U-Haul 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

SAC Holdings was established in order to acquire self-storage properties. These properties are being

managed by the Company pursuant to management agreements. In the past, the Company sold various self-

storage properties to SAC Holdings, and such sales provided significant cash flows to the Company.

Management believes that the sales of self-storage properties to SAC Holdings has provided a unique

structure for the Company to earn moving equipment rental revenues and property management fee revenues

from the SAC Holdings self-storage properties that the Company manages.

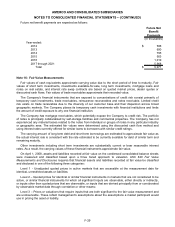

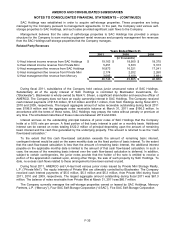

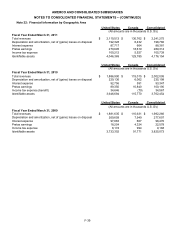

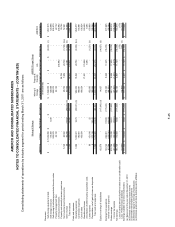

Related Party Revenues

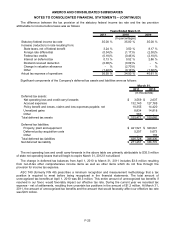

2011 2010 2009

U-Haul interest income revenue from SAC Holdings $ 19,163 $ 18,900 $ 18,375

U-Haul interest income revenue from Private Mini 5,451 5,333 5,313

U-Haul management fee revenue from SAC Holdings 16,873 16,321 17,241

U-Haul management fee revenue from Private Mini 2,174 2,202 2,260

U-Haul management fee revenue from Mercury 3,085 3,109 3,691

$ 46,746 $ 45,865 $ 46,880

Years Ended March 31,

(In thousands)

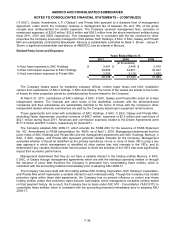

During fiscal 2011, subsidiaries of the Company held various junior unsecured notes of SAC Holdings.

Substantially all of the equity interest of SAC Holdings is controlled by Blackwater Investments, Inc.

(“Blackwater”). Blackwater is wholly-owned by Mark V. Shoen, a significant shareholder and executive officer of

AMERCO. The Company does not have an equity ownership interest in SAC Holdings. The Company received

cash interest payments of $15.8 million, $13.9 million and $14.1 million, from SAC Holdings during fiscal 2011,

2010 and 2009, respectively. The largest aggregate amount of notes receivable outstanding during fiscal 2011

was $196.9 million and the aggregate notes receivable balance at March 31, 2011 was $196.2 million. In

accordance with the terms of these notes, SAC Holdings may prepay the notes without penalty or premium at

any time. The scheduled maturities of these notes are between 2019 and 2024.

Interest accrues on the outstanding principal balance of junior notes of SAC Holdings that the Company

holds at a 9.0% rate per annum. A fixed portion of that basic interest is paid on a monthly basis. Additional

interest can be earned on notes totaling $122.2 million of principal depending upon the amount of remaining

basic interest and the cash flow generated by the underlying property. This amount is referred to as the “cash

flow-based calculation.”

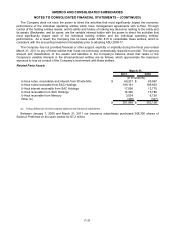

To the extent that this cash flow-based calculation exceeds the amount of remaining basic interest,

contingent interest would be paid on the same monthly date as the fixed portion of basic interest. To the extent

that the cash flow-based calculation is less than the amount of remaining basic interest, the additional interest

payable on the applicable monthly date is limited to the amount of that cash flow-based calculation. In such a

case, the excess of the remaining basic interest over the cash flow-based calculation is deferred. In addition,

subject to certain contingencies, the junior notes provide that the holder of the note is entitled to receive a

portion of the appreciation realized upon, among other things, the sale of such property by SAC Holdings. To

date, no excess cash flows related to these arrangements have been earned or paid.

During fiscal 2011, AMERCO and U-Haul held various junior notes issued by Private Mini Storage Realty,

L.P. (“Private Mini”). The equity interests of Private Mini are ultimately controlled by Blackwater. The Company

received cash interest payments of $5.5 million, $5.3 million and $5.3 million, from Private Mini during fiscal

2011, 2010 and 2009, respectively. The largest aggregate amount outstanding during fiscal 2011 was $67.3

million. The balance of notes receivable from Private Mini at March 31, 2011 was $66.7 million.

The Company currently manages the self-storage properties owned or leased by SAC Holdings, Mercury

Partners, L.P. (“Mercury”), Four SAC Self-Storage Corporation (“4 SAC”), Five SAC Self-Storage Corporation

F-35