U-Haul 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

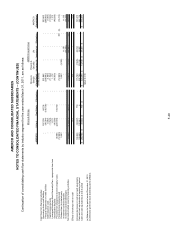

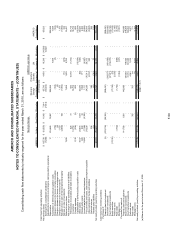

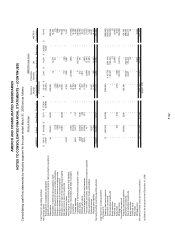

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

F-51

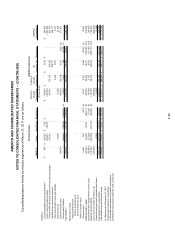

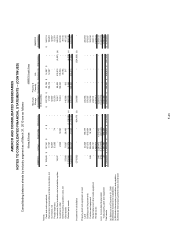

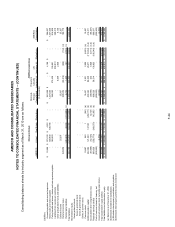

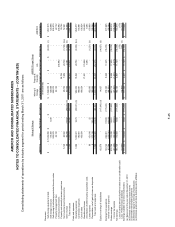

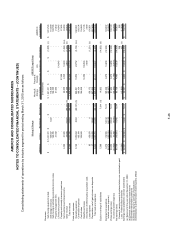

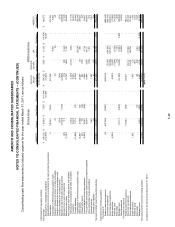

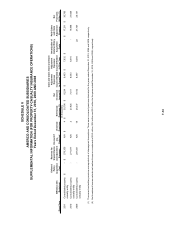

Continuation of consolidating cash flow statements by industry segment for the year ended March 31, 2010, are as follows:

AMERCO U-Haul Real Estate Elimination

Moving &

Storage

Consolidated

Property &

Casualty

Insurance (a)

Life

Insurance (a) Elimination

AMERCO

Consolidated

Cash flows from financing activities:

Borrowings from credit facilities - 42,794 29,359 - 72,153 - - - 72,153

Principal repayments on credit facilities - (187,410) (114,556) - (301,966) - - - (301,966)

Debt issuance costs - (2,129) (216) - (2,345) - - - (2,345)

Capital lease payments - (4,057) - - (4,057) - - - (4,057)

Leveraged Employee Stock Ownership Plan - repayments from loan - 1,111 - - 1,111 - - - 1,111

Proceeds from (repayment of) intercompany loans 38,417 (125,139) 86,722 - - - - - -

Preferred stock dividends paid (12,963) - - - (12,963) - - 107 (b) (12,856)

Dividend from (to) related part

y

7,764 7,764 (4,564) (3,200) -

Investment contract deposits - - - - - - 12,712 - 12,712

Investment contract withdrawals - - - - - - (47,235) - (47,235)

Net cash provided (used) by financing activities 33,218 (274,830) 1,309 - (240,303) (4,564) (37,723) 107 (282,483)

Effects of exchange rate on cash - 2,644 - - 2,644 - - - 2,644

Increase (decrease) in cash and cash equivalents 100,422 (105,799) 4 - (5,373) 2,929 5,975 - 3,531

Cash and cash equivalents at beginning of period 38 213,040 - - 213,078 19,197 8,312 - 240,587

Cash and cash equivalents at end of period 100,460$ 107,241$ 4$ -$ 207,705$ 22,126$ 14,287$ -$ 244,118$

(a) Balance for the period ended December 31, 2009

Moving & Storage AMERCO Legal Group

(b) Eliminate preferred stock dividends paid to affiliate

(page 2 of 2)

(In thousands)