U-Haul 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

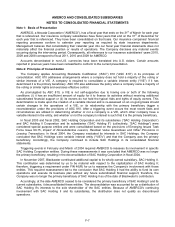

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (CONTINUED)

Recent Accounting Pronouncements

ASU 2010-26 amends FASB ASC 944-30 to provide further guidance regarding the capitalization of costs

relating to the acquisition or renewal of insurance contracts. Specifically, only qualifying costs associated with

successful contract acquisitions are permitted to be deferred. The amended guidance is effective for fiscal years

beginning after December 15, 2011 (and for interim periods within such years), with early adoption permitted as

of the beginning of the entity's annual reporting period. The amended guidance should be applied prospectively,

but retrospective application for all prior periods is allowed. The Company does not believe that the adoption of

this statement will have a material impact on our financial statements.

From time to time, new accounting pronouncements are issued by the FASB or the SEC that are adopted by

the Company as of the specified effective date. Unless otherwise discussed, these ASU’s entail technical

corrections to existing guidance or affect guidance related to specialized industries or entities and therefore will

have minimal, if any, impact on our financial position or results of operations upon adoption.

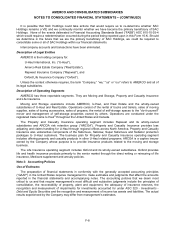

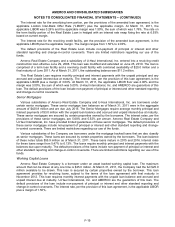

Note 4: Earnings Per Share

Net earnings for purposes of computing earnings per common share are net earnings less preferred stock

dividends, adjusted for the price paid by our insurance companies for purchasing AMERCO Preferred stock less

its carrying value on our balance sheet. Preferred stock dividends include accrued dividends of AMERCO.

Preferred stock dividends paid to or accrued for entities that are part of the consolidated group are eliminated in

consolidation.

The weighted average common shares outstanding exclude post-1992 shares of the employee stock

ownership plan that have not been committed to be released. The unreleased shares, net of shares committed

to be released, were 153,069; 199,363; and 244,452 as of March 31, 2011, 2010, and 2009, respectively.

5,791,700 and 5,992,800 shares of preferred stock have been excluded from the weighted average shares

outstanding calculation as of March 31, 2011 and 2010, respectively because they are not common stock and

they are not convertible into common stock.

From January 1, 2009 through March 31, 2011, our insurance subsidiaries purchased 308,300 shares of our

Series A 8½% Preferred Stock (“Series A Preferred”) on the open market for $7.2 million Pursuant to ASC 260 -

Earnings Per Share, for earnings per share purposes, we recognize the excess or deficit of the carrying amount

of the Series A Preferred over the fair value of the consideration paid. For fiscal 2011 this resulted in a $0.2

million charge to net earnings as the amount paid by the insurance companies exceeded the carrying value, net

of a prorated portion of original issue costs of the preferred stock. For fiscal 2010 we recognized a $0.4 million

gain as the amount paid was less than our adjusted carrying value.

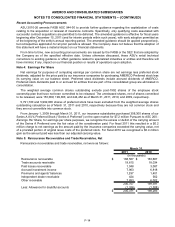

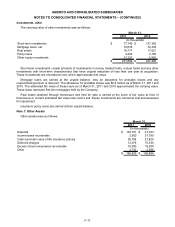

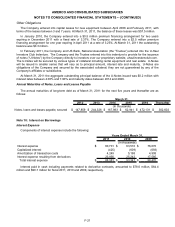

Note 5: Reinsurance Recoverables and Trade Receivables, Net

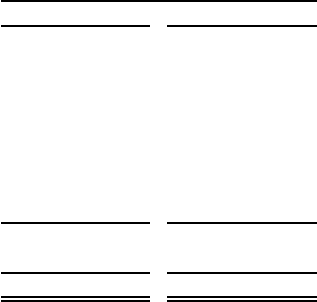

Reinsurance recoverables and trade receivables, net were as follows:

2011 2010

Reinsurance recoverable $ 168,507 $ 163,687

Trade accounts receivable 19,615 18,034

Paid losses recoverable 1,048 3,087

Accrued investment income 7,963 6,818

Premiums and agents' balances 1,297 1,401

Independent dealer receivable 424 562

Other receivable 7,853 6,002

206,707 199,591

Less: Allowance for doubtful accounts (1,336) (1,308)

$ 205,371 $ 198,283

March 31,

(In thousands)

F-14