U-Haul 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

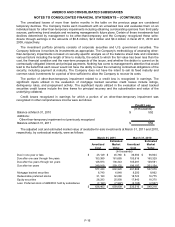

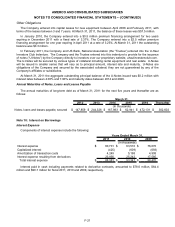

depreciation expense when realized. The amount of (gains) or losses netted against depreciation expense were

($23.1) million, ($2.0) million and $16.6 million during fiscal 2011, 2010 and 2009, respectively. Equipment

depreciation is recognized in amounts expected to result in the recovery of estimated residual values upon

disposal, i.e., minimize gains or losses. In determining the depreciation rate, historical disposal experience,

holding periods and trends in the market for vehicles are reviewed.

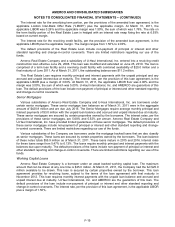

We regularly perform reviews to determine whether facts and circumstances exist which indicate that the

carrying amount of assets, including estimates of residual value, may not be recoverable or that the useful life of

assets are shorter or longer than originally estimated. Reductions in residual values (i.e., the price at which we

ultimately expect to dispose of revenue earning equipment) or useful lives will result in an increase in

depreciation expense over the life of the equipment. Reviews are performed based on vehicle class, generally

subcategories of trucks and trailers. We assess the recoverability of our assets by comparing the projected

undiscounted net cash flows associated with the related asset or group of assets over their estimated remaining

lives against their respective carrying amounts. We consider factors such as current and expected future market

price trends on used vehicles and the expected life of vehicles included in the fleet. Impairment, if any, is based

on the excess of the carrying amount over the fair value of those assets. In fiscal 2010, the Company reduced

the carrying value of certain older trucks by $9.1 million or $0.47 per share before income taxes, in which the tax

effect was approximately $0.17 per share. If asset residual values are determined to be recoverable, but the

useful lives are shorter or longer than originally estimated, the net book value of the assets is depreciated over

the newly determined remaining useful lives.

In fiscal 2006, management performed an analysis of the expected economic value of new rental trucks and

determined that additions to the fleet resulting from purchase should be depreciated on an accelerated method

based upon a declining formula. The salvage value and useful life assumptions of the rental truck fleet remain

unchanged. Under the declining balances method (2.4 times declining balance), the book value of a rental truck

is reduced approximately 16%, 13%, 11%, 9%, 8%, 7%, and 6% during years one through seven, respectively

and then reduced on a straight line basis an additional 10% by the end of year fifteen. Whereas, a standard

straight line approach would reduce the book value by approximately 5.3% per year over the life of the truck. For

the affected equipment, the accelerated depreciation was $44.8 million, $49.1 million and $56.0 million greater

than what it would have been if calculated under a straight line approach for fiscal 2011, 2010 and 2009,

respectively.

Although we intend to sell our used vehicles for prices approximating book value, the extent to which we

realize a gain or loss on the sale of used vehicles is dependent upon various factors including but not limited to,

the general state of the used vehicle market, the age and condition of the vehicle at the time of its disposal and

the depreciation rates with respect to the vehicle. We typically sell our used vehicles at our sales centers

throughout North America, on our web site at uhaul.com/trucksales or by phone at 1-866-404-0355. Additionally,

we sell a large portion of our pickup and cargo van fleet at automobile dealer auctions.

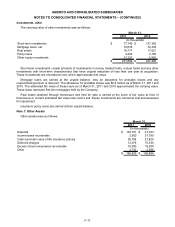

The carrying value of surplus real estate, which is lower than market value at the balance sheet date, was

$9.7 million and $9.8 million for fiscal 2011 and 2010, respectively, and is included in Investments, other.

Receivables

Accounts receivable include trade accounts from moving and self-storage customers and dealers, insurance

premiums and amounts due from ceding re-insurers, less management’s estimate of uncollectible accounts.

Insurance premiums receivable for policies that are billed through contracted agents are recorded net of

commission’s payable. A commission payable is recorded as a separate liability for those premiums that are

billed direct.

Reinsurance recoverables include case reserves and actuarial estimates of claims incurred but not reported.

These receivables are not expected to be collected until after the associated claim has been adjudicated and

billed to the re-insurer. The reinsurance recoverables may have little or no allowance for doubtful accounts due

to the fact that reinsurance is typically procured from carriers with strong credit ratings. Furthermore, the

Company does not cede losses to a re-insurer if the carrier is deemed financially unable to perform on the

contract. Also, reinsurance recoverables include insurance ceded to other insurance companies.

Notes and mortgage receivables include accrued interest and are reduced by discounts and amounts

considered by management to be uncollectible.

F-11