-fueled electric generating unit. NSP-Minnesota is the operating agent under the joint ownership agreement. NSP-Minnesota's share of operating expenses and construction expenditures are included in the applicable utility accounts. Each of the respective owners is responsible for funding its... -

Page 111

... of Dec. 31, 2009, the IRS had not proposed any material adjustments to tax years 2006 and 2007. State Audits - Xcel Energy files consolidated state tax returns based on income in its major operating jurisdictions of Colorado, Minnesota, Texas, and Wisconsin, and various other state income-based tax... -

Page 112

... related to ongoing activity. Xcel Energy's amount of unrecognized tax benefits for continuing operations could significantly change in the next 12 months as the Texas audit begins and when the IRS and other state audits resume. At this time, due to the uncertain nature of the audit process, it is... -

Page 113

... tax benefits ...Life insurance policies ...Other, net ... ... 35.0% 4.0 (2.0) (2.0) 0.8 (0.5) (0.2) - 35.1% 35.0% 4.4 (1.8) (2.1) - (0.1) (0.2) (0.8) 34.4% 35.0% 4.5 (2.5) (1.1) (0.7) 3.1 (3.7) (0.8) 33.8% Effective income tax rate from continuing operations ... The components of Xcel Energy... -

Page 114

...Common Stock Preferred Stock - Xcel Energy has authorized 7,000,000 shares of preferred stock with a $100 par value. At Dec. 31, 2009 and 2008, Xcel Energy had six series of preferred stock outstanding, redeemable at its option at prices ranging from $102 to $103.75 per share plus accrued dividends... -

Page 115

... it can pay to Xcel Energy, the holder of its common stock. Even with these restrictions, NSP-Minnesota could have paid more than $1.1 billion and $1.0 billion in additional cash dividends on common stock at Dec. 31, 2009 and 2008, respectively. The issuance of securities by Xcel Energy generally is... -

Page 116

... exercise price. Restricted Stock - Certain employees may elect to receive shares of common or restricted stock under the Xcel Energy Executive Annual Incentive Award Plan. Restricted stock vests and settles in equal annual installments over a three-year period. Xcel Energy reinvests dividends on... -

Page 117

... prior to 2008). Additionally, Xcel Energy's annual dividend paid on its common stock must remain at a specified amount per share or greater. EPS growth will be measured annually at the end of each fiscal year. The remaining awarded units, plus associated earned dividend equivalents, will be settled... -

Page 118

...the number of stock equivalent units held by each participant as of the dividend date. The stock equivalent units are payable as a distribution of Xcel Energy's common stock upon a director's termination of service. The stock equivalent units granted for the years ended Dec. 31 were as follows: 2009... -

Page 119

... employees covered under a collective-bargaining agreement, which expires in October 2011. Effective Jan. 1, 2009, Xcel Energy adopted new guidance on employers' disclosures about pension and postretirement benefit plan assets. The new guidance expands employers' disclosure requirements for benefit... -

Page 120

... of years of service, the employee's average pay and social security benefits. Xcel Energy's policy is to fully fund the actuarially determined pension costs recognized for ratemaking and financial reporting purposes, subject to the limitations of applicable employee benefit and tax laws, into an... -

Page 121

... at Jan. 1 ...Actual return (loss) on plan assets ...Employer contributions ...Benefit payments ... Fair value of plan assets at Dec. 31 ...Funded Status of Plans at Dec. 31: Funded status ...Noncurrent assets ...Noncurrent liabilities ...Net pension amounts recognized on consolidated balance sheets... -

Page 122

... can be impacted by changes to actuarial assumptions, actual asset levels and other calculations prescribed by the funding requirements of income tax and other pension-related regulations. These regulations did not require cash funding for 2007 through 2009 for Xcel Energy's pension plans and are... -

Page 123

.... Plan Assets - Certain state agencies that regulate Xcel Energy's utility subsidiaries also have issued guidelines related to the funding of postretirement benefit costs. SPS is required to fund postretirement benefit costs for Texas and New Mexico jurisdictional amounts collected in rates and PSCo... -

Page 124

... benefit obligation and plan assets for Xcel Energy postretirement health care plans that benefit employees of its utility subsidiaries is presented in the following table: 2009 2008 (Thousands of Dollars) Change in Projected Benefit Obligation: Obligation at Jan. 1 ...Service cost ...Interest cost... -

Page 125

... other than fulfilling benefit payment obligations, when claims are presented and approved under the plans. Additional cash funding requirements are prescribed by certain state and federal rate regulatory authorities, as discussed previously. Xcel Energy contributed $62.2 million during 2009 and $55... -

Page 126

... prices in their electric and natural gas operations, as well as for trading purposes. This could include the purchase or sale of energy or energy-related products, natural gas to generate electric energy, gas for resale and vehicle fuel. At Dec. 31, 2009, Xcel Energy had various vehicle fuel... -

Page 127

... of implementing new guidance on the normal purchase exception for derivative accounting contained in ASC 815 Derivatives and Hedging, Xcel Energy began recording several long-term purchased power agreements at fair value due to accounting requirements related to underlying price adjustments. As... -

Page 128

... to electric fuel and purchased power; these derivative settlement gains and losses are shared with electric customers through fuel and purchased energy cost-recovery mechanisms, and reclassified out of income as regulatory assets or liabilities, as appropriate. Recorded to cost of natural gas sold... -

Page 129

... of Xcel Energy's long-term debt is estimated based on the quoted market prices for the same or similar issues, or the current rates for debt of the same remaining maturities and credit quality. The fair value estimates presented are based on information available to management as of Dec. 31, 2009... -

Page 130

... discussion of Fru-Con Construction Corporation vs. Utility Engineering et al. Letters of Credit Xcel Energy and its subsidiaries use letters of credit, generally with terms of one year, to provide financial guarantees for certain operating obligations. At Dec. 31, 2009 and 2008, there were $22... -

Page 131

...as common stocks listed by the New York Stock Exchange and commodity derivative contracts listed on the New York Mercantile Exchange. Level 2 - Pricing inputs are other than quoted prices in active markets, but are either directly or indirectly observable as of the reported date. The types of assets... -

Page 132

... electric revenues....rate increase of approximately $91.4 million. As part of its decision, the MPUC approved a 10-year life extension of the Prairie Island nuclear plant for purposes of determining depreciation and decommissioning expenses, effective Jan. 1, 2009. This decision reduced NSP-Minnesota... -

Page 133

... for 2010, which represents a 2.8 percent overall increase in customer bills. This request is based on a ROE of 11 percent, an equity ratio of 52.46 percent and a rate base of $441 million. NSP-Minnesota also requested an additional increase of $3.45 million, for recovery of pension funding costs... -

Page 134

... service at Sherco Unit 3 in December 2009, with installation at A. S. King scheduled to be completed in December 2010. Currently, the estimated project costs are approximately $6.6 million for these two units, and the MPUC authorized NSP-Minnesota to collect the 2010 revenue requirement associated... -

Page 135

... fund for the Monticello nuclear plant, which the MPUC approved in November 2009. NSP-Minnesota began refunding the excess escrow to customers in February 2010. Pending and Recently Concluded Regulatory Proceedings - NDPSC and SDPUC South Dakota Electric Rate Case - In June 2009, NSP-Minnesota filed... -

Page 136

... 2010 revenue requirements pursuant to the refund provision in the 2008 rate case order. The June 2009 MPUC order also directed NSP-Minnesota to return to customers their contributions made to the external escrow decommissioning fund for the Monticello nuclear plant. In NSP-Wisconsin's 2010 electric... -

Page 137

...Rate increase ... $ 45.1 (14.7) - $ 30.4 $ 35.8 (20.3) (9.1) $ 6.4 Other 2009 Electric Fuel Cost Recovery - NSP-Wisconsin's actual fuel and purchased power costs for 2009 were less than the amount authorized in rates, primarily due to lower load and lower market prices for fuel and purchased power... -

Page 138

... 2009, due to the delay in Comanche Unit 3 coming online, the CPUC approved PSCo's proposal to phase in the approved electric rate increase to reflect the actual cost of service. This decision is not expected to have a material impact on PSCo or Xcel Energy's financial results. Under the plan... -

Page 139

.... PSCo supplied energy to the Pacific Northwest markets during this period and has been a participant in the hearings. In September 2001, the presiding ALJ concluded that prices in the Pacific Northwest during the referenced period were the result of a number of factors, including the shortage of... -

Page 140

... purchased power costs to other wholesale customers, effectively raising the fuel cost charges to the complainants. Cap Rock Energy Corporation (Cap Rock), another full-requirements customer of SPS, Public Service Company of New Mexico (PNM) and Occidental Permian Ltd. and Occidental Power Marketing... -

Page 141

... an application to implement a transmission formula rate for the SPS zone of the Xcel Energy OATT. The changed rates affect all wholesale transmission service customers using the SPS transmission network under either the Xcel Energy OATT or the SPP Regional OATT. In September 2009, Xcel Energy filed... -

Page 142

... of Xcel Energy have entered into agreements with utilities and other energy suppliers for purchased power to meet system load and energy requirements, replace generation from company-owned units under maintenance and during outages, and meet operating reserve obligations. NSP-Minnesota, 132 -

Page 143

..., estimated future fuel and electricity prices, future operating cash flows, an incremental borrowing rate, the expected life of the plant and a debt to equity financing ratio. Leases - Xcel Energy and its subsidiaries lease a variety of equipment and facilities used in the normal course of business... -

Page 144

... costs through insurance claims. Additionally, where applicable, the subsidiary involved is pursuing, or intends to pursue, recovery from other PRPs and through the rate regulatory process. New and changing federal and state environmental mandates can also create added financial liabilities for Xcel... -

Page 145

... which Xcel Energy is alleged to be a PRP that sent hazardous materials and wastes. At Dec. 31, 2009, the liability for the cost of remediating these sites was estimated to be $102.1 million, of which $6.3 million was considered to be a current liability. MGP Sites Ashland MGP Site - NSP-Wisconsin... -

Page 146

...providing a process for plans, implementation and cost recovery for utility efforts to curb mercury emissions at certain power plants. For NSP-Minnesota, the Act covers units at the A. S. King and Sherco generating facilities. Xcel Energy installed and is operating and maintaining continuous mercury... -

Page 147

... reasonable progress goals for Colorado's Class I areas, the new ozone standard, and Rocky Mountain National Park nitrogen deposition reduction goals. The CAPCD has indicated that it expects to have a final plan for additional point-source NOx controls by the end of 2010. NSP-Minnesota submitted its... -

Page 148

... the decommissioning of two NSP-Minnesota nuclear generating plants, Monticello and Prairie Island, originates with the in-service date of the facility. Monticello began operation in 1971. Prairie Island units 1 and 2 began operation in 1973 and 1974, respectively. See Note 18 to the consolidated... -

Page 149

...Xcel Energy accrues an obligation for plant removal costs for other generation, transmission and distribution facilities of its utility subsidiaries. Generally, the accrual of future non-ARO removal obligations is not required. However, long-standing ratemaking practices approved by applicable state... -

Page 150

... of NSP-Minnesota's two nuclear plant sites. NEIL also provides business interruption insurance coverage, including the cost of replacement power obtained during certain prolonged accidental outages of nuclear generating units. Premiums are expensed over the policy term. All companies insured with... -

Page 151

... Arandell, Xcel Energy, e prime and NSP-Wisconsin believe the allegations asserted against them are without merit and they intend to vigorously defend against the asserted claims. Environmental Litigation Carbon Dioxide Emissions Lawsuit - In 2004, the attorneys general of eight states and New York... -

Page 152

... On July 2, 2009, WildEarth Guardians (WEG) filed a lawsuit against PSCo alleging that PSCo violated the CAA by constructing Comanche Unit 3 without a final MACT determination from the Colorado Department of Public Health and Environment, Air Pollution Control Division (APCD). The state has proposed... -

Page 153

.... None of the aforementioned lawsuit settlements are expected to have a material effect on Xcel Energy's consolidated financial statements. Nuclear Waste Disposal Litigation - In 1998, NSP-Minnesota filed a complaint in the U. S. Court of Federal Claims against the United States requesting breach of... -

Page 154

...PSCo - On July 14, 2009, Stone & Webster, Inc. (Shaw) filed a complaint against PSCo in State District Court in Denver, Colo. for damages allegedly arising out of its construction work on the Comanche Unit 3 coal fired plant in Pueblo, Colo. Shaw, a contractor retained to perform certain engineering... -

Page 155

...storing spent fuel from NSP-Minnesota's nuclear plants as well as from other U. S. nuclear plants. NSP-Minnesota has funded its portion of the DOE's permanent disposal program since 1981. The fuel disposal fees are based on a charge of 0.1 cent per Kwh sold to customers from nuclear generation. Fuel... -

Page 156

... may require to be paid back to customers in future electric and natural gas rates. Any portion of Xcel Energy's business that is not regulated cannot establish regulatory assets and liabilities. If changes in the utility industry or the business of Xcel Energy no longer allow for the application of... -

Page 157

... Information The regulated electric utility operating results of NSP-Minnesota, NSP-Wisconsin, PSCo and SPS, as well as the regulated natural gas utility operating results of NSP-Minnesota, NSP-Wisconsin and PSCo are each separately and regularly reviewed by Xcel Energy's chief operating decision... -

Page 158

... reportable segments: regulated electric utility, regulated natural gas utility and all other. • Xcel Energy's regulated electric utility segment generates, transmits, and distributes electricity in Minnesota, Wisconsin, Michigan, North Dakota, South Dakota, Colorado, Texas, and New Mexico... -

Page 159

...the wholesale power to meet the electric load for these customers, initially by amending the current wholesale full-requirements contract with West Texas Municipal Power Agency (WTMPA), which provides service to LP&L through 2019 and then for an additional 25 years under a new contract directly with... -

Page 160

..., or auditing scope or procedures. Item 9A - Controls and Procedures Disclosure Controls and Procedures Xcel Energy maintains a set of disclosure controls and procedures designed to ensure that information required to be disclosed in reports that it files or submits under the Securities Exchange... -

Page 161

... Owners and Management and Related Stockholder Matters Information concerning the security ownership of the directors and officers of Xcel Energy and securities authorized for issuance under equity compensation plans is contained in Xcel Energy's Proxy Statement for its 2010 Annual Meeting of... -

Page 162

... Condensed Financial Information of Registrant. Schedule II - Valuation and Qualifying Accounts and Reserves for the years ended Dec. 31, 2009, 2008 and 2007. Exhibits Indicates incorporation by reference Executive Compensation Arrangements and Benefit Plans Covering Executive Officers and Directors... -

Page 163

..., 1999). Financing Agreement between Adams County, Colorado and PSCo, dated as of Aug. 1, 2005 relating to $129,500,000 Adams County, Colorado Pollution Control Refunding Revenue Bonds, 2005 Series A. (Exhibit 4.01 to PSCo Current Report on Form 8-K, dated Aug. 18, 2005, file number 001-3280). 153 -

Page 164

..., 2008). Xcel Energy Non-employee Directors' Deferred Compensation Plan as amended and restated Jan. 1, 2009 (Exhibit 10.08 to Form 10-K of Xcel Energy (file no. 001-03034) for the year ended Dec. 31, 2008). Form of Services Agreement between Xcel Energy Services Inc. and utility companies (Exhibit... -

Page 165

... Stock Agreement (Exhibit 10.08 to Form 10-Q of Xcel Energy (file no. 001-03034) for the quarter ended Sept. 30, 2009). Xcel Energy 2010 Executive Annual Discretionary Award Plan. NSP-Minnesota 10.25* 10.26* 10.27* 10.28* 10.29* 10.30* 10.31* 10.32* 10.33* 10.34* 10.35* 10.36* 10.37* Facilities... -

Page 166

... of Ratio of Earnings to Fixed Charges. Subsidiaries of Xcel Energy Inc. Consent of Independent Registered Public Accounting Firm. Written Consent Resolution of the Board of Directors of Xcel Energy Inc., adopting Power of Attorney Principal Executive Officer's certification pursuant to 18... -

Page 167

... charges and financing costs ...Total expenses and other deductions ...Income from continuing operations before income taxes ...Income tax benefit ...Income from continuing operations ...Income (loss) from discontinued operations, net of tax ...Net income ...Dividend requirements on preferred stock... -

Page 168

... The income from operations of the subsidiaries is reported on a net basis as equity in income of subsidiaries. Cash dividends paid to Xcel Energy by subsidiaries were $647 million, $630 million, and $694 million in the three years ended Dec. 31, 2009, respectively. See Xcel Energy Inc. notes to the... -

Page 169

SCHEDULE II XCEL ENERGY INC. AND SUBSIDIARIES Valuation and Qualifying Accounts Years Ended Dec. 31, 2009, 2008 and 2007 (amounts in thousands of dollars) Additions Charged to Charged to costs and other expenses accounts(a) Balance at Jan. 1 Deductions from reserves(b) Balance at Dec. 31 Reserve... -

Page 170

... Vice President and Chief Financial Officer (Principal Financial Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities on Feb. 26, 2010. /s/ RICHARD C. KELLY RICHARD... -

Page 171

... to compliance with the New York Stock Exchange's corporate governance listing standards. FISC A L AGEN T S XCEL ENERGY INC. Transfer Agent, Registrar, Dividend Distribution, Common and Preferred Stock Wells Fargo Shareowner Services, 161 North Concord Exchange, South St. Paul, Minnesota 55075... -

Page 172

...ed renewable energy certiï¬cates (RECs) to match 100 percent of the electricity used in Mohawk's operations. 414 Nicollet Mall Minneapolis, MN 55401 xcelenergy.com © 2010 Xcel Energy Inc. 10-02-029 Xcel Energy is a registered trademark of Xcel Energy Inc. Northern States Power Company-Minnesota...