U-Haul 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.AMERCO AND CONSOLIDATED SUBSIDIARIES

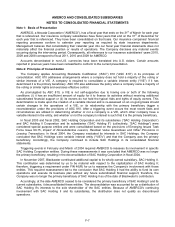

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Cash and Cash Equivalents

The Company considers cash equivalents to be highly liquid debt securities with insignificant interest rate

risk with original maturities from the date of purchase of three months or less.

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally

of cash deposits. Accounts at each United States financial institution are insured by the Federal Deposit

Insurance Corporation (“FDIC”) up to $250,000. Accounts at each Canadian financial institution are insured by

the Canada Deposit Insurance Corporation (“CDIC”) up to $100,000 CAD per account. At March 31, 2011 and

March 31, 2010, the Company had $309.2 million and $204.4 million, respectively, in excess of FDIC and CDIC

insured limits. To mitigate this risk, the Company selects financial institutions based on their credit ratings and

financial strength.

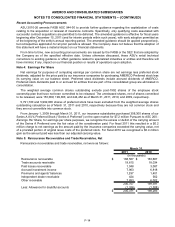

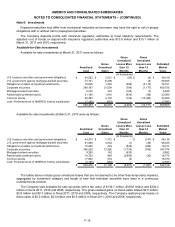

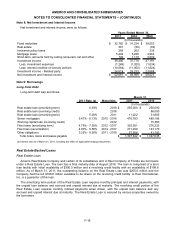

Investments

Fixed Maturities and Marketable Equities. Fixed maturity investments consist of either marketable debt,

equity or redeemable preferred stocks. As of the balance sheet dates, all of the Company’s investments in these

securities are classified as available-for-sale. Available-for-sale investments are reported at fair value, with

unrealized gains or losses recorded net of taxes and applicable adjustments to deferred policy acquisition costs

in stockholders’ equity. Fair value for these investments is based on quoted market prices, dealer quotes or

discounted cash flows. The cost of investments sold is based on the specific identification method.

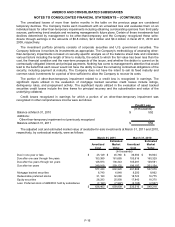

In determining if and when a decline in market value below carrying value is an other-than-temporary

impairment, management makes certain assumptions or judgments in its assessment including but not limited

to: ability to hold the security, quoted market prices, dealer quotes, discounted cash flows, industry factors,

financial factors, and issuer specific information. Other-than-temporary impairments, to the extent of the decline,

as well as realized gains or losses on the sale or exchange of investments are recognized in the current period

operating results.

Mortgage Loans and Notes on Real Estate. Mortgage loans and notes on real estate are reported at their

unpaid balance, net of any allowance for possible losses and any unamortized premium or discount.

Recognition of Investment Income. Interest income from bonds and mortgage notes is recognized when

earned. Dividends on common and preferred stocks are recognized on the ex-dividend dates. Realized gains

and losses on the sale or exchange of investments are recognized at the trade date.

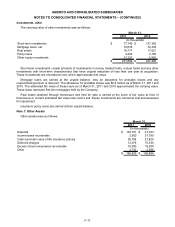

Fair Values

Fair values of cash equivalents approximate carrying value due to the short period of time to maturity. Fair

values of short-term investments, investments available-for-sale, long-term investments, mortgage loans and

notes on real estate, and interest rate swap contracts are based on quoted market prices, dealer quotes or

discounted cash flows. Fair values of trade receivables approximate their recorded value.

The Company’s financial instruments that are exposed to concentrations of credit risk consist primarily of

temporary cash investments, trade receivables, reinsurance recoverables and notes receivable. Limited credit

risk exists on trade receivables due to the diversity of our customer base and their dispersion across broad

geographic markets. The Company places its temporary cash investments with financial institutions and limits

the amount of credit exposure to any one financial institution.

The Company has mortgage receivables, which potentially expose the Company to credit risk. The portfolio

of notes is principally collateralized by self-storage facilities and commercial properties. The Company has not

experienced any material losses related to the notes from individual notes or groups of notes in any particular

industry or geographic area. The estimated fair values were determined using the discounted cash flow method

and using interest rates currently offered for similar loans to borrowers with similar credit ratings.

The carrying amount of long-term debt and short-term borrowings are estimated to approximate fair value as

the actual interest rate is consistent with the rate estimated to be currently available for debt of similar term and

remaining maturity.

Other investments including short-term investments are substantially current or bear reasonable interest

rates. As a result, the carrying values of these financial instruments approximate fair value.

F-9