U-Haul 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

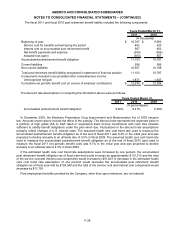

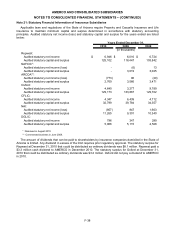

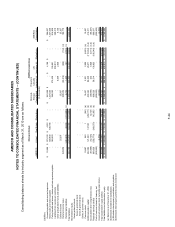

Note 21: Statutory Financial Information of Insurance Subsidiaries

Applicable laws and regulations of the State of Arizona require Property and Casualty Insurance and Life

Insurance to maintain minimum capital and surplus determined in accordance with statutory accounting

principles. Audited statutory net income (loss) and statutory capital and surplus for the years ended are listed

below:

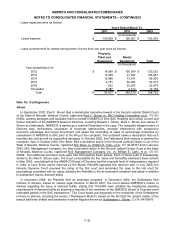

2010 2009 2008

Repwest:

Audited statutory net income $ 6,946 $ 6,016 $ 6,724

Audited statutory capital and surplus 125,102 118,447 103,842

NAFCIC*:

Audited statutory net income (loss) - (6) 13

Audited statutory capital and surplus - 3,019 3,025

ARCOA**:

Audited statutory net income (loss) (773) 96 (29)

Audited statutory capital and surplus 2,769 3,566 3,471

Oxford:

Audited statutory net income 4,640 3,277 9,789

Audited statutory capital and surplus 129,173 133,867 129,702

CFLIC:

Audited statutory net income 4,347 6,439 4,712

Audited statutory capital and surplus 32,799 39,784 34,357

NAI:

Audited statutory net income (loss) (857) 847 1,663

Audited statutory capital and surplus 11,265 9,301 10,340

DGLIC:

Audited statutory net income 796 347 299

Audited statutory capital and surplus 5,966 5,115 4,528

* Dissolved in August 2010.

** Commenced business in June 2008.

Years Ended December 31,

(In thousands)

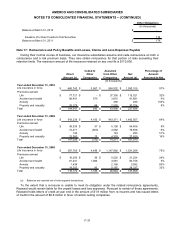

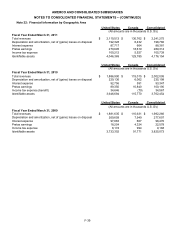

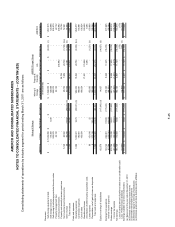

The amount of dividends that can be paid to shareholders by insurance companies domiciled in the State of

Arizona is limited. Any dividend in excess of the limit requires prior regulatory approval. The statutory surplus for

Repwest at December 31, 2010 that could be distributed as ordinary dividends was $8.1 million. Repwest paid a

$3.3 million cash dividend to AMERCO in December 2010. The statutory surplus for Oxford at December 31,

2010 that could be distributed as ordinary dividends was $3.2 million. Oxford did not pay a dividend to AMERCO

in 2010.

F-38